Stocks, Futures Rise as Slower CPI Curbs Rate Bets: Markets Wrap

(Bloomberg) -- Stocks extended a rally Thursday following softer-than-expected US inflation data, which stoked speculation that the Federal Reserve could pivot to a shallower pace of interest-rate hikes.

Tech shares spurred a more than 1% climb in an Asian equity index amid gains in Hong Kong and China. US and European futures rose after the S&P 500 hit a three-month high and the Nasdaq 100 pulled 20% above a June low.

China’s bourses advanced even as investors digested a warning from its central bank about inflation threats and a pledge to avoid massive stimulus.

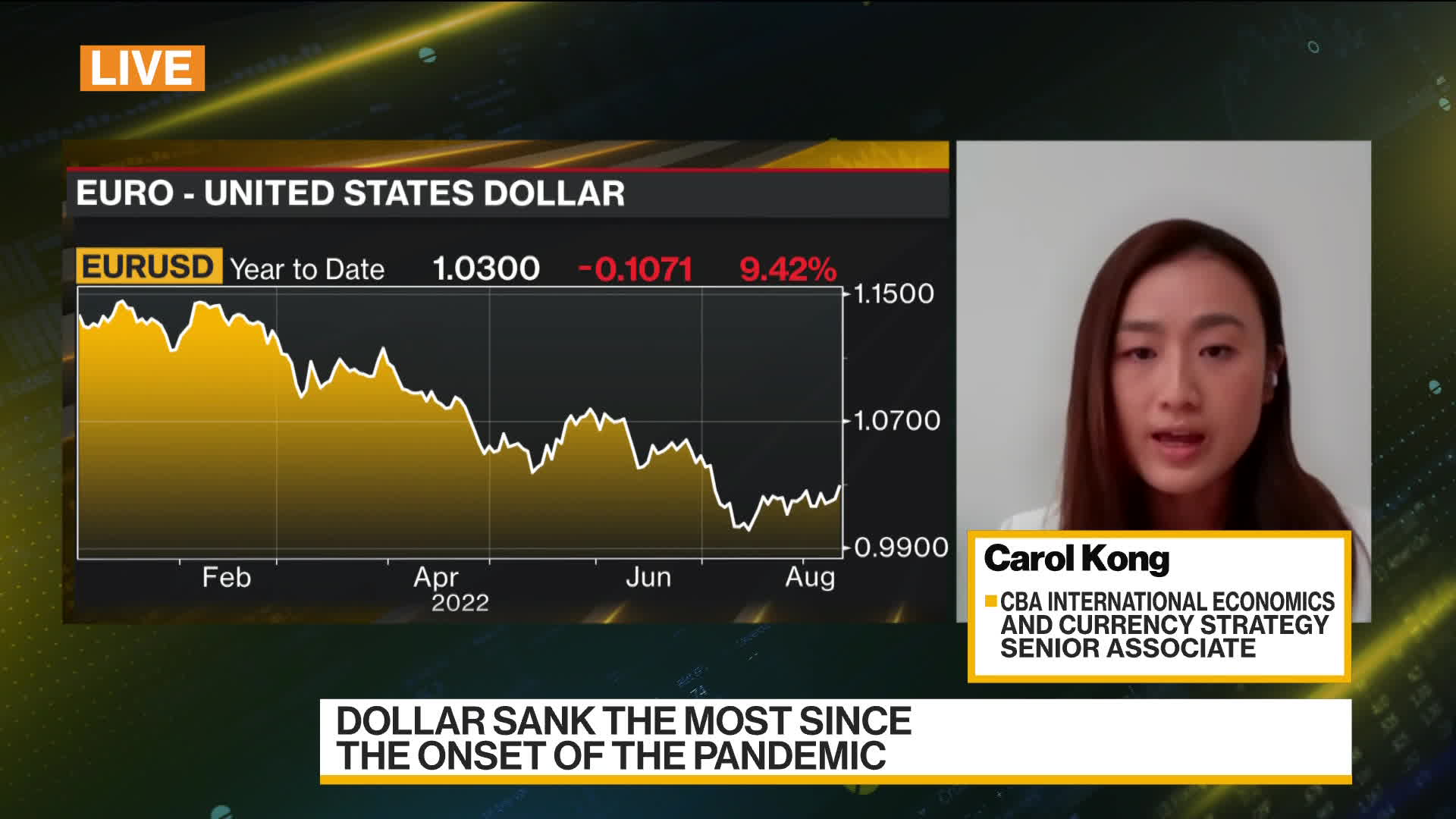

The dollar edged up, paring a retreat from a day earlier that was the biggest since the onset of the pandemic. Singapore’s currency weakened after the city state trimmed its 2022 economic growth forecast.

Short-term Treasury yields dropped Wednesday as investors scaled back expectations of how aggressively the Fed will have to tighten monetary policy. There’s no cash Treasuries trading in Asia due to a Japan holiday.

US headline inflation was 8.5% in July, down from the 9.1% June print that was the largest in four decades. Price pressures are still intense and Fed officials were quick to stress more rate hikes are coming. They also signaled investors should rethink expectations of cuts next year to shore up economic growth.

The question is whether the rebound in global equities and other riskier investments from this year’s rout can continue against that backdrop.

“We still need to see a couple more monthly decreases in underlying inflation before the FOMC can start to think about pausing its tightening cycle,” Carol Kong, strategist at Commonwealth Bank of Australia Ltd., said on Bloomberg Television. “The market is still currently underestimating US inflation and how sticky it will be over the medium term.”

Fed-Speak

Minneapolis Fed President Neel Kashkari said he wants the Fed’s benchmark interest rate at 3.9% by the end of this year and at 4.4% by the end of 2023.

Alluding to market pricing of the Fed’s policy path, Kashkari said it was not realistic to conclude that the Fed will start cutting rates early next year, when inflation is very likely to be well in excess of the 2% goal.

