Halliburton Sees Best Profit in 12 Years Amid Smaller Shale

(Bloomberg) -- Halliburton Co., the world’s biggest provider of fracking work, posted its best earnings for a first quarter in a dozen years despite a shrinking business in the shale patch that it said isn’t likely to recover this year.

The company that dominates the North American oilfield services market expects the hunt for natural gas not to return until next year. The company forecast “flattish” sales growth in the US and Canada this year and low double-digit increase elsewhere in the world. Shares fell 0.7% at 10:28 a.m. in New York trading.

“While we expect an eventual recovery in natural gas activity driven by demand from LNG expansions, our 2024 plan does not anticipate this recovery,” Chief Executive Officer Jeff Miller told analysts and investors Tuesday on a conference call.

Drilling and fracking for the heating and power plant fuel will be “the next big leg of growth in North America” in 2025 and beyond, he said.

The oil-services giant reported better-than-expected quarterly earnings of $679 million, excluding certain items, it said Tuesday in a statement. International sales grew 12% while North America revenue fell 8% compared to a year earlier. The world’s biggest hired hands of the oilfield are in the midst of a multi-year pivot away from the once-booming shale patch in search of greater growth overseas.

“Our customers’ multi-year activity plans across markets and asset types confirms my confidence in the strength and duration of this upcycle,” Miller said in the statement. “Our international business delivered its 11th consecutive quarter of year-on-year growth.”

The company, which has seen three straight quarters of year-over-year sales declines in its US and Canada region, is expected by analysts to show a full-year revenue drop of 1.4% in North America, according to data compiled by Bloomberg. International sales are expected by analysts to climb 11.5% this year.

SLB, a larger rival which dominates international services work, reported similar results last week with a 13% jump in total revenues while its North American sales dropped 6% from the same period a year earlier. Baker Hughes Inc. will round out the Big 3 oilfield-service earnings when it posts results later today.

Halliburton, with its unrivaled footprint in all of the major shale basins, offers the closest proxy to US producer activity. After better-than-expected output in 2023, the US shale patch is now in the midst of slowing down amid dwindling inventory for top-tier drilling locations, weak natural gas prices and industry consolidation. Total North American producer spending is forecast to drop 1% this year, according to Barclays PLC.

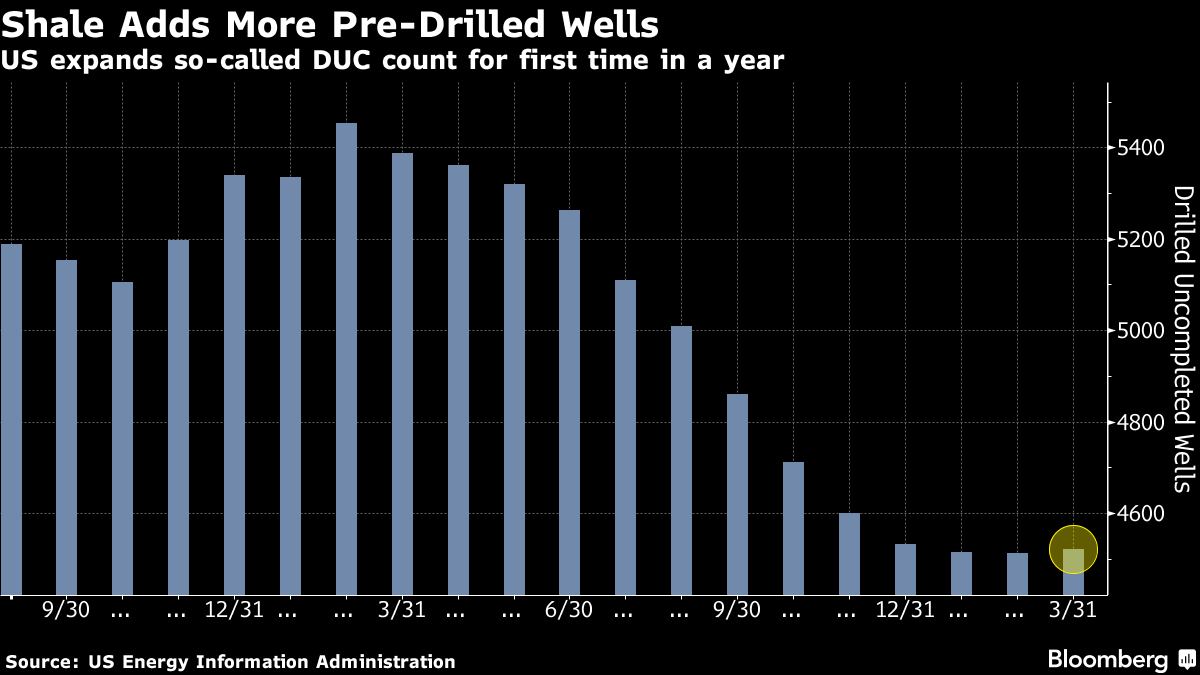

The closely watched tally of pre-drilled wells, known as the fracklog, reversed course last month, according to the US Energy Information Administration. The report indicated that the number of wells fracked grew slower than those drilled, offering another indication of a slowing hydraulic fracturing market.

(Updates with company guidance in second to fourth paragraphs)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More gas & LNG news

Oman Will Seek Talks With BP, Shell to Secure Latest LNG Project

GE Vernova Sees ‘Humble’ Wind Orders as Data Centers Favor Gas

China’s Oil Demand May Peak Early on Rapid Transport Shift

Qatar Minister Calls Out EU for ESG Overreach, Compliance Costs

Chevron Slows Permian Growth in Hurdle to Trump Oil Plan

After $2.5 Billion IPO Haul, Oman’s OQ Looks at More Share Sales

ADNOC signs 15-year agreement with PETRONAS for Ruwais LNG project

Woodside signs revised EPC deal with Bechtel for Louisiana LNG

Vitol, Glencore Eye New Fortress’ Jamaica LNG Assets