Asia Pacific emerges as a nexus for EV sales and energy storage evolution, says Wood Mac

As regulations change and consumers' preferences shift, the electric vehicle (EV) and energy storage system (ESS) industries are set to experience substantial growth, with the Asia Pacific region playing a vital role, according to new research from Wood Mackenzie.

These findings come from Wood Mackenzie’s ‘Electric vehicle & battery supply chain: strategic planning outlook to 2050’ report.

The Asia Pacific region: a key player in the growth of electric vehicle

Wood Mackenzie’s analysis notes that passenger plug-in electric vehicle sales are set to soar, reaching an estimated 39 million units by 2030, partially fuelled by recent US regulations. While global sales will continue to rise through 2050, the Asia Pacific region will emerge as the primary growth driver, accounting for a substantial portion of the market.

Meanwhile, regulations demanding a higher share of EVs in car manufacturers’ portfolios will have an impact on the industry. Max Reid, senior research analyst – Electric Vehicles & Battery Supply Chain Service, for Wood Mackenzie, said “car manufacturers are adapting to stricter regulations and evolving consumer preferences by focusing on the C/SUV-C and D/SUV-D model segments and providing high-performance and energy-efficient battery packs for electric vehicles. This collective effort is shaping the future of the automotive sector towards sustainable mobility and a more sustainable future.”

Growing demand for batteries

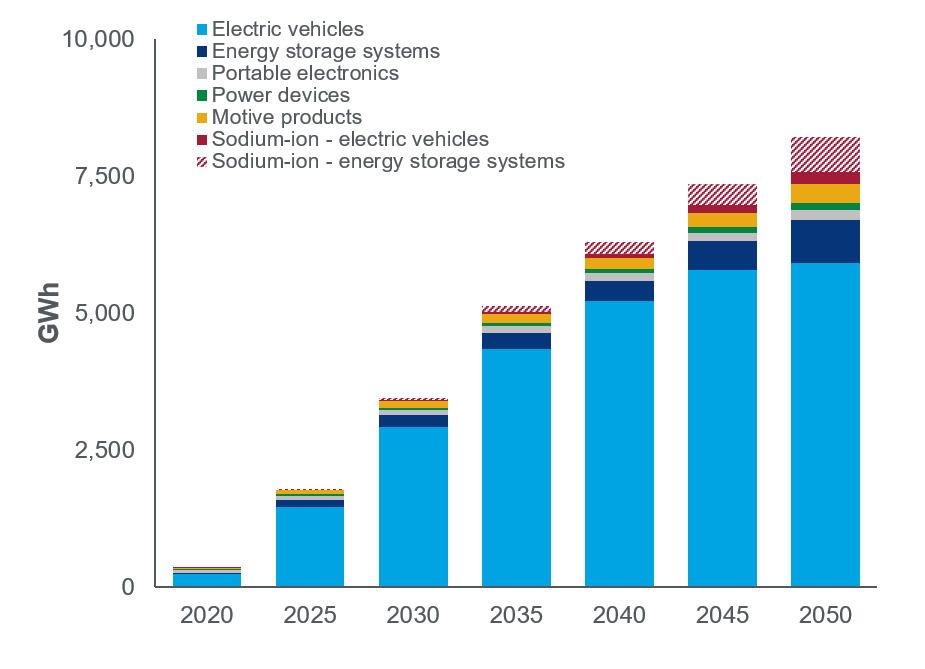

Global battery demand is projected to skyrocket at a compound annual growth rate of 26% until the end of the decade, reaching 3.4 terawatt hours (TWh) by 2030, primarily driven by EVs and ESS, motive products, portable electronics, and power devices will also contribute to the overall market. However, demand growth is expected to slow to 3% in the 2040s, with a forecasted demand of approximately 7.3 TWh by 2050.

Source: Wood Mackenzie Electric Vehicle and Battery Supply Chain Service

Role of cathode technologies

The type of cathode technologies used in batteries can significantly affect the demand for raw materials required. “According to our analysis, the use of iron-based chemistries will lead to a drop in the average cost of battery packs to below US$100 per kilowatt hour by 2029. Lithium-ion battery technology is expected to grow with a projected capacity of 3.4 TWh by 2030 and 7.35 TWh by 2050, matching demand. On the other hand, the rise of sodium-ion technology is also anticipated, with an additional capacity of 158-gigawatt hours (GWh) expected to be added. While lithium iron phosphate (LFP) batteries currently comprise almost 70% of production and installation in China, this technology shift is unlikely to occur elsewhere. It is expected to level off in China by the end of the decade,” added Reid.

Only China, South Korea, and Japan produce significant quantities of nickel-based cathode active materials. But by the end of the decade, more countries like Germany, Canada, the United States, Poland, Indonesia, and Finland are also expected to start producing them. However, most of the production will still be in the Asia Pacific region.

Lithium and nickel in high demand

The global demand for lithium-ion battery technology will drive a fivefold increase in the lithium market by 2050. Currently, the majority of mined lithium comes from Australia and China, but by 2030, Africa and North America will contribute 30% of the mined supply.

The demand for nickel in the market is expected to increase significantly as lithium-ion batteries rely heavily on it to enhance their energy density. However, compared to lithium, the supply of nickel for batteries will mostly come from Asia. This could pose a significant risk to battery pack prices, especially for those that use nickel-based chemistries that demand high nickel content.

Recycling: circularity will increase as EVs reach end-of-life

Regarding recycling, the report highlights that by 2030, there will be two million tonnes of black mass from shredded and processed battery waste available for processing each year. This amount will increase significantly in the 2030s as early-decade electric vehicles reach end-of-life. However, only 157,000 tonnes of lithium carbonate equivalent will come from the recycling sector in 2030, meeting just 7% of the overall demand. By 2050, nearly two million tonnes of battery materials will be recycled annually, contributing to sustainability efforts.

“As the demand for electric vehicles (EVs) and energy storage systems (ESS) increases, planning carefully and investing further to maintain a stable supply chain is essential. Neglecting to do so could result in higher costs for raw materials and refined chemicals later in the decade,” Reid concluded.

Notes:

• Electric vehicle & battery supply chain: strategic planning outlook to 2050 draws on insight from our Electric Vehicle and Battery Supply Chain Service. The report covers future demand, production capacity and pricing, and a detailed analysis of contributing factors.

• Mined lithium represents more than half of global supply, with the rest coming from brine sources.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.