Oil Falls After Weekly Losses as Traders Focus on Mideast Risk

(Bloomberg) -- Oil fell after its first back-to-back weekly decline this year as traders weighed the potential next steps from Iran and Israel amid simmering tensions in the Middle East.

Brent slipped below $87 a barrel after losing 3.5% last week, the biggest drop since early February. There’s an uneasy calm over the market after prices whipsawed on Friday, with Iran downplaying Israel’s response to the Islamic Republic’s unprecedented drone and missile strike on the Jewish state.

The US House has passed new sanctions on Iran’s oil sector following the hostilities, putting the measure on track to pass the Senate in days. The country also approved fresh funding for Ukraine in its war against Russia.

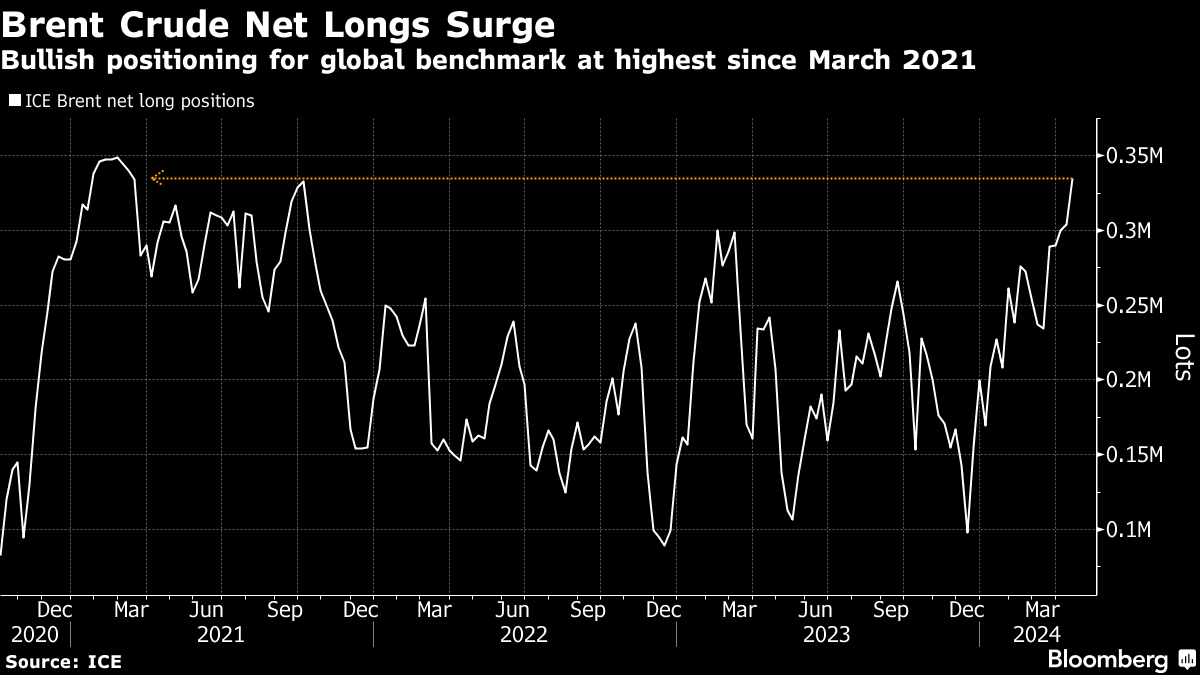

Still, money managers are the most bullish on Brent since March 2021 as they snap up contracts to profit from any spike higher amid heightened tensions. Other markets are also signaling bullishness, with oil call options — which profit when prices rise — trading at a premium over the opposing puts.

“What is quite surprising is, despite the elevated risk and tension in the Middle East, oil prices do not appear to be overly concerned,” said Warren Patterson, head of commodities strategy for ING Groep NV. The market will need to see if US sanctions impact Iranian flows before reacting, he added.

Oil is around 13% higher this year due to the geopolitical tensions and OPEC+’s supply cuts that have tightened the market. Investors will focus on a slew of US economic data this week, including the Federal Reserve’s preferred measured of inflation, which will give more clues on the path for monetary policy.

Earnings from the world’s largest oil majors including TotalEnergies SE, Chevron Corp. and Exxon Mobil Corp. are also due this week, as well as Asian companies Reliance Industries Ltd. and Cnooc Ltd. Big Oil’s production growth will be in the spotlight this quarter as earnings stabilize.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad