Oil Gains as Traders Track Risk-On Tone and Middle East Tension

(Bloomberg) -- Oil advanced as a risk-on tone swept across wider financial markets following the steep interest-rate cut by the Federal Reserve, while traders monitored escalating tensions in the Middle East.

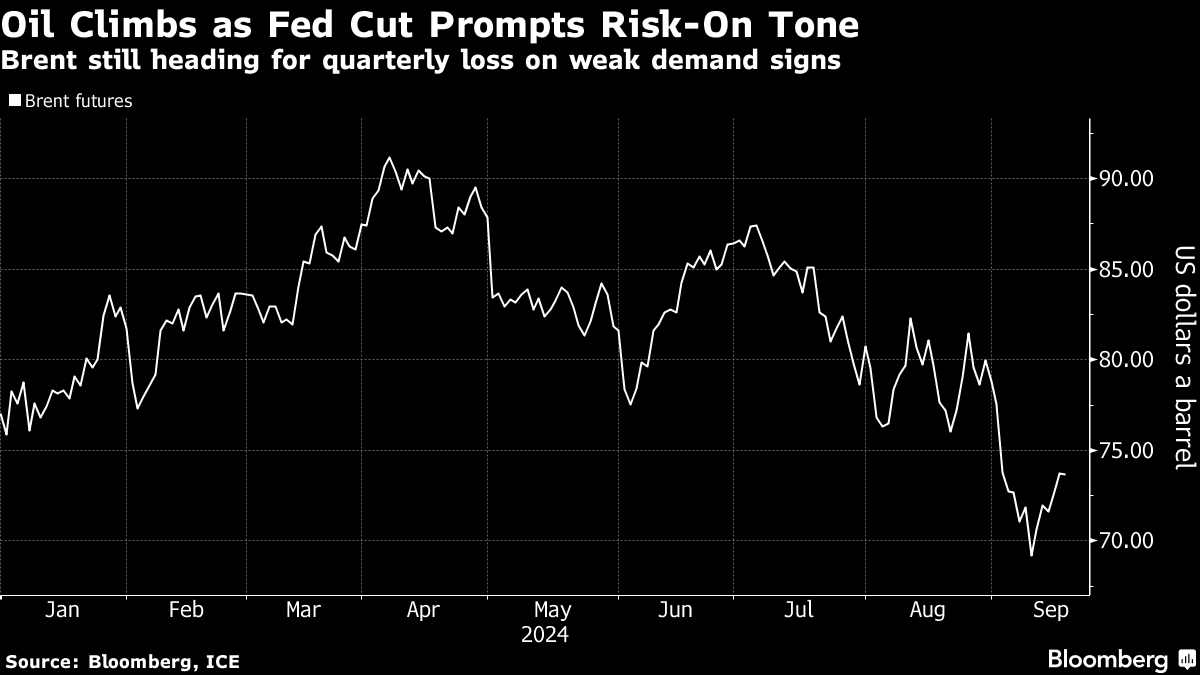

Brent futures climbed to near $74 a barrel after closing little changed on Wednesday, while West Texas Intermediate was above $71. European stock futures gained alongside Asian equities as the Fed’s move reinforced expectations that the US economy will avoid a downturn.

Investors are closely watching developments in the Middle East after Israel’s Defense Minister Yoav Gallant declared what he called a “new phase” in the war with regional Islamist groups. That’s raised fears about a wider conflict that could involve Iran, an OPEC producer.

Brent is still on track for the biggest quarterly loss this year on concerns over China’s economic slowdown and ample supply. US gasoline demand fell further below 9 million barrels and jet fuel consumption ebbed for a third straight week, according to government data, adding to bearish headwinds.

Shrinking US inventories could underpin further price gains. Crude stockpiles at the key storage hub at Cushing, Oklahoma, are significantly lower than the five-year seasonal average and close to what’s considered “tank bottom” levels, according to EIA data.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight