Global carbon markets will play a vital role in energy transitions, says IEF

Carbon markets will play an important role in achieving climate, energy security, and sustainable development goals by boosting the efficiency of energy transitions and raising money for clean energy projects, according to Joseph McMonigle, Secretary General of the International Energy Forum (IEF).

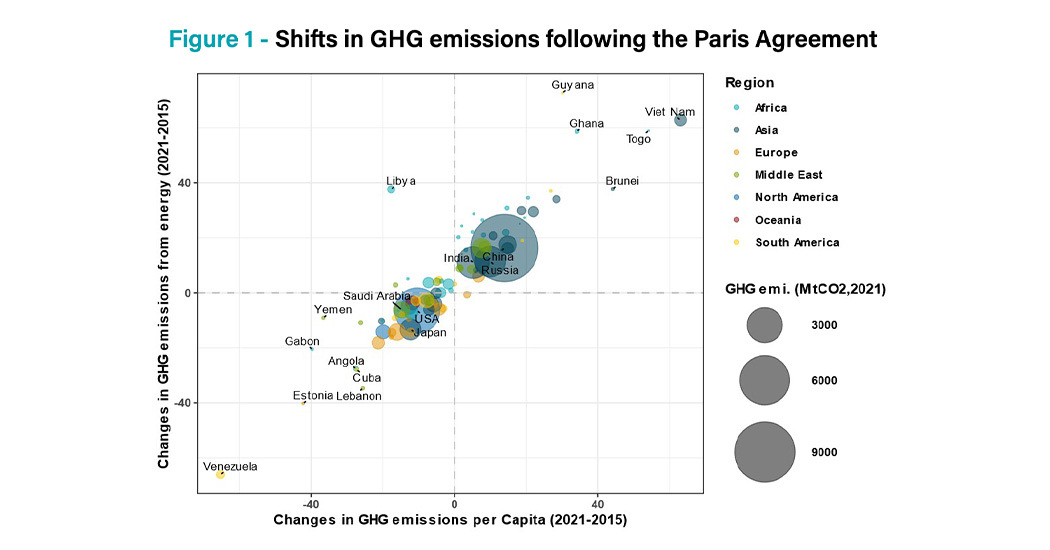

He was speaking at the launch of a new IEF report entitled ‘The Role of Carbon Markets in Transitions,’ which focuses on the potential of carbon markets to accelerate the transition to net zero carbon emissions and universal access to affordable and reliable energy under the Paris Agreement and Sustainable Development Goals.

“Carbon markets play an important role in aligning resources to achieve our global climate, energy security and affordability goals,” McMonigle said. “But they are at an inflexion point. With stronger international collaboration and smart regulation, they can raise billions of dollars for clean energy projects, especially in the developing world, that would otherwise not get off the ground,” he added.

As the global demand for carbon credits grows as a part of the energy transition, there’s been a spate of expansion in national carbon compliance programmes as well as voluntary carbon markets, alongside tax mechanisms to encourage lower-carbon industrial production.

Last year, AirCarbon Exchange (ACX) announced that its exchange and clearing house in Abu Dhabi Global Market (ADGM), ACX Abu Dhabi, had gone live with key trades being settled on the platform – marking the beginning of what is anticipated to be a burgeoning market for voluntary carbon markets (VCM). And in October, the European Union launched the initial phase of Carbon Border Adjustment Mechanism (CBAM) – the world's first system to impose CO2 emissions tariffs on imported steel, cement and other heavy industry products.

State of play in global markets

The IEF report reviews the state of play in both mandatory compliance markets, and the rapidly emerging voluntary carbon market, where companies offset emissions by financing projects that remove or avoid producing CO2, often in other countries.

The report urges governments to shape carbon markets into a win-win for both consumers and producers. Market fragmentation and carbon credit risk can be addressed by fostering cohesive policy approaches, standardisation and transparency, knowledge sharing across borders and digitisation, the report says.

It also highlights the significant potential for carbon markets to generate investment for carbon capture, utilisation, and storage (CCUS) technologies. Currently, CCUS projects mostly fall outside the scope of carbon market incentives, despite their capacity to significantly reduce CO2 emissions and generate a large supply of reliable carbon credits.

“The incentives provided by carbon markets for CCUS are expected to facilitate the broader deployment of this technology and a further reduction in associated costs,” the report says.

Boosting clean hydrogen production

According to the IEF, carbon credits could also be used to improve the economics of clean hydrogen production and other technologies that rely on CCUS. Moreover, finance raised from carbon markets could be applied to innovation in low carbon intensity materials that might one day transform industries that rely on concrete, steel, plastic, ammonia and steel, the report says.

For countries that are yet to introduce mandatory compliance carbon markets, “voluntary carbon markets represent an initial step in addressing both national and international climate challenges,” the report says. “Countries and businesses may transition into compliance markets or use voluntary carbon markets for equivalent effect depending on performance and circumstances,” it adds.

The global carbon markets community has sought to regroup following the lack of tangible progress on Article 6 of the Paris Agreement on climate change – which sets out the principles for international carbon markets – during negotiations at COP28 last December, and many are looking forward to COP29 in Azerbaijan this year for signs of progress.

McMonigle urged governments to finalise agreement on Article 6 of the Paris Agreement, which is considered critical to meet national emissions targets. “Agreement on Article 6 is key to unlocking the potential of international carbon markets and we hope to see more progress at COP29 in Azerbaijan,” he said.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.