Hedge Funds Turn More Bullish Across Energy as Prices Rally

(Bloomberg) -- Hedge funds boosted bullish wagers across the energy complex as crude prices broke out of their recent range, climbing above $80 a barrel, and gasoline prices surge to multi-month highs.

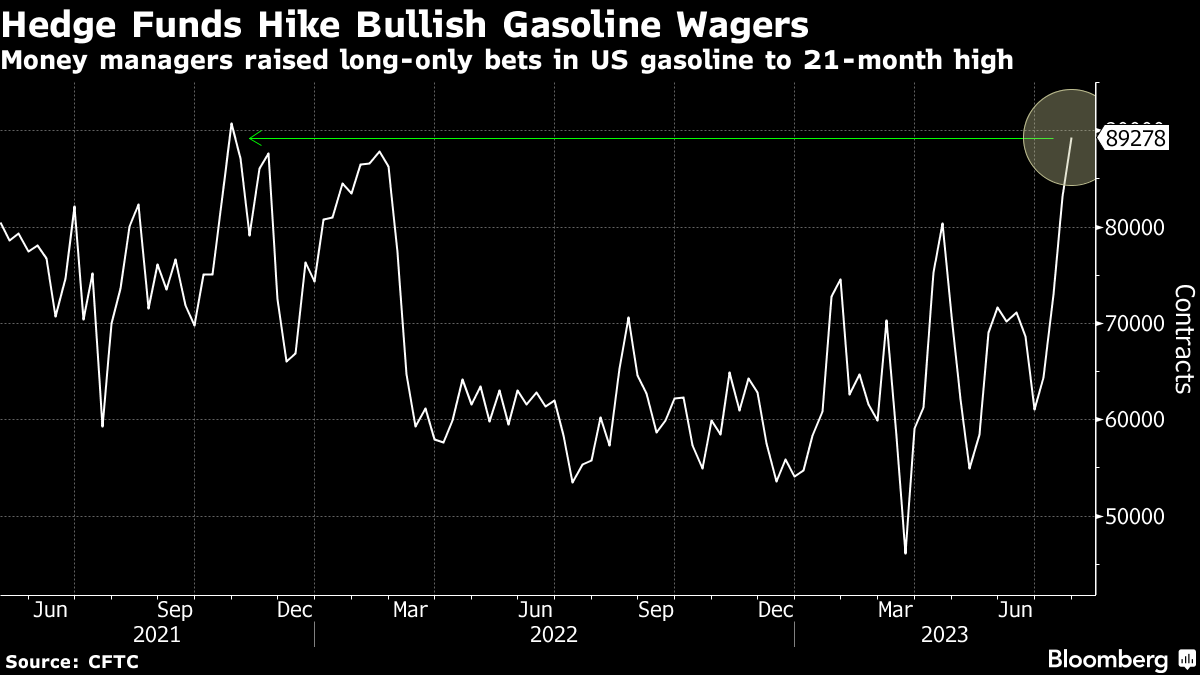

Speculators hiked net long positions in the two benchmark crude futures to a three-month high while long-only bets in US gasoline futures skyrocketed to about 89,278 lots in the week ending July 25, the highest in nearly two years, according to data from the Commodity Futures Trading Commission and Intercontinental Exchange.

The bullish stance is a reversal of months of relatively bearish positioning and a welcome relief for investors betting on oil strength in the second half of the year as inventories dwindle.

Energy prices have rallied in recent weeks on signs of tight supply and resilient demand even in the face of rising interest rates. Gasoline prices have received a further boost from a spate of refinery issues.

Speculators also increased bullish bets on Nymex diesel and ICE gasoil to 6-month highs. Robust diesel exports have helped offset soft US domestic demand and Europe continues to pull a large amount of Gulf Coast diesel, making up for dwindling volumes to Brazil.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output