Why the gas sector is on the rise in the Middle East

The Middle East has dominated the oil market since the 1950s. The region has consistently supplied around 35% of the world’s oil for the last two decades and still holds 40% of the world’s oil reserves.

For the gas sector, things were different. For a long time, associated gas was considered an undesired by-product that was often flared. Countries had little incentive to develop their gas fields as domestic markets were not well established and export routes non-existent.

But things are changing: gas production is now growing twice as fast as regional demand.

We drew on insight from Lens Gas & LNG to explore the rise of the Middle East gas sector in a new report.

Middle East gas: a slow start – but gathering pace

It has been an undeniably slow start for Middle East gas. In 1971, Shell discovered the North Field, but withdrew from the licence as, at the time, the field was deemed non-commercial. ADNOC was a pioneer when it built its Das Island LNG terminal in 1977. Saudi Aramco started the construction of the Master Gas System (MGS) in the 1970s and the system became fully operational in 1982. By the turn of the millennium, the entire region was only producing 18 bcfd.

But things then started to change fast. Governments realised low-cost gas could displace liquids in the power and industrial sectors and, therefore, free additional oil volumes for export. LNG demand was also growing rapidly worldwide.

Substantial investments were made to expand and upgrade the domestic gas pipeline networks. Saudi Arabia continued to expand the MGS, and in 2001 opened the Hawiyah Gas Plant – the first in the kingdom to process non-associated gas. Qatar and Oman started to build LNG trains. The first three trains in Qatar were brought on stream between 1996 and 1999, and initially had capacity of 2.2 mmtpa each. Oman LNG was brought on stream in 2000.

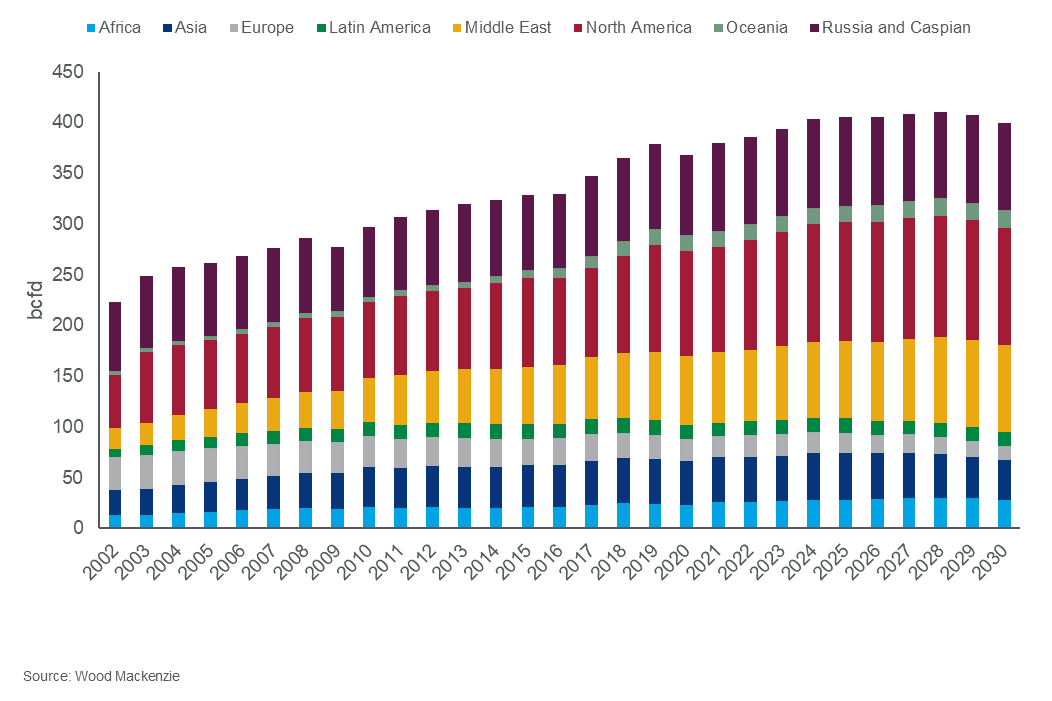

Two decades later, the region is producing 72 bcfd and Qatar is exporting 80 mmtpa of LNG.

Middle East gas production is growing fast

Looking forward, Middle East gas production will continue to increase and should reach 86 bcfd in 2030. That’s an impressive 14 bcfd of additional supply, equivalent to the gas consumption of the entire European power sector.

Qatar LNG exports should reach 126 mmtpa by the end of the decade, while Abu Dhabi should be able to export 15.4 mmtpa after the new Ruwais LNG plant comes on stream in 2028.

Chart shows global gas production by region. Middle East gas production grew 3.6x in the last two decades, with more to come.

To fulfil that level of production growth, investments in non-associated gas projects are set to reach a record US$25 billion this year and a cumulative total of US$121 billion by 2030. Colossal investments will be directed towards the North Field expansion and the Ghasha ultra-sour gas project.

Record investments in gas projects to meet export opportunities and domestic demand growth

Gas supply growth in the Middle East is a compelling opportunity given the competition to supply Europe with volumes lost from Russia. Half of the projected 14 bcfd growth in Middle East gas supply is destined for LNG export.

The other half is to meet the forecasted 7 bcfd of domestic demand growth.

Gas demand in Iraq is expected to grow strongly. The country is desperate for new and reliable sources of cheap gas for its domestic power needs. Iraq has been relying on 2 bcfd of gas imports from Iran, but as demand is steadily growing Tehran might not be able to deliver the same level of gas exports to Baghdad. Early indications are that Iran is going after second-tier assets to sustain its production level.

Domestic demand in Saudi Arabia is also steadily growing, but supply is now growing even faster. This is driven by conventional offshore projects, especially the Fadhili Gas Project. Conversely, in the UAE, demand is expected to slightly decrease driven by a shift towards renewables. Gas demand for power in Oman is also considerably lower in the longer term thanks to increasing wind and solar capacity.

Qatar is the jewel in the Middle East gas crown for IOCs

Gas projects in the region present attractive opportunities for international oil companies (IOCs). Gas accounts for only 34% of their Middle East production mix but generates 71% of the value. That’s a staggering US$122 billion (NPV10, January 2023).

More than half of this value is created by ExxonMobil, Shell and TotalEnergies in Qatar. Shell’s Pearl GTL is by far the most valuable project at US$18.7 billion. The six Qatargas joint ventures hold a combined value of US$36 billion for IOCs, while North Field East alone contributes an additional US$6.7 billion. Other high-value projects include Khazzan, BP’s flagship project in Oman, at US$9 billion, Karish offshore Israel at US$6.1 billion and Shah, Occidental’s ultra-sour gas development in the UAE, at US$5 billion.

IOC appetite for Middle East gas is increasing

The North Field East and North Field South awards last year showed that IOC appetite for Middle East gas is only increasing. ExxonMobil, Shell, TotalEnergies, Eni and ConocoPhillips were all awarded stakes in one or both projects.

Some of the biggest M&A deals in the region are also gas-focused. In 2021, BP sold 20% of Khazzan to PTTEP for US$2.45 billion and Delek Drilling sold 22% of Tamar and Dalit licences to Mubadala for just over US$1 billion. More recently, ADNOC and BP offered to buy 50% of Israel’s NewMed Energy for around US$2 billion.

…and value is not the only driver

Middle East gas projects can help oil and gas companies solve the energy trilemma. With 3,200 tcf, the region holds abundant resources. The reserves are also the world’s most affordable to extract with development costs of US$3.7/boe.

In terms of sustainability, Scope 1 and 2 emissions from gas fields in the Gulf remain high due to venting and processing emissions. But since gas has lower Scope 3 emissions compared to oil and coal, the overall carbon footprint remains competitive. Only Israel manages to achieve exceptionally low emissions intensity below 5 kgCO2e/boe thanks to the dry nature of the gas, which requires little processing, few highly productive wells and high utilisation rates of processing facilities.

Gastech is at the heart of natural gas, LNG, hydrogen, low-carbon solutions, and climate technologies

REGISTER AS A VISITOREnergy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.