Oil Steadies Above $87 as Traders Weigh Easing Middle East Risks

(Bloomberg) -- Oil steadied after a modest loss as traders weighed the next steps between Israel and Iran amid signs of easing hostilities following a tit-for-tat exchange of attacks last week.

Brent traded above $87 a barrel after slipping 0.3% on Monday, and West Texas Intermediate was near $82. Israel is returning to its goals of eliminating what it says is the last remaining stronghold of Hamas in Gaza and of freeing the remaining hostages, which will keep tensions elevated in the region.

“Crude has unwound the Israel-Iran risk premium but could slip into a holding pattern,” said Vandana Hari, founder of Vanda Insights in Singapore. “It’s hard to see a correction from current levels unless there’s a breakthrough on the Gaza front.”

Futures are coming off a back-to-back weekly loss, but remain higher this year due to geopolitical risks and OPEC+ supply cuts that have tightened the market. The US Congress has moved to further curb Iran’s oil sector, although analysts see a muted impact on exports.

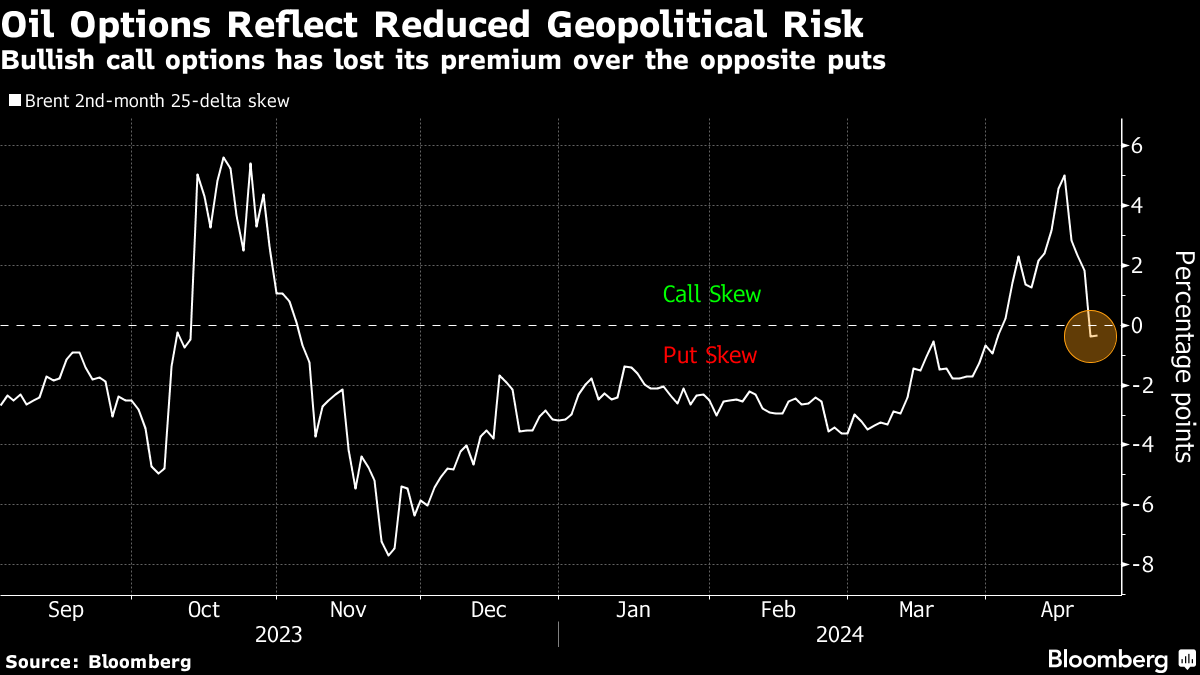

Easing tensions are being reflected in the options market, with bullish Brent calls — which profit when prices gain — losing its premium to the opposite puts. However, timespreads are still signaling strength, with the gap between the two nearest contracts for the global benchmark at 94 cents a barrel in backwardation, compared with 79 cents a week ago.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Stocks Slip, Gold Up as Inflation Views Weighed: Markets Wrap

Oil Set for Weekly Gain After Fed Cut as Focus Shifts to Mideast

Oil Gains as Traders Track Risk-On Tone and Middle East Tension

Oil Edges Lower With US Stockpiles and Mideast Tensions in Focus

Oil Climbs Ahead of Fed Decision But Demand Concerns Persist

Energy Transfer Says Blast Occurred on Texas NGL Line

Oil Steadies as Falling Libyan Exports Offset Weak Chinese Data

Alcoa to Get $1.1 Billion for Stakes in Saudi Aluminum Plants

Hedge Funds Have Never Been This Bearish on Brent Crude Before

Oil Fades After Short-Lived Rebound as Storm Francine Passes

ADNOC Gas takes a leading role to shape the future of low-carbon energy

TC Energy powers North America's future by delivering critical infrastructure

Crown LNG at the forefront of cutting-edge harsh weather solutions

World Economic Forum on the role of technology in scaling critical mineral supply chains

Leveraging carbon markets and technology for a stronger global climate response

Why data centres and AI could shake up the global LNG market

Why energy executives expect the world to hit net zero by 2060

CSIS: long-term LNG demand to reshape global export capacity growth

More women in energy vital to the industry’s success

India’s energy sector presents lucrative opportunities for global companies

Partner content

TAQA Water Solutions pioneers water sustainability efforts worldwide

Integrally geared compressors cut the carbon and boost carbon capture

Navigating the trading seas: exploring the significance of benchmarks

Back to the Future(s): the best commodities benchmarks are still physically settled