Chicago counterpart Charles Evans said inflation remains “unacceptably high” and that “we will be increasing rates the rest of this year and into next year.”

Financial Conditions

“The easing of financial conditions likely annoys the Fed, and we should not be surprised to see Fed speakers continue to try to talk down the market and risk assets,” said Christian Hoffmann, portfolio manager at Thornburg Investment Management.

Swaps referencing the Fed’s September meeting brought a half-point rate increase back into play as opposed to a bigger move. A key portion of the Treasury yield curve remains deeply inverted, a pattern widely thought to signal the risk of a recession.

Elsewhere, crude oil held most of a jump above $91 a barrel, while Bitcoin broke past $24,000 in a sign of the brighter spirits in markets.

Respected for decades for combining decent returns and relatively low volatility, the 60/40 portfolio has generated a 11.5% loss so far this year. Is it time to put the strategy to rest entirely or does it just need a tweak? Have your say in the anonymous MLIV Pulse survey.

What to watch this week:

- US PPI, initial jobless claims, Thursday

- San Francisco Fed President Mary Daly is interviewed on Bloomberg Television, Thursday

- Euro-area industrial production, Friday

- US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.3% as of 12:36 p.m. in Tokyo. The S&P 500 rose 2.1%

- Nasdaq 100 futures increased 0.4%. The Nasdaq 100 rose 2.9%

- Australia’s S&P/ASX 200 index jumped 0.8%

- South Korea’s Kospi index added 1.3%

- Hong Kong’s Hang Seng index advanced 1.9%

- China’s Shanghai Composite index added 1.2%

- Euro Stoxx 50 futures climbed 0.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was at $1.0290, down 0.1%

- The Japanese yen was at 133.13 per dollar, down 0.2%

- The offshore yuan was at 6.7367 per dollar, down 0.2%

Bonds

- The yield on 10-year Treasuries was little changed at 2.78% on Wednesday

- Australia’s 10-year yield rose six basis points to 3.30%

Commodities

- West Texas Intermediate crude was at $91.79 a barrel, down 0.2%

- Gold was at $1,786.78 an ounce, down 0.3%

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad