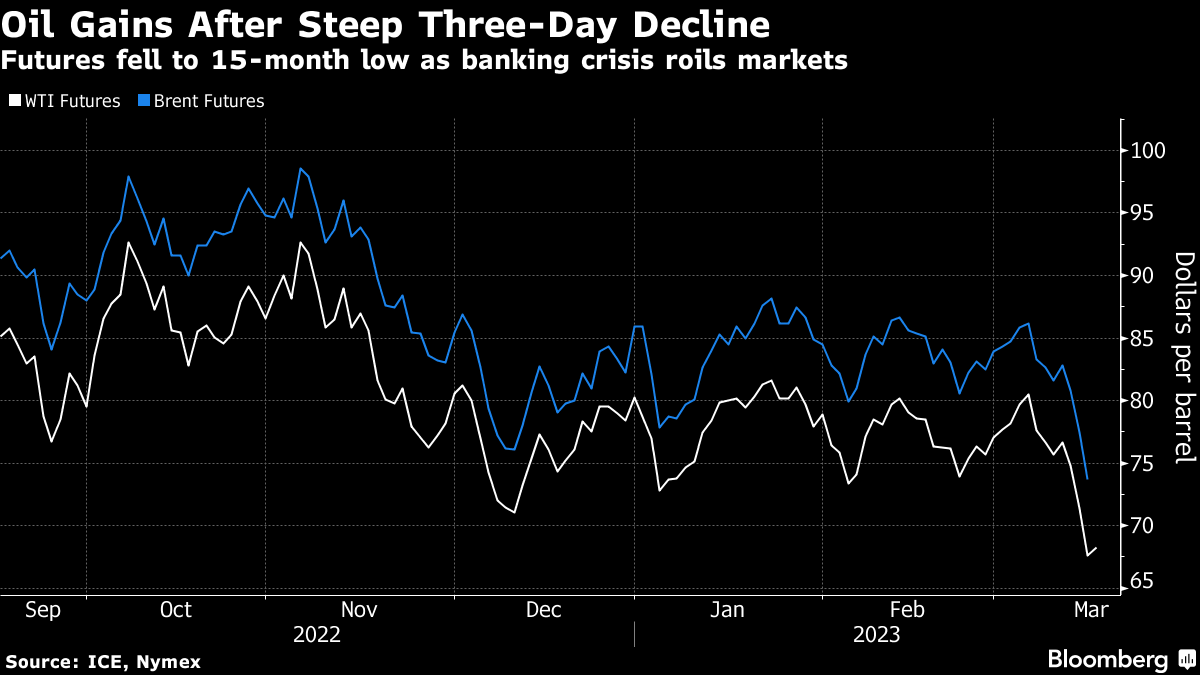

Oil Climbs From 15-Month Low After Banking Crisis Roils Market

(Bloomberg) -- Oil rose from the lowest close in 15 months after a three-day rout started by the US banking crisis and accelerated by options covering.

West Texas Intermediate futures traded near $68 a barrel after tumbling around 12% over the previous three sessions. The turmoil whipped up by the collapse of Silicon Valley Bank and fresh upheaval at Credit Suisse Group AG has reverberated across global assets, with selling in oil gathering pace as firms tried to limit their exposure in the options market.

“We seem to be walking on thin ice right now, with the fragile risk environment still trying to stabilize from the SVB fallout,” said Yeap Jun Rong, a market strategist for IG Asia Pte in Singapore. “There seems to be a lack of bullish catalysts for oil prices to tap for now.”

OPEC’s top official earlier this month flagged concerns about slowing demand in Europe and the US, and investors will be watching to see if the rout draws a response from the cartel and its allies. However, traders are abandoning bets that the Federal Reserve will raise interest rates amid the banking turmoil.

Further oil price gains may be limited in the near term, with OPEC this week forecasting a modest surplus in the second quarter, a typical period of soft demand before the summer. The International Energy Agency on Wednesday said that the market was already in surplus on stubborn Russian output.

A long-term timespread for global benchmark Brent has weakened during the recent selloff, narrowing to $2.94 a barrel in backwardation on Wednesday. That compares with $5.26 at the end of last week.

US crude inventories expanded by 1.55 million barrels last week, according to data from the Energy Information Administration on Wednesday. Net total oil exports, including crude and refined products, jumped to 3.5 million barrels a day. That figure has only been surpassed once since 1990.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week