Russia to Cut Gas to Poland, Bulgaria Until Pay Demands Met

(Bloomberg) -- Russia’s Gazprom PJSC said it has halted gas flows to Poland and Bulgaria and will keep the supplies turned off until the two countries agree to Moscow’s demand to pay for the fuel in rubles.

European gas prices surged more than 20% on the sudden escalation as Russia turns its vast energy resources into a weapon against Ukraine’s European allies.

Moscow is making good on a threat to halt gas flows to countries that refuse President Vladimir Putin’s new demand to pay in rubles. The question now is which countries will be hit next, as the speaker of the Duma called on other “unfriendly” states to also be cut off.

“We should do the same with other countries that are unfriendly to us,” Vyacheslav Volodin said in a Telegram post.

The European Union has rejected paying in rubles in principle, saying it violates sanctions and strengthens Russia’s hand. But now that payment deadlines are starting to fall due, governments across Europe need to decide whether to stick to that line and face the prospect of energy rationing -- or accede to Putin’s demands.

There’s been no comment from major European capitals yet, though European Commission President Ursula von der Leyen said the bloc’s gas coordination group is meeting on Wednesday to chart a united response to Russia’s “blackmail.”

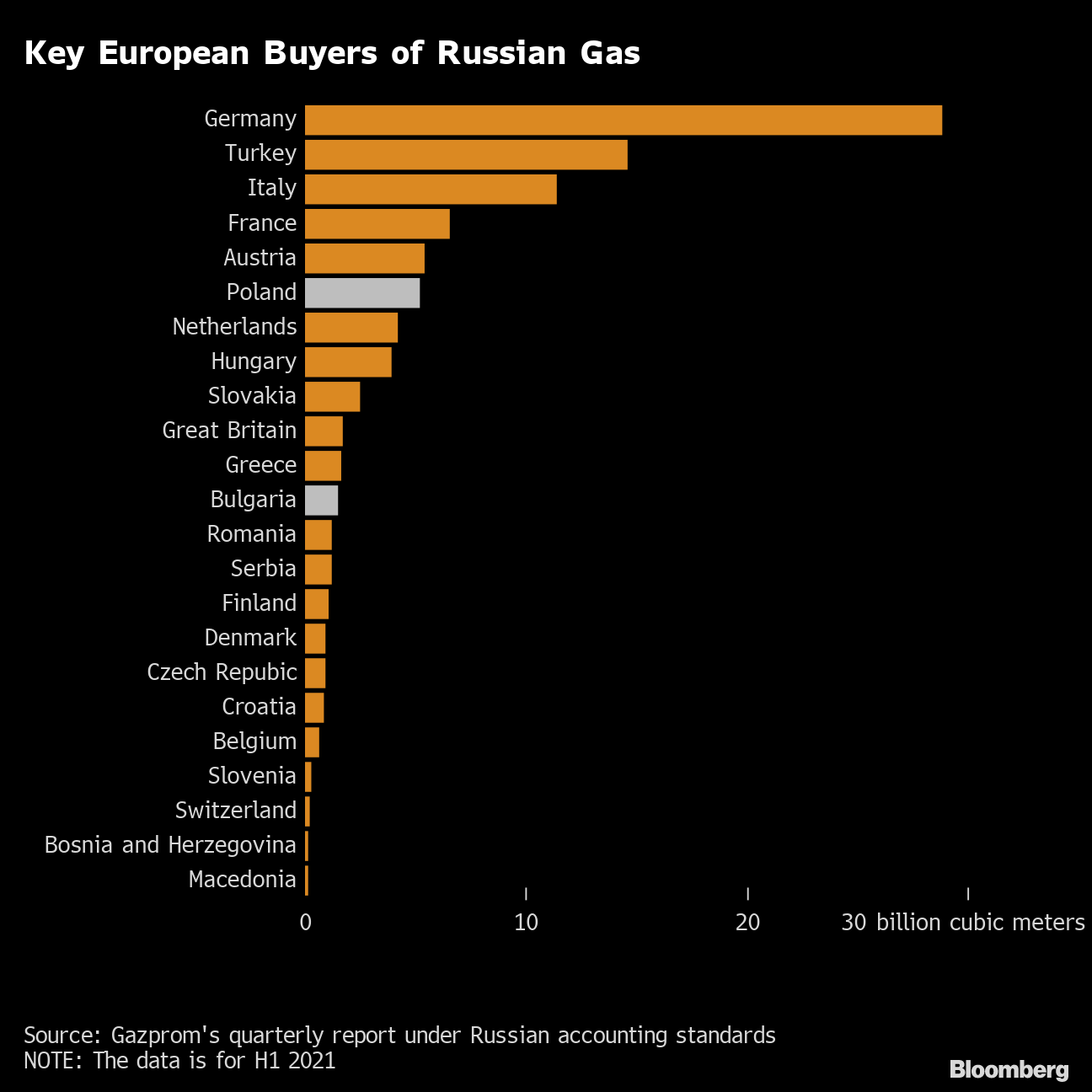

The EU had appeared to indicate last week a possible compromise solution that would allow the gas to keep flowing. But the move against bloc members Poland and Bulgaria probably makes a fix harder to achieve. Germany is massively dependent on Russian gas and has raised the prospect of rationing fuel if flows are cut.

Putin’s gambit also removes from the EU’s potential toolkit the option of sanctioning Russian gas. European ambassadors meet on Wednesday and options to ban oil are expected to be discussed.

Putin’s Calculation

When he first announced the demand, Putin said shifting to rubles would help protect Russia’s huge gas revenues from sanctions or seizure by the EU. The move also appeared aimed at ensuring Gazprombank, one of few big state banks not hit with the severest sanctions, would remain largely untouched.

