Oil Rises as US Crude Inventories Show First Decline in a Month

(Bloomberg) -- Oil extended gains after a US government report showed crude stockpiles fell for the first time in a month and demand for fuel improved.

West Texas Intermediate rose as much as 3.4% to trade above $81 a barrel. Crude inventories fell 215,000 barrels last week, the US Energy Information Administration reported. The country’s demand for distillates, which includes diesel, jumped last week bringing the four-week average back above 2020 levels for this time of year. Meanwhile, leaks in three Nord Stream pipelines that began Tuesday and are widely suspected to be sabotage are prompting concerns of a broader escalation of Russia’s energy conflict with Europe.

Oil futures markets have been volatile for months amid lackluster liquidity. Prices have now plunged almost 40% from their peak earlier this year, hitting revenues of petrostates, some of which form the Organization of Petroleum Exporting Countries.

Russia, which has to discount its barrels because of Western sanctions, is pushing OPEC and its allies to cut their collective output by 1 million barrels a day when the producer nations meet next week, Reuters reported Tuesday. A production cut would further tighten supplies and could rally prices.

The European Union also announced a new round of sanctions on Russia Wednesday, which will include additional import bans on Russian products and prohibit sales of key technologies to the country. The measures will include a price cap on Russian oil exports, but the price details are not yet known.

Some of China’s top refiners are also expecting a better economy in the winter, a bullish signal for oil demand. Demand in the country, which is the world’s biggest crude importer, has remained weak for years because of its Covid Zero policy.

Risk assets were gripped by volatile trading on Wednesday as the Bank of England said it would buy long-dated government bonds in whatever quantities needed to restore order to the market. The dollar earlier rose to another record after the White House talked down the prospect of weakening the currency.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Kent confirms enhanced project alliances with ExxonMobil and Repsol Norge

Apr 16, 2024

Mexico’s Sheinbaum Plans to Spend Billions on Gas, Solar Plants

Apr 15, 2024

What’s Next for Crude Oil? Analysts Weigh In After Iran’s Attack

Apr 15, 2024

Oil Traders Weigh Risks of Iran-Israel Conflict in Tight Market

Apr 14, 2024

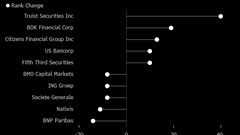

US Regional Banks Dramatically Step Up Loans to Oil and Gas

Apr 14, 2024

Oil Rises to October High as Israel Prepares for Iranian Attack

Apr 12, 2024

Gold Hits New Record, Oil Rises on Mideast Tension: Markets Wrap

Apr 12, 2024

Oil Swings Near $90 With Risk of Iran Strike on Israel in Focus

Apr 11, 2024

Oil Holds Two-Day Loss as Report Points to Rising US Inventories

Apr 10, 2024

Commodity Traders Rake in Billions in Second Blockbuster Year

Apr 08, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

Neway sees strong growth in Africa

Feb 27, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum