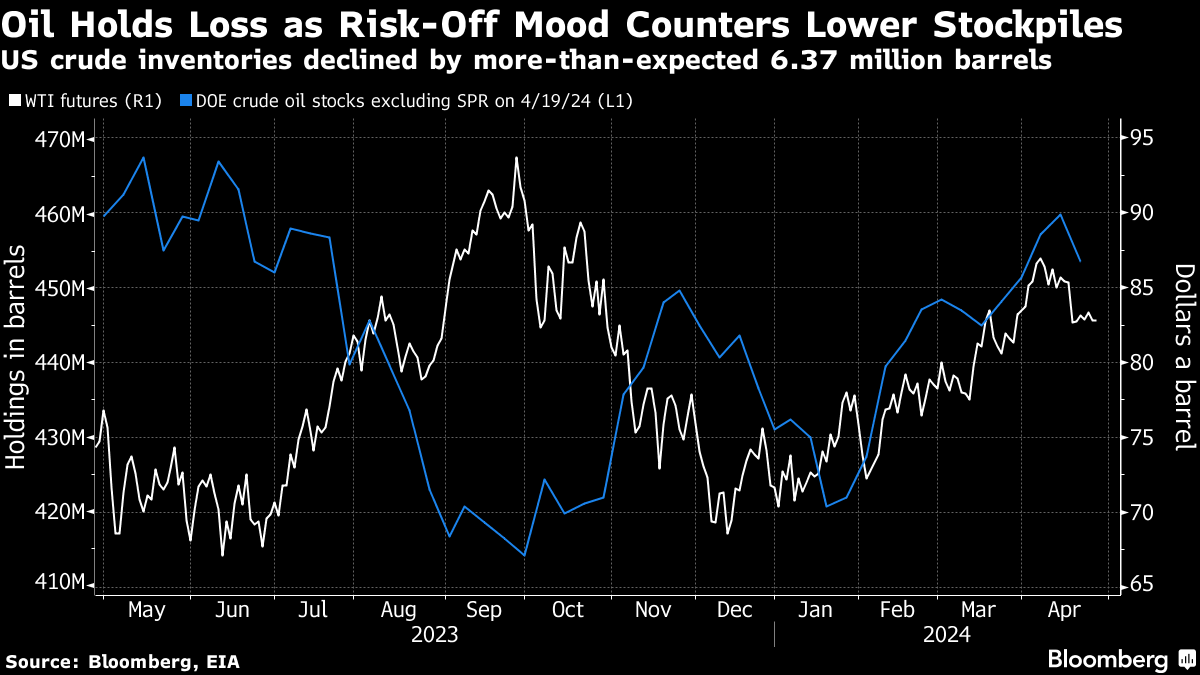

Oil Holds Modest Loss as Risk-Off Tone Counters Lower Stockpiles

(Bloomberg) -- Oil held a modest decline, with a risk-off tone in broader markets countering a drawdown in US stockpiles.

Brent crude traded near $88 a barrel after a 0.5% drop on Wednesday, with West Texas Intermediate close to $83. The drop came despite data showing nationwide crude inventories fell by a bigger-than-expected 6.37 million barrels last week as refineries ramped up processing and exports rose.

In wider markets, Asian equities retreated following concerns about the US tech sector, with a disappointing outlook from Meta Platforms Inc. spurring declines. At the end of the week, the Federal Reserve’s preferred inflation gauge will provide clues about the path ahead for monetary policy.

Crude remains higher this year, aided by supply curbs from OPEC+ and tensions in the Middle East, although it’s pulled back from recent highs above $90 a barrel as geopolitical risks in the region eased. Options skews remain in a bearish tilt toward puts, while the world’s biggest oil exchange-traded fund — the US Oil Fund — posted its largest daily outflow on record.

“As markets look beyond the risks of supply disruptions from geopolitical tensions, oil prices may take their cue from the cautious risk environment,” said Yeap Jun Rong, market strategist for IG Asia Pte. Still “for now, the upward trend since the start of the year remains in place.”

The outlook for oil demand also remains clouded, with a weakness in some refined products like diesel. Profit margins for turning crude into diesel in Asia was near the lowest level in nearly a year.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week