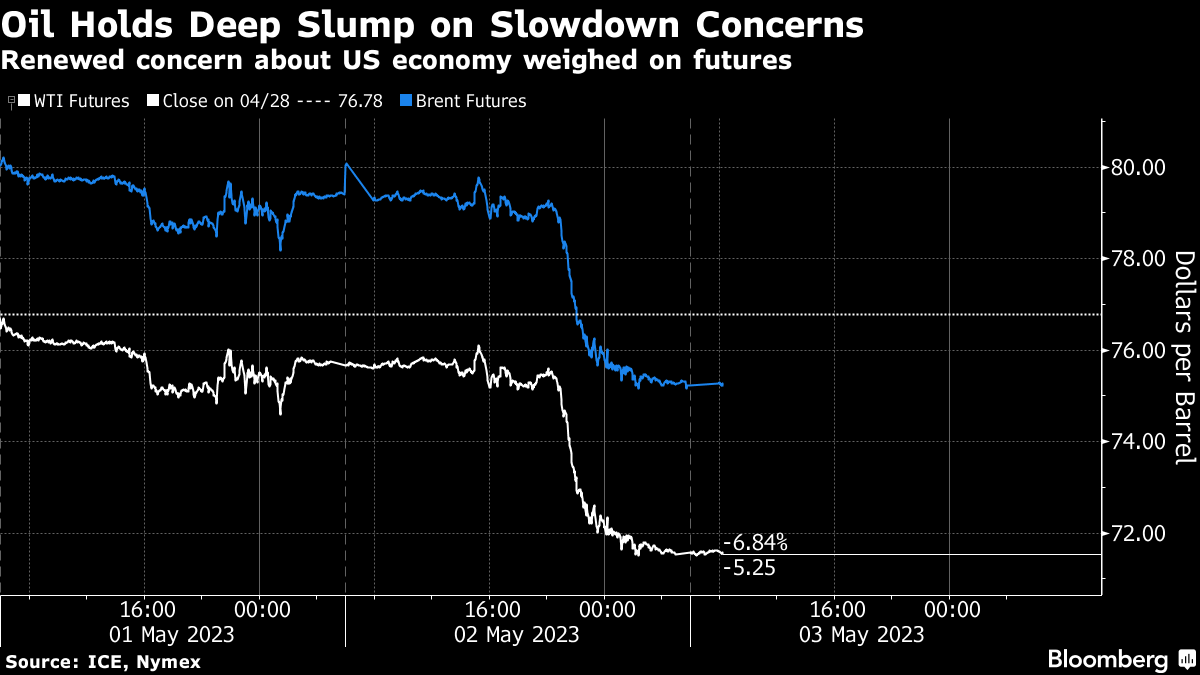

Oil Steadies After Collapsing by 5% as Demand Concerns Escalate

(Bloomberg) -- Oil steadied in Asia after tumbling 5% on Tuesday as data pointed to a possible US recession and investors shunned risk assets.

Brent held above $75 a barrel after closing at the lowest in more than five weeks. Crude fell along with other commodities as figures showed a cooling US labor market ahead of what’s expected to be the Federal Reserve’s final interest-rate hike in its current tightening cycle. Renewed concern about the US banking sector added to selling pressure.

Crude has had a rough ride in 2023 despite China’s reemergence from its restrictive Covid Zero policy and sizable cuts to supply by the Organization of Petroleum Exporting Countries and its allies including Russia. The retreat has been spurred by concerns that the US may be headed for a recession, and by Moscow’s ability to keep crude exports flowing amid the war in Ukraine.

“It would appear that macro trumps fundamentals, a trend which has become increasingly stronger in recent weeks,” said Warren Patterson, head of commodities strategy for ING Groep NV. “As for where the floor is for the market, $70 a barrel should provide good technical support for Brent.”

In the US, data from the industry-funded American Petroleum Institute offered a mixed picture. Nationwide crude inventories contracted by almost 4 million barrels last week and distillate inventories also dropped, but there was a build in crude at the key Cushing, Oklahoma hub, according to people familiar with the figures. Government data comes later on Wednesday.

In Russia, meanwhile, there is no sign of a sustained drop in crude flows out of the country. Exports jumped back above 4 million barrels a day in the week to April 28, a level surpassed only once since Moscow’s troops invaded Ukraine in February 2022, according to tanker-tracking data compiled by Bloomberg.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company