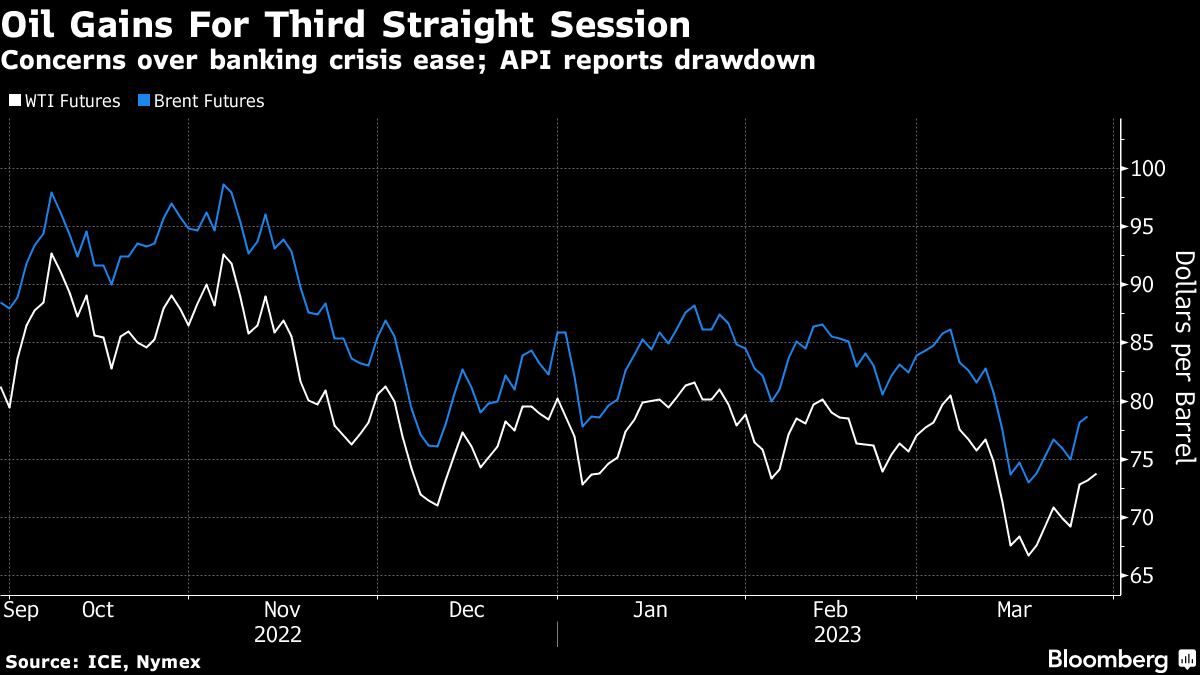

Oil Extends Gains as Report Points to Shrinking US Stockpiles

(Bloomberg) -- Oil extended gains after an industry report signaled a big draw in US crude stockpiles as an ongoing dispute halts exports from Turkey.

West Texas Intermediate futures rose for a third session toward $74 a barrel, with easing concerns over the banking crisis adding to bullish sentiment. The American Petroleum Institute reported crude inventories dropped by 6.1 million barrels last week, according to people familiar with the data. That will be the biggest decline this year if confirmed by government figures later Wednesday.

The US is urging Iraq and Turkey to resume exports from the port of Ceyhan after a dispute involving Kurdish authorities halted around 400,000 barrels a day of shipments, tightening the market and helping to boost prices. However, Iraq’s government said it’s up to Kurdistan to break the deadlock.

Oil is still on track for a fifth monthly loss after concerns over a potential US recession and resilient Russian flows weighed on prices. OPEC+ is showing no signs of adjusting production when its Joint Ministerial Monitoring Committee meets next week, staying the course amid turbulence in financial markets.

“Supply concerns continue to support oil prices,” said Warren Patterson, the Singapore-based head of commodities strategy at ING Groep NV. “Market attention will increasingly turn to OPEC+ with next week’s JMMC meeting.”

US crude inventories have gained ten out of 11 weeks so far this year, rising to the highest level since May 2021. Analysts surveyed by Bloomberg forecast the Energy Information Administration will report stockpiles expanded again last week, increasing by a further 1.75 million barrels.

Energy Daily, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output