Putin has also repeatedly highlighted the economic and political costs of higher energy prices in Europe, suggesting the Kremlin may believe that western governments won’t be able to withstand the pressure domestically of a cutoff as long as Moscow can.

Europe Risks Rationing If Putin Cuts Off Russian Gas Supply

The first ruble payments are due in late April and May, though companies’ individual payment schedules have not been disclosed. Polish news outlet Onet.pl reported earlier that the deadline for Poland’s main gas company PGNiG fell on Friday, and Gazprom said on Tuesday the payment was due immediately.

Other companies have more time and European governments and executives are in many cases still trying to figure out how best to respond. The EU last week suggested that companies continue to pay in euros, and seek possible exemptions from Moscow to the new decree.

EXPLAINER: How Europe Became So Dependent on Putin for Its Gas

That ruling demands companies set up two accounts, one in a foreign currency and one in rubles, with Gazprombank. The Russian bank would convert the foreign currency payments into rubles before transferring the payment to Gazprom PJSC, the state-owned gas company.

Benchmark Dutch futures soared as much as 24% to 127.50 euros per megawatt-hour, the highest level since April 1. They traded 9% higher at 9 a.m. in London.

Transit Warning

Gazprom also warned Poland and Bulgaria -- which are both transit countries for Russian gas --- that if they syphon off gas that’s meant for other destinations then the company will reduce transit flows.

This is the first cut-off to Europe since disputes on gas prices between Russia and Ukraine in 2006 and 2009 led to disruptions in onward supplies to European nations. The second disruption, in the freezing winter of 2009, lasted almost two weeks and halted all gas transit to the EU via Ukraine, leading to a scramble for supply. Slovakia and some Balkan countries had to ration gas, shut factories and cut power supplies.

Poland has said it has enough gas in storage and that consumers won’t feel the hit. Bulgaria has secured supplies for “at least a month,” Energy Minister Alexander Nikolov told reporters in Sofia.

“It’s clear that at the moment the natural gas is used more as a political and economic weapon in the current war, and not in the context of legal-commercial relations,” Nikolov said.

(adds EU, Duma comments)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week