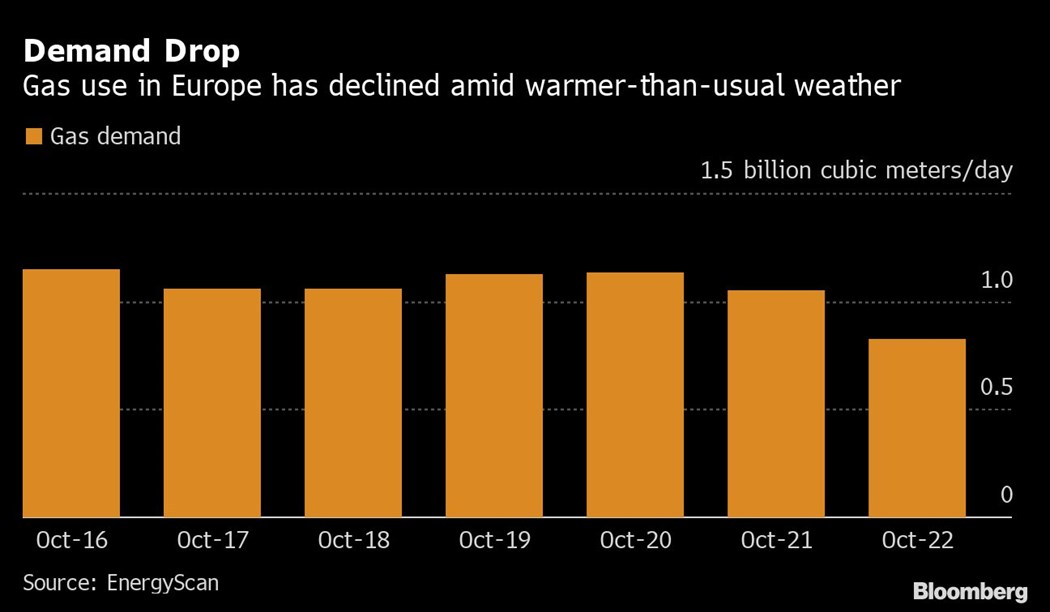

Europe’s Gas Use Slides 22% as Households Keep the Heating Off

(Bloomberg) -- Europe reined in its natural-gas consumption last month as households kept the heating off amid warm weather, providing some relief to a tight market ahead of winter.

Governments across the region have been pleading with consumers to reduce their gas use after a slump in Russian supplies raised the specter of rationing once the weather gets cold. A mild autumn has helped conserve the fuel, but power plants continue to burn increasing quantities to keep the lights on.

Western Europe’s total gas demand in October fell 22% from a year earlier, led by residential, business and small industrial users, according to data from Engie SA’s market-analysis platform EnergyScan. The electricity sector increased consumption by 14%.

Aside from the warm weather, demand has been curtailed by rocketing prices, with many small industrial users cutting back operations to survive. That retrenchment, together with strong inflows of liquefied natural gas and brimming storage sites, has helped to ease concerns that governments will have to limit supplies to customers over the coming months.

There are “emerging signs of behavioral change regarding heating usage,” said Julien Hoarau, head of analysis at EnergyScan. That’s helped to exert “strong bearish pressure on spot gas prices across Europe and strengthened the continent’s ability to balance its gas system this winter.”

While benchmark prices remain three times higher than the five-year average, they’ve declined more than 60% from their August peak.

Gas demand from residential, business and small industrial users dropped 33% in October, while usage by large industrial consumers fell 27%, according to EnergyScan data. Strong demand from the power sector pared the overall decline as a wave of nuclear-plant outages in France and low hydroelectric output elsewhere forced countries to burn more gas.

See also: Engie Says European Gas Demand Plummets as Bills Climb

Gas use for electricity generation in France more than doubled in October compared with a year earlier, the data show, while neighboring countries also resorted to more gas-fired power. The shift was in some instances helped by the recent drop in prices, which boosted gas’s appeal versus coal. Germany used about 40% more gas to fire power plants last month.

Read more: Too Much Gas. Europe’s Energy Crisis Takes a Surprise Turn

Uncertainty continues to cloud the coming months, with both supply and demand hard to anticipate.

The onset of colder weather will inevitably make demand reductions harder, while measures to cap prices in some nations may curb the incentive to cut back, as seen in Spain. A restart of idled operations among European industry would also stretch supplies, though an improvement in French nuclear output next year -- and more rain -- could reduce the use of gas for power, Hoarau said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

TotalEnergies launches Marsa LNG project and deploys multi-energy strategy in Oman

Apr 22, 2024

Mexico’s Sheinbaum Wants Debt-Laden Pemex to Go Green

Apr 20, 2024

Europe’s Top LNG Plant Operator Wants to Move Into Ammonia, CO2

Apr 19, 2024

Southwest Gas Unit Gets $314.8 Million From IPO, Icahn Deal

Apr 17, 2024

Kazakhstan’s Compensation Claims Against Kashagan Oil Firms Jump to $150 billion

Apr 17, 2024

Oman LNG and Shell agree 10-year supply deal amid transition-led demand growth

Apr 17, 2024

Power Demand Surge Is Complicating Carbon Goals, Duke CEO Says

Apr 16, 2024

Equinor strengthens its gas position with a swap of onshore assets in the US

Apr 16, 2024

Tepco Flagship Nuclear Plant to Load First Fuel Since Fukushima

Apr 15, 2024

GE Vernova’s technology to help LG&E and KU further diversify sustainable energy portfolio

Apr 15, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum