Soaring EV Sales Could Still Leave World Short on Emissions Goal

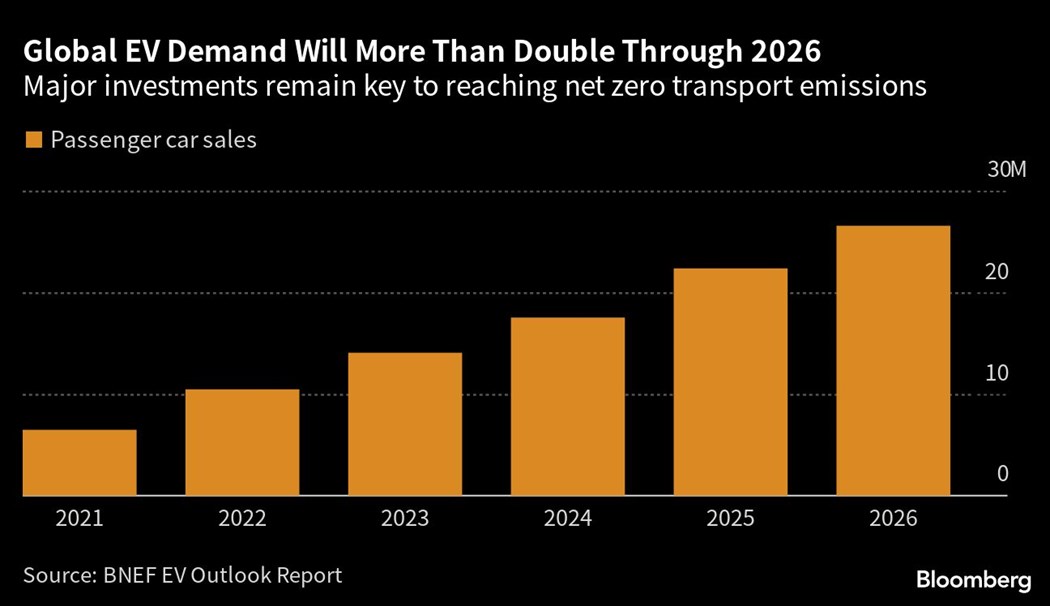

(Bloomberg) -- Electric-vehicle sales are poised to more than double by 2026 but eliminating emissions from road transportation by the middle of this century will require even greater efforts, according to BloombergNEF.

The research firm sees shipments of plug-in passenger vehicles surging to around 27 million from 10.5 million last year as sales jump in China and the US. That’s offsetting slower growth in Europe, where tight supply chains and a cost-of-living crisis are weighing on demand.

While shipments of combustion-engine passenger cars have peaked six years ago, it’ll take time to replace the roughly 1.3 billion roaming roads today. Some 30% of the global fleet will still burn gasoline and diesel by 2050. Heavier commercial vehicles are expected to be trailing cars with just 32% of the fleet decarbonizing on that timeline.

Investments in zero-emission trucks “should be a priority focus for policymakers,” BNEF analysts led by Colin McKerracher wrote in the researcher’s annual Electric Vehicle Outlook released Thursday. “Eliminating emissions from road transport will require all hands on deck.”

After a plodding start, EVs are now spreading rapidly as automakers from General Motors Co. to Volkswagen AG are forced to keep pace with tightening emissions regulation, retooling factories to churn out a wide variety of battery models with attractive driving ranges. Countries are now competing to attract investments to build new manufacturing clusters — mainly battery cell plants but also mining, processing and recycling operations.

In the US, so far a slow mover in the electric transition, President Joe Biden’s package of generous clean-technology subsidies is turbo-charging spending. The share of EVs in the country will more than triple by 2026 to 28% of passenger-vehicle sales, according to BNEF. EVs will be even more prevalent in China and Europe, where their share will climb to 52% and 42%, respectively.

The shift to battery power, already displacing 1.5 million barrels of oil a day, will cause road fuel demand to peak in four years. That’s ratcheting up pressure elsewhere, with lithium-ion battery prices rising for the first time last year. BNEF expects innovation to deliver new battery chemistries that are more resource-efficient and powerful.

Even so, lithium could become a supply-chain risk if no new discoveries are made over the next two decades and more investments are needed. Hydrogen’s role in decarbonizing big rigs, offering fast refueling times and transportability, remains uncertain due to its cost, BNEF said.

To get to BNEF’s net zero scenario, investments in charging infrastructure are set to reach as much as $3 trillion by 2050. Reaching the last 10% to 20% of the market is particularly challenging, according to the report.

“Support for charging infrastructure needs to be expanded dramatically, including for remote and otherwise under-served locations,” BNEF writes. “Dense public charging networks can help reduce the EV range consumers feel they need, which will in turn reduce pressure on battery raw material supplies.”

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

SunPower Slides After Disclosing Plans to Restate Earnings

Apr 23, 2024

AFC Joins $20 Billion Morocco-to-UK Subsea Power Export Project

Apr 22, 2024

China’s Rapid Solar Growth Slows as Grid Seeks to Keep Pace

Apr 22, 2024

Europe Is Being Scorched and Flooded by Growing Climate Extremes

Apr 22, 2024

Biden Unveils Winners of $2 Billion in Green Tax Credits

Apr 19, 2024

Europe’s Demand for LNG Set to Peak in 2024 as Crisis Fades

Apr 19, 2024

Clean Hydrogen’s Best Bet May Be a Rainforest State in Borneo

Apr 18, 2024

PG&E, Edison, California Apply for $2 Billion US Grid Grant

Apr 18, 2024

China’s Solar Surge Is Making a Missing Power Data Problem Worse

Apr 18, 2024

First Solar Jumps After Report Says Biden to End Trade Loophole

Apr 17, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum