China Rare-Earths Pact Spurs Speculation of Bigger Consolidation

(Bloomberg) -- A tie-up between two rare-earths companies is throwing a spotlight on China’s efforts to build industry giants to gain better pricing power in global markets.

China Northern Rare Earth (Group) High-Tech Co. announced over the weekend an agreement with China Rare Earth Holdings Ltd. to cooperate in mining, trade and deep processing operations. Shares of China Rare Earth soared as much as 15% in early trading Monday, while China Northern climbed as much as 4.5%.

While the cooperation pact included few specifics, it’s raising speculation of further restructuring in the industry. That will be in focus as a rare-earths industry forum kicks off in Baotou, China, on Monday.

The government has been restructuring the industry for years, seeking to consolidate all its rare earth miners and processors into two huge firms, one in the north and one in the south. China hopes to maintain its dominance in the production of the strategic metals, of which it controls 70%, as the U.S. and Europe look to develop their own production and supply chains and diversify away from China.

The importance of the materials, ubiquitous across a range of applications from consumer goods to military gear, was highlighted in 2019 as China considered whether to use its dominance as a counter in the trade war with Washington.

Demand for rare earths is rising, driven by growing need for permanent magnets, which include the NdFeB variety, found in everything from phones to computers to cars. Prices of neodymium and praseodymium, -- two of the 17 rare earth elements that are used in NdFeB magnets -- surged to the highest in a decade earlier this month.

Today’s Events

- China sets monthly loan prime rates, 09:30

- China’s 3rd batch of Nov. trade data, including country breakdowns for energy and commodities

- Rare earths industry forum in Baotou, China

Today’s Chart

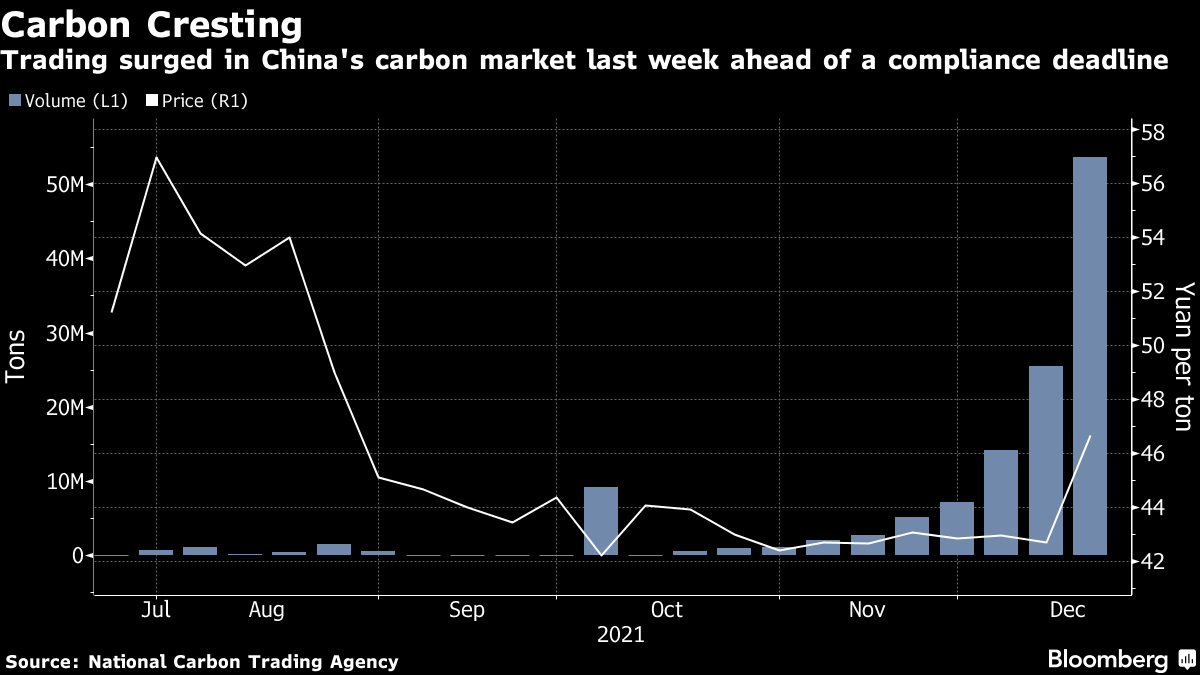

Trading activity in China’s fledgling national carbon market surged last week, with allowances for nearly 54 million tons of emissions changing hands ahead of a year-end compliance deadline. Still, pricing remains muted at 46.66 yuan ($7.32) a ton, compared to 81.3 euros ($91.36) in Europe.

On The Wire

Iron ore extended gains to a two-month high as Chinese banks stepped up support for the economy and steel mills boost production into the end of the year. Chinese banks lowered borrowing costs for the first time in 20 months, which follows the central bank’s action earlier this month to cut the amount of cash banks must hold in reserve as focus shifts to shoring up an economy showing strain from a property slump and virus outbreaks.

- China’s Solar Giants Fall After U.S. Climate Plan Failure

- China’s Oil Imports From UAE, Brazil Climb; Iraq, Angola Drop

- China Warns on Investment Risk and Debt Rate for Central SOEs

- Rio Eyes China Relations as Former Ambassador Barton Named Chair

- To Quench Growth Thirst, Housing Potion Is Needed : China Today

The Week Ahead

Tuesday, Dec. 21

- Nothing major scheduled

Wednesday, Dec. 22

- Nothing major scheduled

Thursday, Dec. 23

- USDA weekly crop export sales, 08:30 EST

Friday, Dec. 24

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- Mysteel annual conference in Shanghai

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company