Solar Beats Coal in Europe for First Time - But There’s a Glitch

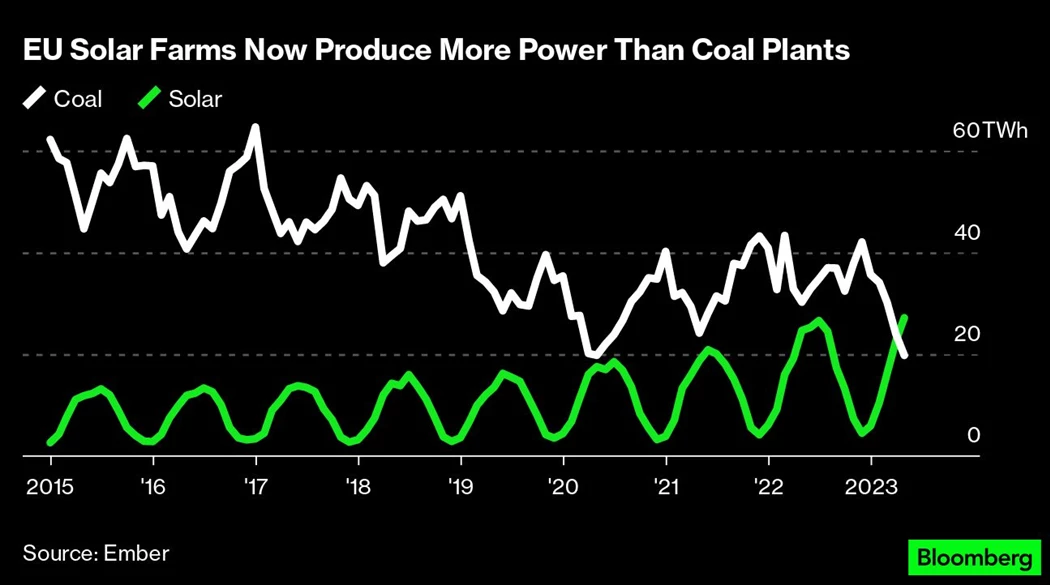

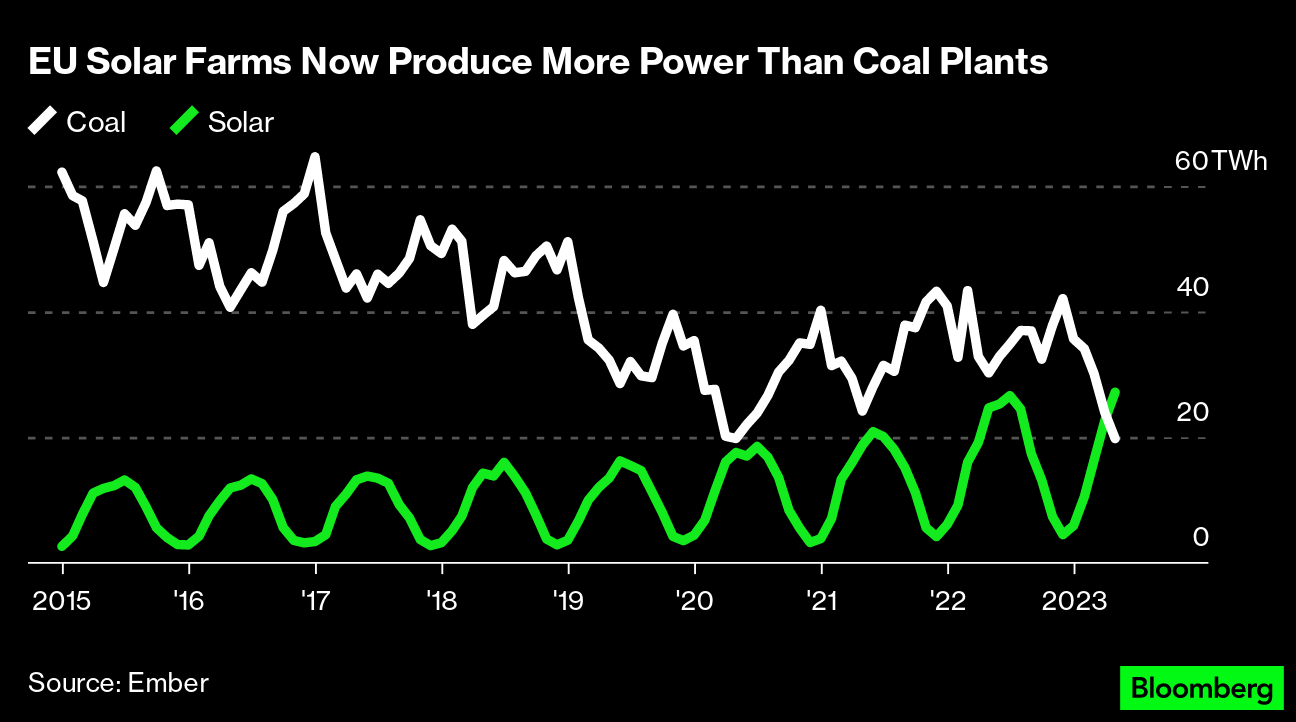

(Bloomberg) -- The European Union’s transition to clean energy marked a milestone in May, when solar panels generated more electricity than all of the bloc’s coal plants for the first time — and that’s before summer sun boosts production even further.

While the furious expansion of solar generation bodes well for efforts to replace fossil fuels, the breakthrough also exposed flaws in the energy system. Power prices turned negative during some of May’s sunniest days as grid operators struggled to handle the surge.

“This summer will be something we’ll have to look at like it’s a postcard from the future,” said Kesavarthiniy Savarimuthu, analyst at BloombergNEF. “The biggest message will be: we’re not ready.”

Although solar was a fast and easy solution to respond to last year’s energy crisis triggered by Russia’s moves to squeeze natural gas supplies, the downside is the technology is best in sunny months when demand is typically lower. Systems to store that energy in batteries or by creating green hydrogen aren’t advanced enough to allow summer sun to keep lights on at night or help heat homes in the winter.

Nowhere is the solar boom — and the adjustment risks — clearer than in the Netherlands. There are over 100 megawatts of solar panels for every 100,000 Dutch residents, double the deployment of sunny Spain and more than triple the rate in China — by far the global leader in total solar capacity.

The Netherlands’ claim to the densest solar network on Earth is thanks largely to long-running government support. The program rewards households for installing solar panels, with every watt of electricity offsetting energy bills, regardless of whether usage matches up with the sunniest parts of the day.

“The Dutch government did this to stimulate solar panels, but it’s a little too successful,” said Jorrit de Jong, spokesman at Dutch electric grid operator TenneT, who has seven roof-top solar panels that produce at least 80% of his annual household electricity consumption. “If I do my laundry or charge my car at moments when there isn’t sun, it doesn’t matter for me because I get paid by my energy company.”

The government in the Netherlands plans to change the system starting in 2025. Under new rules, households that send power back to the grid would be able to deduct a declining amount from their annual bill. By 2031, producers would only benefit from power they actually consume and not get compensated for any excess.

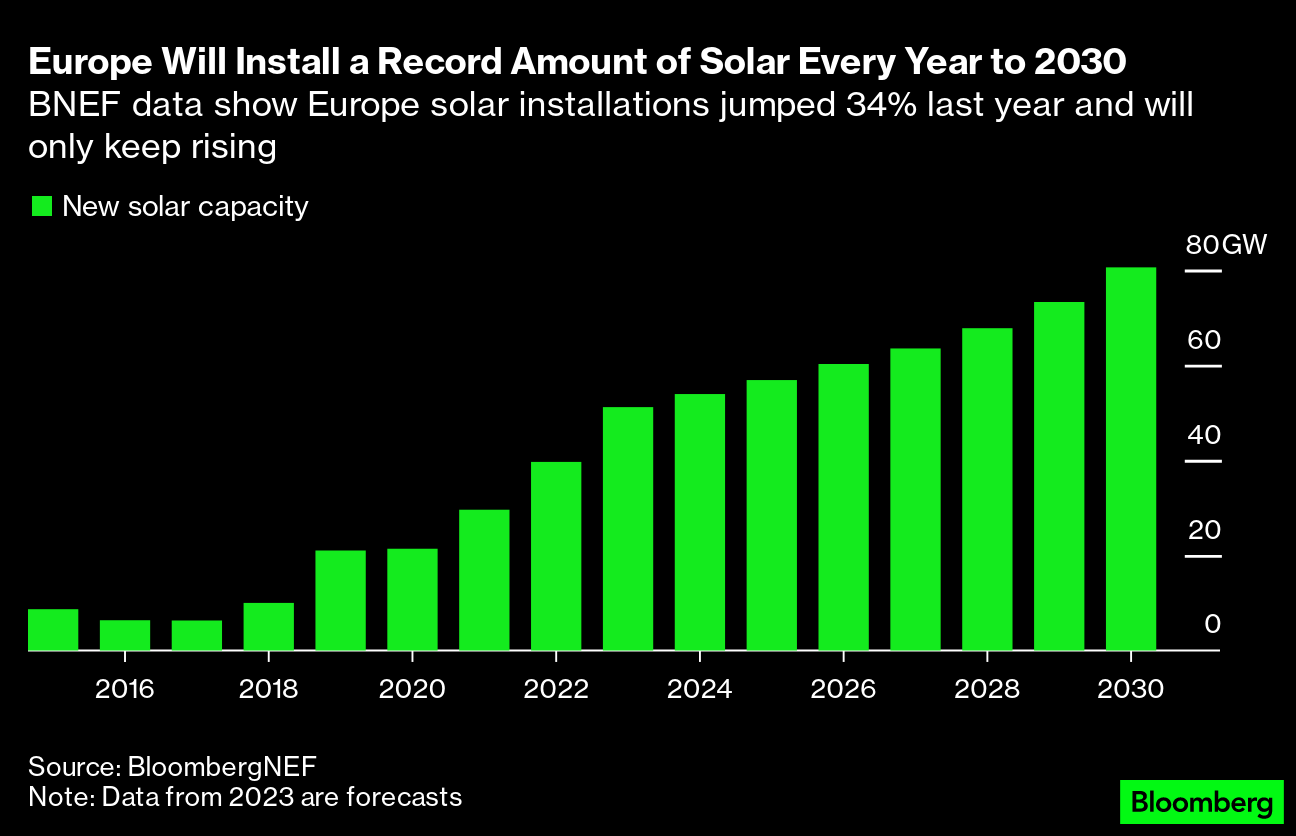

Across Europe, people are following the Dutch example. Since the start of Russia’s invasion of Ukraine, installations of solar panels in the EU have accelerated. In May, production rose 10% compared to the previous year to reach a record 27 terawatt hours.

In contrast to wind, hydro or geothermal power, solar has a key advantage of being quick to install. All it takes is an incentive for homeowners or property companies to turn roofs into mini energy parks. But electricity grids were set up around massive generators that could work in tandem with grid operators to keep networks balanced. A more distributed system is harder to manage and will be tested in earnest this summer.

While record solar and wind production have helped drive out coal and gas plants at an impressive rate this year, the EU still has a long way to go to reach its goal of net-zero emissions by 2050. Germany is under even more pressure, with Europe’s biggest power market aiming for a decarbonized grid by 2035. Getting there will require not only a massive expansion of clean energy, but also changes that better align consumption with generation.

There are already signs of a mismatch between supply and demand. Last weekend, electricity prices turned negative at times as solar output hit a record in Germany, Europe’s biggest producer. Negative prices aren’t unheard of and are typically linked to strong wind generation at night or on weekends when demand is thin.

When there’s a surge in power, suppliers have to pay consumers to use electricity. It doesn’t mean 100% of the power is coming from renewables. Some conventional plants can’t flexibly switch on and off or are required to run to maintain grid stability.

Increasing price swings and persistent low or negative rates during peak production periods for renewable power could put further investment at risk, according to Axel Thiemann, chief executive officer of Sonnedix, one of Europe’s biggest solar developers.

Since the end of 2021, Sonnedix has roughly doubled its pipeline of European projects, but Thiemann warned development will get more difficult without changes to how power is managed.

“As more investment gets realized, the grid will get more and more saturated during certain parts of the day in the summer,” he said in an interview. “Even if you have unlimited amounts of solar projects that are permitted, they will not be built unless there’s a clear route to market.”

Better coping with the ebb and flow of renewable generation will require a new kind of flexibility in the power system, which wasn’t necessary when all electricity came from a few giant fossil fuel and nuclear plants that could be turned up or down depending on demand.

“Our current power system wasn’t planned for these kinds of flexibility needs,” said Thorsten Lenck, project manager at Berlin-based think tank Agora Energiewende.

There are various ways to adapt. Batteries connected to the grid could use power during the sunniest or windiest parts of the day to sell when renewables aren’t producing as much. Consumers could also be incentivized to use power during times of peak production. That could be particularly important as more electric vehicles hit the roads and households switch from traditional boilers to heat pumps.

“We’re going to have an unprecedented amount of solar production this summer and it tends to increase the volatility in power prices,” said Joke Steinwart, analyst at Aurora Energy Research. “This presents big opportunities for flexible technologies like batteries.”

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Longi Delays Solar Module Plant in China as Sector Struggles

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry

California Popularized Solar, But It's Behind Other States on Panels for Renters

A $50 Billion London Investor Takes a Contrarian View on Trump