BHP Mega Bid and $10,000 Copper Expose Mining’s Biggest Problem

(Bloomberg) -- Copper’s surge to $10,000 a ton just days after the bombshell news that BHP Group is trying to buy Anglo American Plc is highlighting a core disconnect at the heart of the industry: miners just aren’t building enough mines.

The biggest producers all want to increase copper output to take advantage of rising demand in electric vehicles, grid infrastructure and data centers. BHP has made its $39 billion proposal to buy Anglo American in large part because the world’s biggest miner wants to grow in copper.

Yet, that bullishness still isn’t translating into the huge investments involved in developing new pits and shafts and associated infrastructure. A successful takeover would make BHP the biggest copper producer with about 10% of the market, but it won’t make any difference toward meeting the world’s supply needs.

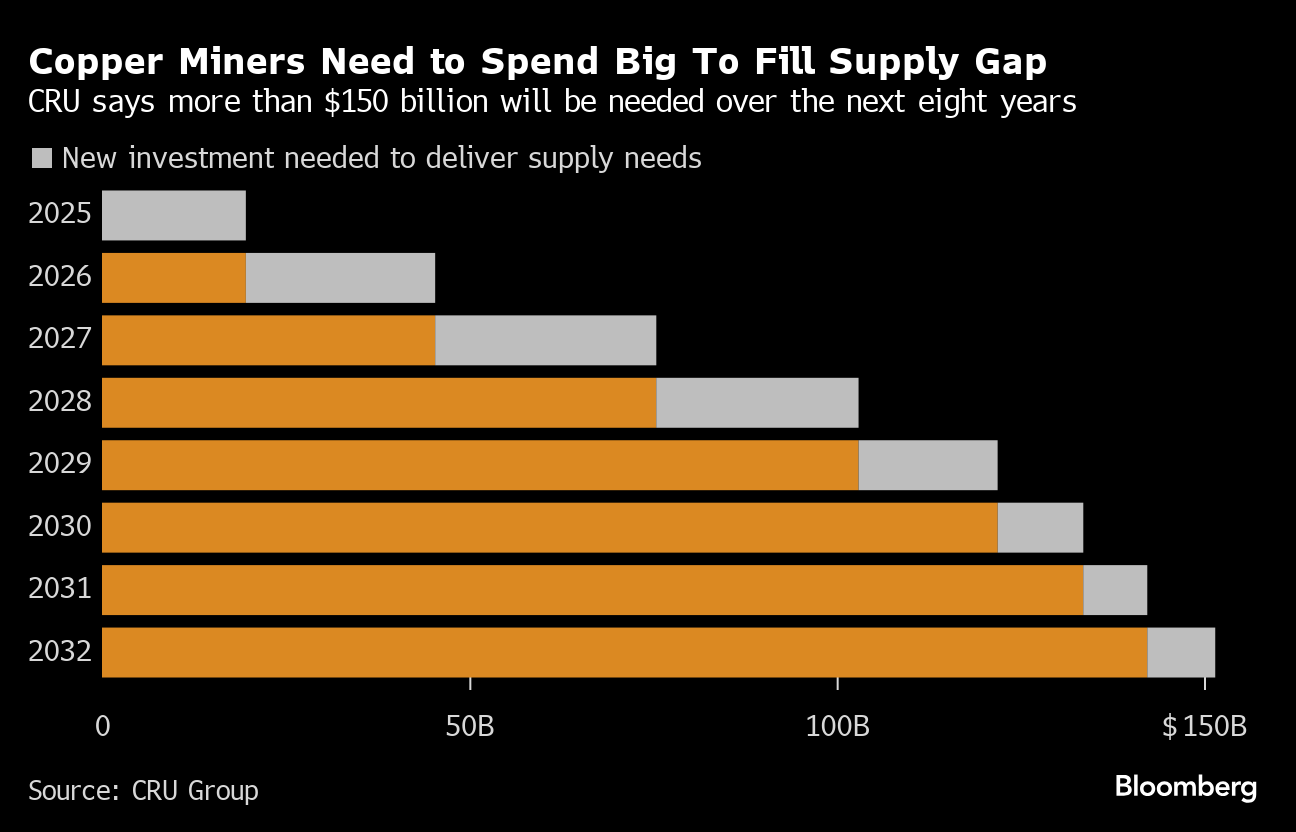

Production from existing mines is set to fall sharply in the coming years, and miners would need to spend more than $150 billion between 2025 and 2032 in order to fulfill the industry’s supply needs, according to CRU Group.

“Copper looks like the last remaining supply risk for the EV industry,” said Bernard Dahdah, senior commodities analyst at Natixis SA. “In a net-zero scenario, we’re going to need a vast amount of copper, and we’re going to need a different strategy to boost supply.”

The question of supply has been the driving force for copper’s 16% rally this year. Unlike the last time that prices hit $10,000, copper demand is relatively tepid for now and the physical market is well supplied.

Instead, the surge is being fueled by investors betting on looming shortages and the expectation that mining executives and their shareholders aren’t ready to finance and build enough new projects — and would rather buy out their rivals instead.

The reasons behind the underinvestment aren’t new, but they’re all getting worse: high-quality deposits are getting harder to find, and so is funding for small explorers; social and environmental resistance to mining is growing, and the cost of labor, equipment and raw materials has surged. And the handful of miners that have kept building have had a torrid time of late.

Speaking at the copper industry’s annual Cesco Week gathering earlier this month — and one day after BHP had privately made its pitch to Anglo — BHP’s head of copper and potash strategy Laura Whitton gave an assessment of the ways in which copper mining had become more difficult and more expensive.

The world was more reliant on older mines with lower ore grades than in the past, she said. “On supply, there’s a true challenge.”

While the copper market is relatively well supplied for now, investment bank analysts and a growing crowd of hedge fund investors are increasingly bullish on the outlook, believing it has the potential to rally to unprecedented levels over the next few years as the market faces growing shortages.

One key challenge is that new mines take years and often decades to build, and so decisions need to be calculated based on whether copper prices far in the future will justify the investment.

Miners would need $12,000 copper to justify spending on new mines, according to Olivia Markham, who co-manages the BlackRock World Mining Fund. And even then their investors may be reluctant to fund them.

“At a geological level, we have the projects — what we need is the money,” said Dahdah. “The last time copper prices were at $10,000, miners didn’t increase spending, they increased dividends.”

The lessons of the past decade would suggest that if the money does flow, it could come from China, but there are headwinds there too. Chinese-owned miners were responsible for about 40% of the net increases in supply over the past decade, but that looks set to fall to 16% over the next five years, according to McKinsey and Co.

Massive Chinese investment in overseas mining assets has already upended the markets for key battery metals such as nickel, lithium and cobalt, pushing them all into surpluses. Copper is also a key component in EV batteries and motors, but the global market is so large that China won’t be able to solve the industry’s supply challenge on its own.

“There is a clear and compelling need for additional mine capacity to be brought online,” said William Tankard, principal analyst for base metals at CRU. “The gauntlet is being laid down at the feet of the miners, and it’s going to be exceptionally challenging to deliver.”

Copper rose 0.4% to $10,003 a ton on Monday, adding to five weeks of gains.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances