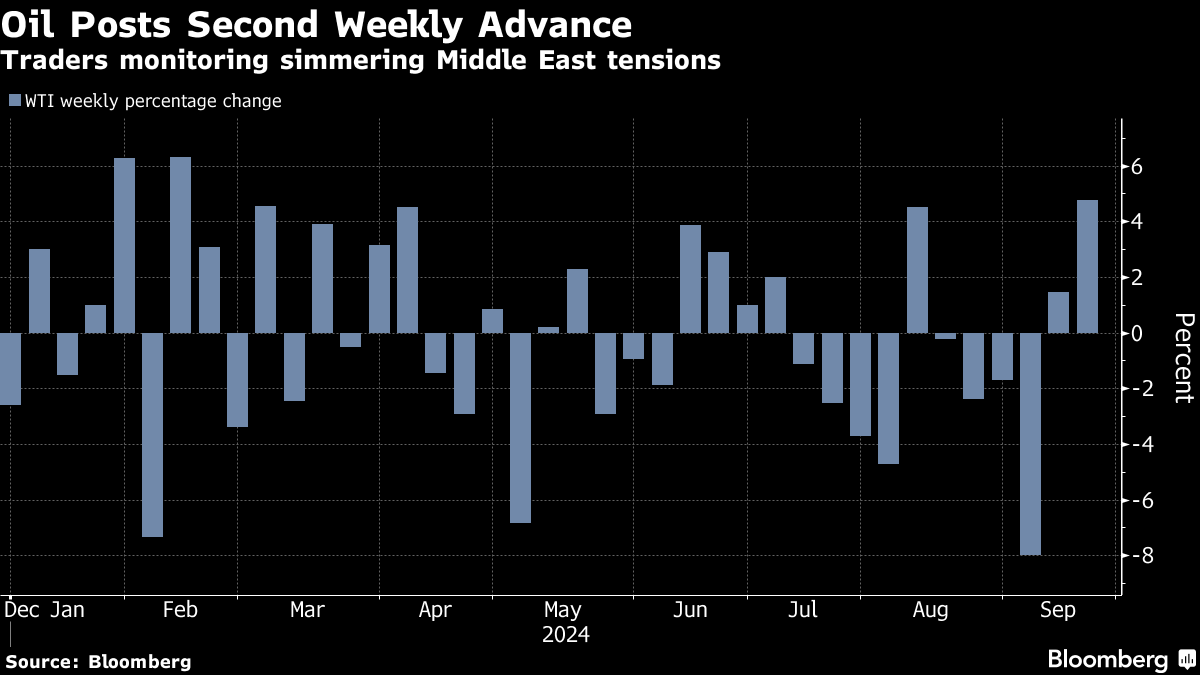

Oil Holds Steady as Middle East Tensions Rise, Fed Boost Fades

(Bloomberg) -- Oil closed little changed after a day of choppy trading as tensions in the Middle East ratcheted higher while the boost from Federal Reserve’s steep interest-rate cut faded.

West Texas Intermediate settled below $72 a barrel while Brent settled above $74 a barrel. Still, WTI posted its biggest weekly advance since February.

Israel said it killed senior Hezbollah commander Ibrahim Aqil in an airstrike on Beirut’s southern suburbs Friday. Hezbollah hasn’t confirmed the killing, but the attack fueled concerns that the conflict could spread to directly involve Iran, threatening crude flows from the region.

“Crude struggled for direction today, as cross-currents in the market remain stronger than any clear directional theme,” said Rebecca Babin, senior energy trader at CIBC Private Wealth. “Recent rallies have been driven by short-covering and heightened geopolitical risks, but ongoing concerns around China’s demand outlook and 2025 supply balances continue to cast a shadow.”

WTI sank below $66 a barrel last week amid anxiety about weak consumption, particularly in top importer China. The Fed’s rate cut now provides room for Beijing to offer more monetary and fiscal stimulus, according to a report in Securities Times.

US fuelmakers are getting set for the lightest maintenance season in three years, according to market intelligence firm IIR Energy, easing some concerns about oil supplies backing up. Refineries plan to take about 529,000 barrels of daily capacity offline during the fall.

©2024 Bloomberg L.P.