Futures Slip, Stocks Waver Amid Growth Concerns: Markets Wrap

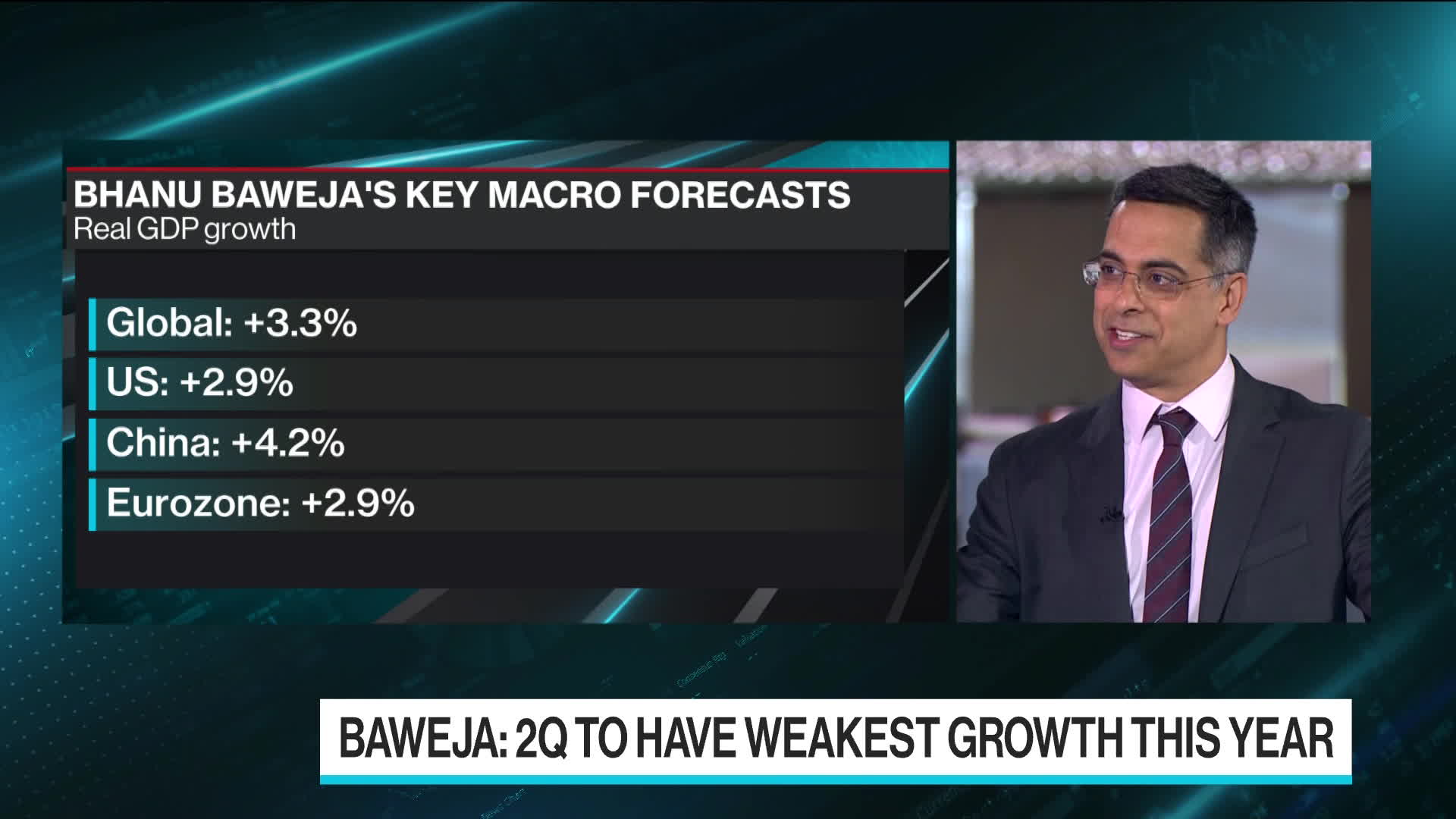

(Bloomberg) -- US equity futures slipped and stocks in Europe fluctuated as traders weighed China’s latest measures to support its economy after poor data fueled concerns about the outlook for global growth.

Contracts on the S&P 500 and Nasdaq 100 dropped, but were off their session lows. Twitter Inc. shares declined in pre-market trading, on course to wipe out all their gains since billionaire Elon Musk disclosed his stake in the social media platform. The Stoxx Europe 600 index fell as much as 0.8% before paring losses, with declines for tech and travel stocks offsetting gains for basic resources as industrial metals rallied.

China’s industrial output and consumer spending hit the worst levels since the pandemic began, hurt by Covid lockdowns. Officials are taking measured steps to help the economy: China effectively cut the interest rate for new mortgages over the weekend to bolster an ailing housing market, but the one-year policy loan rate was left unchanged Monday.

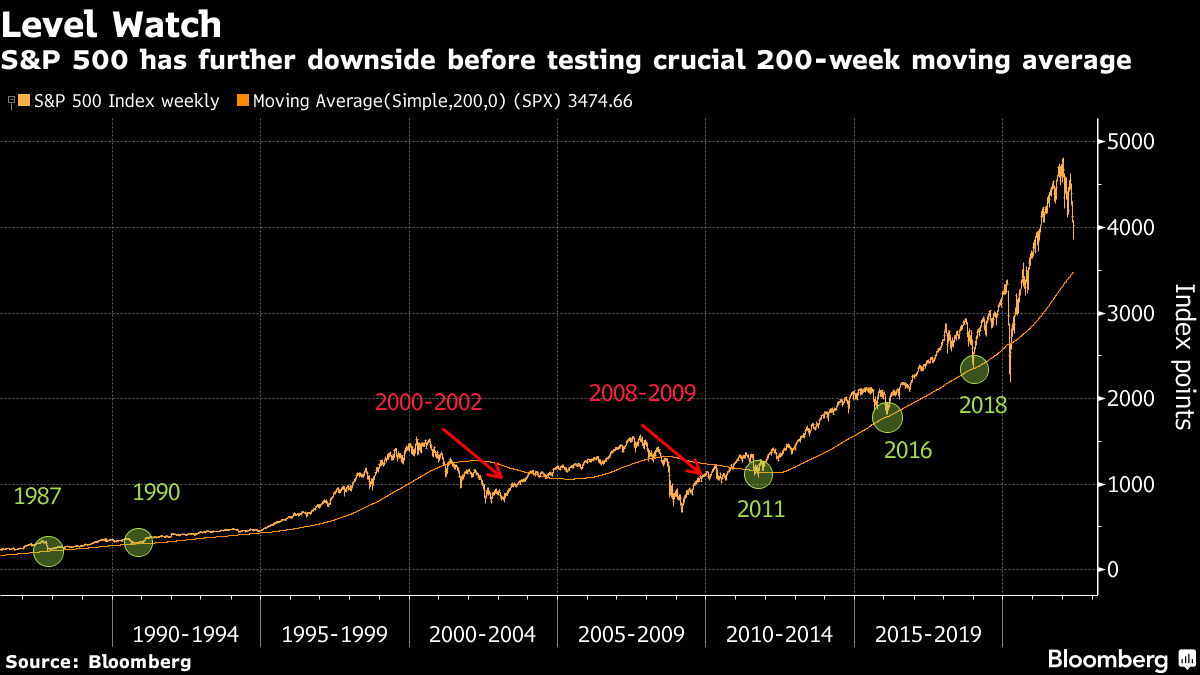

The risk of an economic downturn amid price pressures and rising borrowing costs remains the major worry for markets. Goldman Sachs Group Inc. Senior Chairman Lloyd Blankfein urged companies and consumers to gird for a US recession, saying it’s a “very, very high risk.” Traders remain wary of calling a bottom for equities despite a 17% drop in global shares this year, with Morgan Stanley warning that any bounce in US stocks would be a bear-market rally and more declines lie ahead.

“Trying to time the market is likely to prove time-consuming and loss-making,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “Investor sentiment is fickle, and markets are likely to remain choppy until we get greater clarity on the three Rs: rates, recession, and risk.”

In the bond market, the 10-year US yield was little changed around 2.93%. A key question is whether economic worries will help stem this year’s Treasury selloff, which has been driven by inflation and tightening US monetary settings. Yields on European bonds rose.

Cryptocurrencies dipped as the mood in stocks weakened. That took Bitcoin back to around the $30,000 level.

Energy Costs

Food and fuel prices are feeding into rising costs. Wheat jumped by the exchange limit on India’s move to curb exports. Oil was dented by the Chinese figures but held around $110 a barrel. Shanghai is close to the necessary threshold for loosening its six-week lockdown, a development that could spur bets on rising energy demand.

Meanwhile, the European Commission warned the euro area’s pandemic recovery would almost grind to a halt, while prices would surge even more quickly if there are serious disruptions to natural-gas supplies from Russia.

Traders are watching efforts by Finland and Sweden to join the North Atlantic Treaty Organization in the wake of Russia’s invasion of Ukraine. The shift in Europe’s security alliance could exacerbate tensions with Russia.

What to watch this week:

- New York Fed President John Williams speaks Monday

- Fed Chair Jerome Powell among slate of Fed speakers Tuesday

- Reserve Bank of Australia releases minutes of its May policy meeting Tuesday

- G-7 finance ministers and central bankers meeting Wednesday

- Eurozone, UK CPI Wednesday

- Philadelphia Fed President Patrick Harker speaks Wednesday

- China loan prime rates Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 fell 0.3% as of 6:56 a.m. New York time

- Futures on the Nasdaq 100 fell 0.5%

- Futures on the Dow Jones Industrial Average fell 0.1%

- The Stoxx Europe 600 fell 0.2%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.2% to $1.0433

- The British pound was little changed at $1.2255

- The Japanese yen fell 0.1% to 129.35 per dollar

Bonds

- The yield on 10-year Treasuries was little changed at 2.92%

- Germany’s 10-year yield advanced five basis points to 1.00%

- Britain’s 10-year yield advanced four basis points to 1.78%

Commodities

- West Texas Intermediate crude fell 0.9% to $109.49 a barrel

- Gold futures fell 0.3% to $1,802.40 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company