Oil Extends Decline as Market Metrics Point to a Weaker Outlook

(Bloomberg) -- Oil fell as metrics showed signs of a weaker market despite an uptick in geopolitical tensions before an OPEC+ meeting on supply.

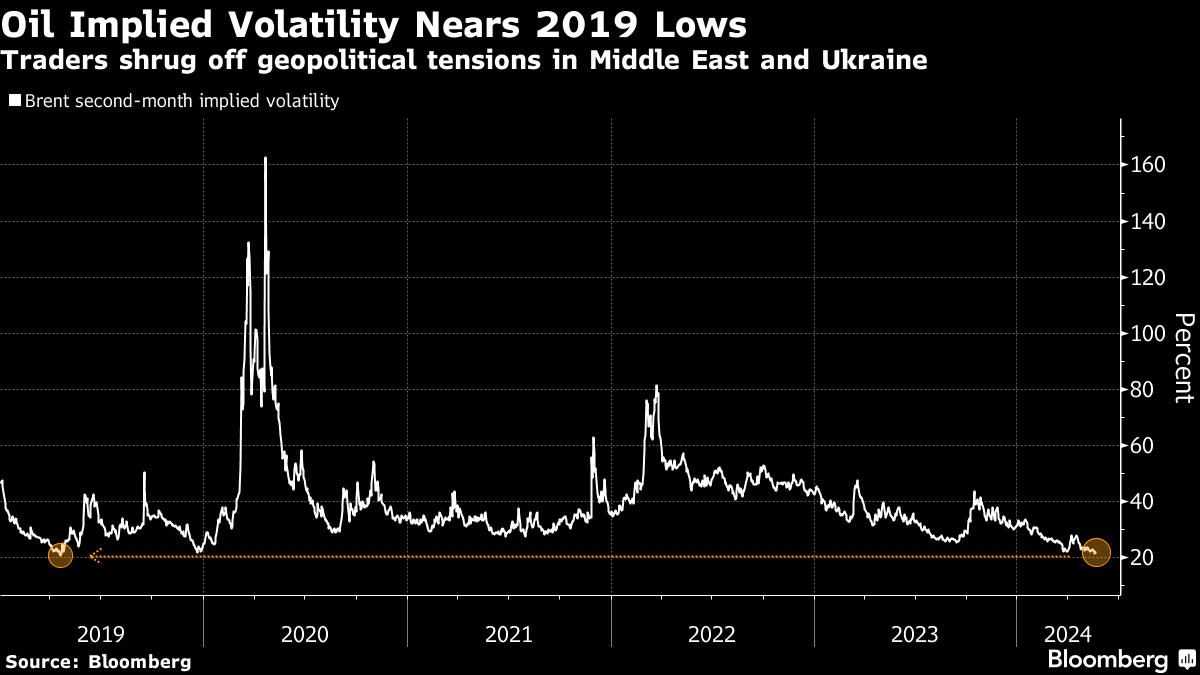

Brent’s prompt spread narrowed to its smallest backwardation since January, while money managers continued to reduce bets on gains. Futures have been trading in a tight range, with implied volatility near the lowest since 2019.

The global benchmark dropped toward $83 a barrel, after ending 0.3% lower on Monday, while West Texas Intermediate was near $79, despite more Ukrainian drone attacks on Russian refineries, and another Houthi strike against a tanker in the Red Sea over the weekend.

Oil is about 8% higher this year due to the OPEC+ cuts, but Brent has eased since mid-April. Traders are looking to a meeting of the cartel in early June that will set the group’s supply policy for the second half, with market watchers largely expecting a rollover of curbs.

The value of swaps tied to physical North Sea cargoes was negative for the first time since February on Monday, adding to the bearish signs. Some refiners have also cut processing rates, citing poor demand for fuels.

“Dented demand prospects are casting a shadow over the oil markets,” said Priyanka Sachdeva, senior market analyst at brokerage Phillip Nova Pte in Singapore. “Whatever support we see in oil prices is purely a function of an anticipatory disruption in supplies, and it’s becoming tougher day by day to justify that premium,” she said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output