AI Promises Faster Oil Drilling and Even More US Crude Supply

(Bloomberg) -- From a dark Houston control room, Rafael Guedes watched on a monitor as a robot took charge of a drilling rig in a North Dakota oil field, locking out the human operator.

Glowing red boxes lit up the screen as an artificial intelligence program took over the distant Nabors Industries Ltd. rig, beaming instructions by satellite and making split-second decisions to drill through the rock as smoothly as possible. Guedes, the company’s director of performance tools, estimates the program from Corva LLC will save the human operator about 5,000 commands while drilling the well and increase the speed by at least 30%.

“This is all automated — the driller doesn’t have to press anything,” said Guedes, as a green line on screen tracked the drill bit’s path underground. “Now you can use your brain power for something else.”

The oil industry has long mostly relegated artificial intelligence to back-office tasks like evaluating seismic surveys, while keeping drilling and hydraulic fracturing firmly in human hands. Now companies are increasingly using AI, machine learning and remote operations to drill faster, suggest better ways to frack and predict when active well pumps will fail. The goal is for the emerging technology to cut costs and help squeeze more oil from the ground, threatening to undermine efforts by the Organization of the Petroleum Exporting Countries to rein in global oil output and boost prices.

“A shale well gets an 8% recovery rate,” said Subodh Saxena, senior vice president at Nabors. “If that can be improved, the size of the prize is phenomenal.”

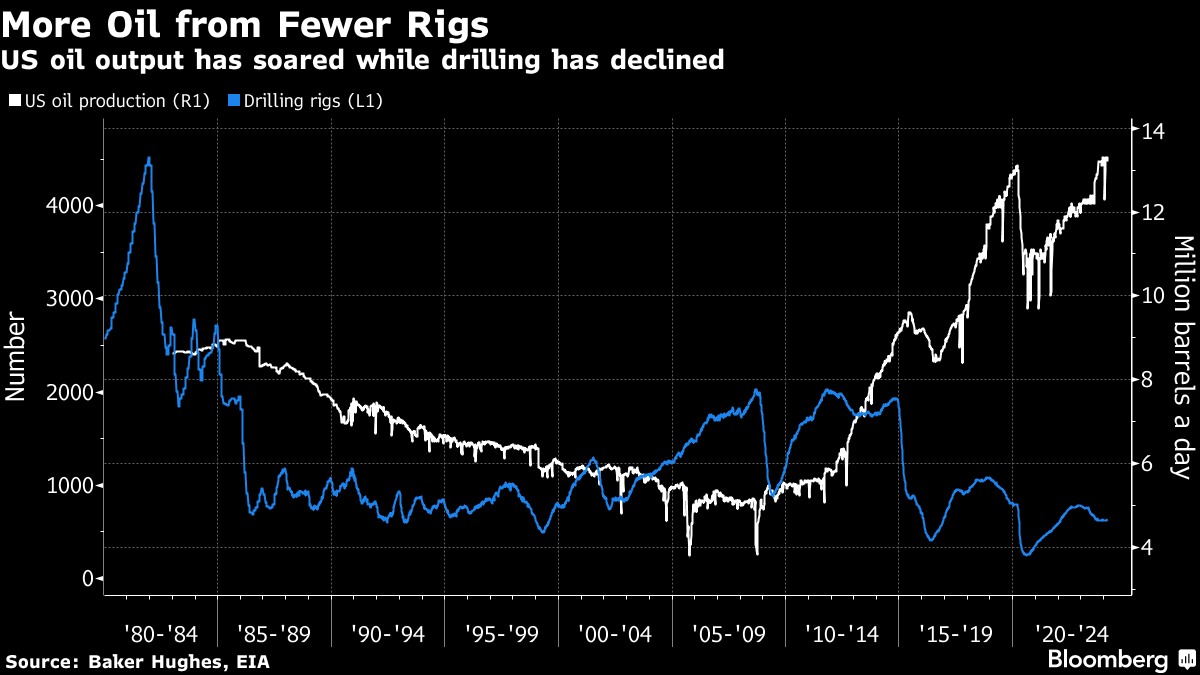

Advanced AI is gaining a foothold in the oil field as drillers and producers are relentlessly focused on improving efficiency. While the technology is being tested around the globe, the US is perhaps the most important spot to watch. The shale basins of Texas, North Dakota and other states have long been laboratories for discovering faster and cheaper ways to pump oil, turning the US into the world’s top producer.

Over the past five years, contractors have shaved a day off the roughly two weeks it takes to drill a well and three days off the 11-day average for fracking one, according to industry data provider Kimberlite International Oilfield Research. They’ve done it with a broad mix of new technologies and techniques, including drilling horizontal wells up to 3 miles long. Now AI holds the promise of even greater gains.

Improved efficiency should bring lower costs. James West, an analyst with Evercore ISI, expects companies to start touting their cost savings from AI in the next few fiscal quarters. “There’ll be significant cost savings, at a minimum double digits, but probably in the 25% to 50% of cost savings in certain scenarios,” he said.

With deployment just getting underway, it’s too soon to know the potential impact on jobs. But the technology may help companies overcome worker shortages they’ve experienced in recent years. Energy workers worldwide recently surveyed by Airswift Holdings Ltd., an oil-field headhunting firm, indicated an openness to AI, with most saying it could boost their job satisfaction and productivity.

The technology is being tested not just in shale formations but in offshore oil fields. SLB, the world’s biggest oil-services provider, announced in January that it autonomously drilled sections of five wells off the coast of Brazil, leading to a 60% faster drilling time.

Jesus Lamas, president of SLB’s well construction unit, said that in the next three to five years, 15% of all wells will be autonomously controlled by AI. The technology could be key not just to lowering drilling costs but to helping the industry meet climate change goals, he said. Even as renewable power advocates say AI could help integrate solar and wind energy onto the grid — speeding the transition away from fossil fuels — oil and gas companies see it as a way to lessen the global warming footprint of their operations in a carbon-constrained world. More efficient drilling means less energy spent per well.

“We need to do something different,” Lamas said. “We need to lower the cost of a barrel, we need to increase efficiency and we need to decrease the CO2 emissions per barrel.”

Artificial intelligence is also helping keep existing wells flowing. RoboWell, an AI project from Halliburton Co. and AIQ, was recently launched to help Abu Dhabi National Oil Co. keep its gas wells pumping through autonomous self adjustments.

Hilcorp Energy Co., one of the biggest private oil and gas producers in the US, estimates it can prevent roughly half a billion cubic feet of gas production from going off line by using machine learning to predict equipment failures, said Lisa Helper, a geologist at the Houston company. Otherwise, it could take about a week for a worker driving around in a truck to check all the wells, looking for those that had stopped pumping.

“We always want to be a lean operator,” Helper said last month at an industry conference in Houston. “Utilizing AI and machine learning in the field, in the office, then eventually through subsurface analysis has enabled us to keep a very tight, optimal workforce.”

Although such predictive technology is installed on just a small number of wells in the Permian Basin, it will ultimately expand and have more of an impact, said James Brady, chief digital officer at Baker Hughes Co. The No. 3 oilfield services provider has been building AI models to predict failures of electric submersible pumps, which are used to keep older wells flowing.

For a particular client in the Permian Basin, Baker Hughes can predict equipment failure within 30 days on about 65% of the client’s wells. The company aims to reach 70% and offer more complete recommendations for servicing the pumps.

“Over the last few years, we’ve gotten better and better at it,” said Brady, a veteran of more than three decades in the oil industry. “When you actually come up with a more combined model using physics as well as the data science, you start getting a higher probability of prediction.”

Monitoring wells, rather than drilling them remotely, remains the most common oil-field use of artificial intelligence so far, according to Kimberlite. But other applications are emerging. Startup ShearFRAC is using AI to frack wells more efficiently. The company’s technology dispenses suggestions to fracking crews in the field who then choose whether to implement them. In a nod to Apple Inc.’s Siri, the suggestions are delivered to the crew’s computer screens by a robot named Sheary and announced with a soft audio “ping.” Andrew McMurray, ShearFRAC’s chief executive officer, said the company eventually plans to offer more-automated fracking.

Corva, which is modeling every US shale basin for its AI software, plans to move into South America within the next two years, said William Fox, general manager for drilling at the Houston company. He said he’s been surprised at how much the US oil industry has been able to optimize with AI.

“Shale is the laboratory of the drilling industry,” Fox said. “What is proven and adopted in this incredibly competitive, hard-driving market, if it works in North American shale, it will work even better elsewhere.”

(Adds details of Halliburton AI project in paragraph thirteen.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains