Explained: how ConocoPhillips’s acquisition of Marathon Oil signals a shale 4.0 wave

ConocoPhillips announced on Wednesday the acquisition of Marathon Oil in an all-stock deal valued at US $22.5 billion. Marathon Oil shareholders will receive 0.2550 shares of ConocoPhillips common stock for each share of Marathon Oil common stock, according to a press statement.

The exchange of shares represents a 14.7% premium to Marathon Oil's closing share price on May 28, 2024, and a 16.0% premium to the prior 10-day volume-weighted average price. The merger requires approval from Marathon Oil stockholders, regulatory clearance, and other customary closing conditions. The transaction is expected to close in Q4 2024.

How will ConocoPhillips benefit from this acquisition?

This strategic move aims to further strengthen ConocoPhillips’ position in the US onshore oil and gas market. Ryan Lance, Chairman and CEO of ConocoPhillips, emphasised the strategic fit of the acquisition, stating: “This acquisition of Marathon Oil further deepens our portfolio and fits within our financial framework, adding high-quality, low cost of supply inventory adjacent to our leading US unconventional position.”

The acquisition is expected to be immediately accretive to ConocoPhillips' earnings, cash flow, and return of capital per share. It also adds over 2 billion barrels of resource to ConocoPhillips' U.S. onshore portfolio, with an estimated average cost of supply under $30 per barrel WTI.

ConocoPhillips anticipates achieving $500 million in cost and capital synergies within the first-year post-closing, through reduced general and administrative costs, lower operating costs, and improved capital efficiencies.

What does it mean for shale consolidations?

The shale merger and acquisition (M&A) market had slowed down in recent months following Diamondback’s acquisition of Endeavor in February, according to Rystad Energy.

After a flurry of dealmaking since last fall, initiated by ExxonMobil’s purchase of Pioneer, no significant deals had been announced, raising concerns about the quality and availability of remaining private exploration and production (E&P) inventory and the associated deal multiples. This dynamic has changed with the ConocoPhillips announcement, creating a diversified energy powerhouse with assets across several core tight oil regions in the Lower 48 states.

The deal signifies a shift in the 'Shale 4.0' wave of consolidation, according to Rystad Energy, where public E&P companies and operators outside of the Permian Basin become primary acquisition targets. This trend was predicted by Rystad Energy following earlier acquisitions focused on private firms.

What is the shale 4.0 era?

The 'Shale 4.0' era, which began last year, represents a strategic shift by management teams and investors towards building long-term, scalable companies in the US. After proving their ability to generate significant free cash flow through capital discipline and returning cash to shareholders via buybacks and dividends, operators are now focused on ensuring their assets can sustain returns for decades.

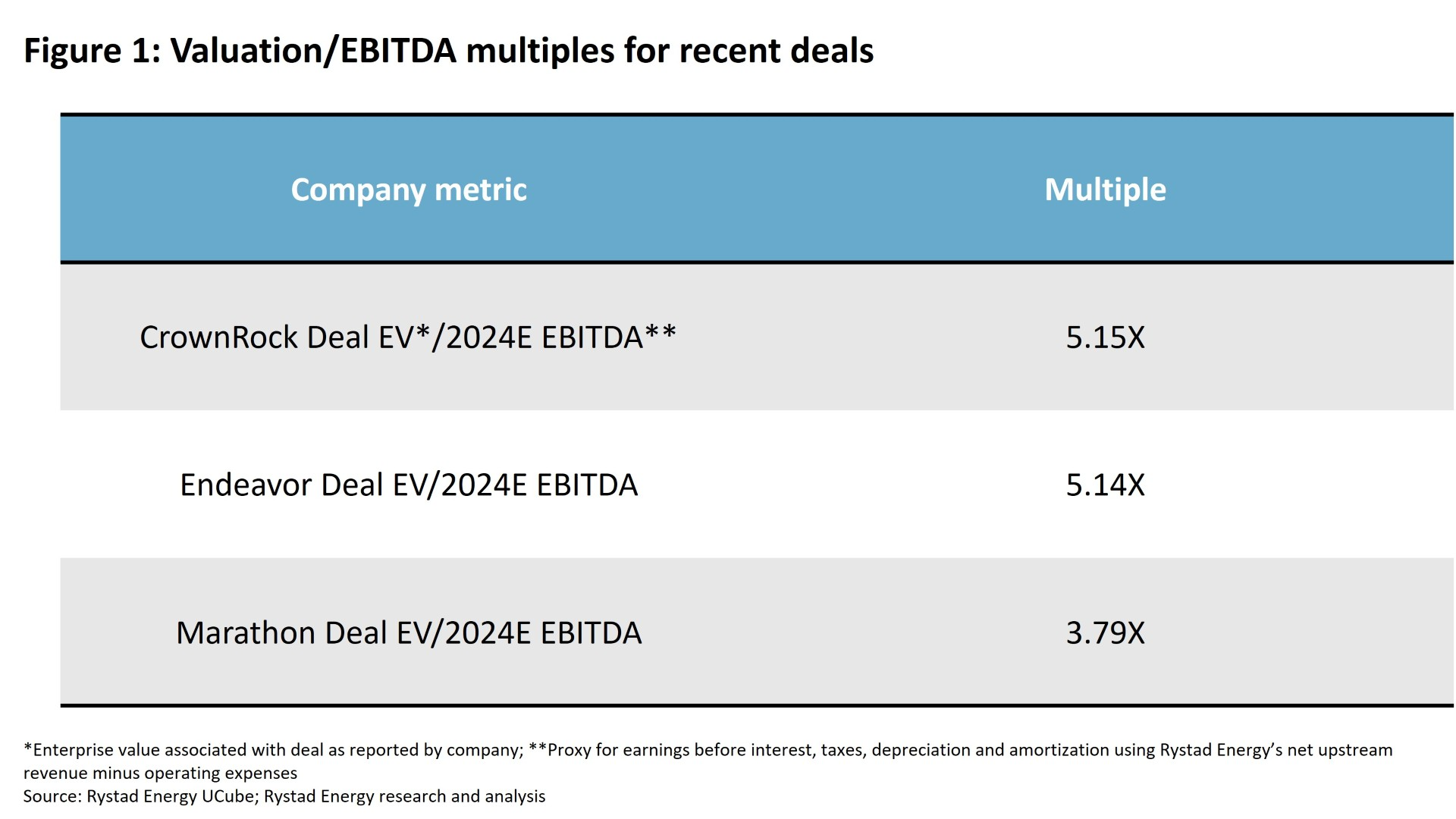

This shift has led to M&A activities concentrating on building long-term scale in the most commercially viable areas. As a result, the Permian Basin has become highly coveted, with private E&Ps like CrownRock and Endeavor being sold for high multiples due to their scale in economically advantageous areas.

With few remaining private E&P options of scale in the Permian, ConocoPhillips faced a choice between acquiring a smaller private E&P with limited impact, paying a high premium for a larger public Permian player, or purchasing a smaller public player with insufficient inventory scale and quality.

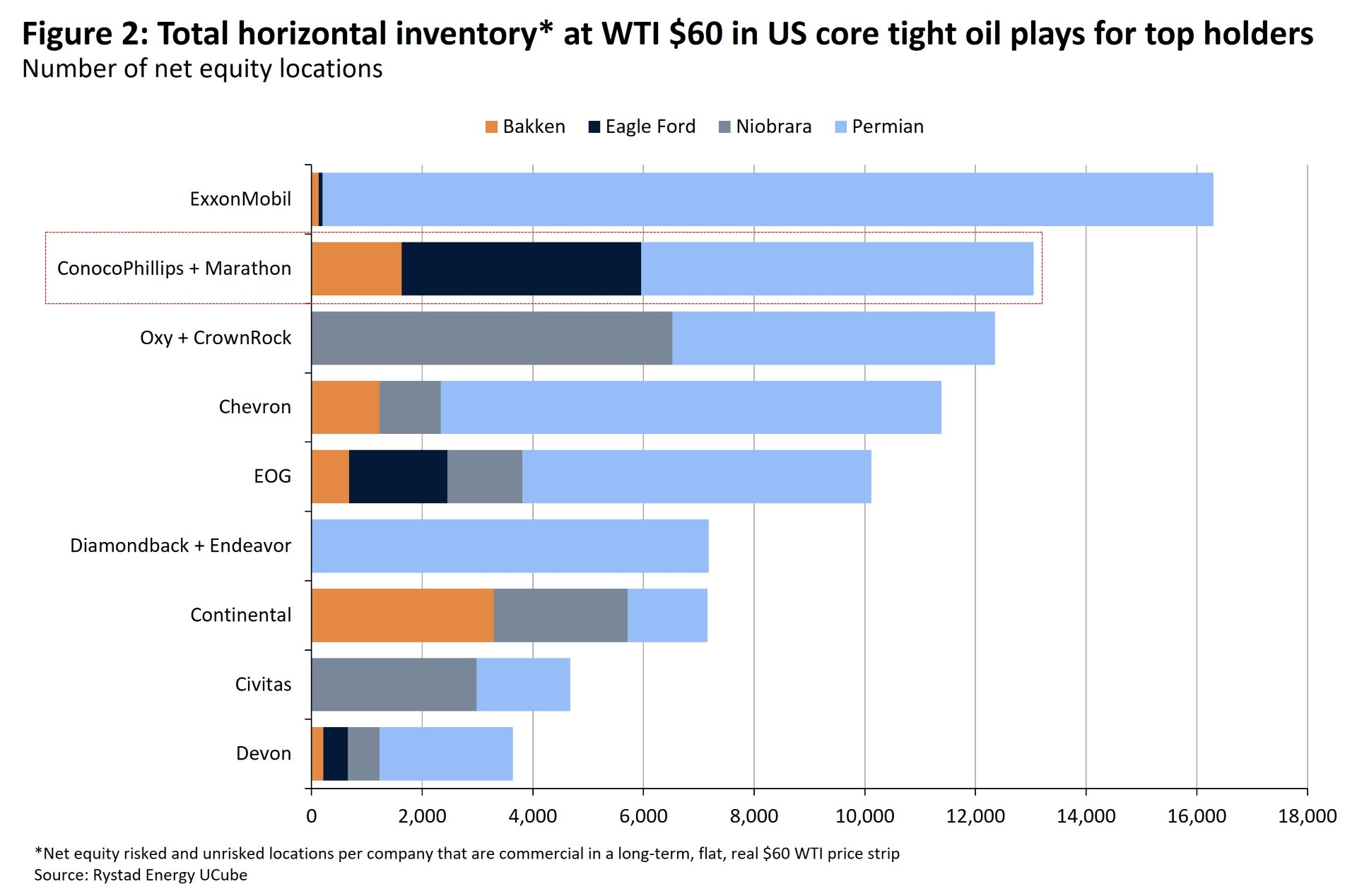

Instead, ConocoPhillips opted to look beyond the heavily consolidated Permian Basin and pursue Marathon Oil, which will elevate its position to second in total inventory in the Lower 48 core tight oil plays, just behind ExxonMobil. This acquisition was achieved at a relatively lower EBITDA multiple compared to what would have been required for a core Permian player.

What does this mean for the Permian basin?

With the Marathon Oil acquisition, ConocoPhillips now positions itself as a leading multi-basin consolidator with significant undeveloped locations across the Bakken, Eagle Ford, and Permian basin.

While still retaining a significant Permian portion of its inventory—built up in part from acquisitions of Concho Resources and Shell’s Permian assets—ConocoPhillips’ decision to forgo another Permian deal in search of diversification also helps to further bolster the analysis that the Permian is already heavily consolidated, with few remaining opportunities for entry or expansion at a relatively inexpensive price.

According to Rystad Energy’s analysis, six companies – ExxonMobil, Chevron, Diamondback (including Endeavor), ConocoPhillips (even before Marathon), Oxy (including CrownRock), and EOG – control about 62% of remaining net tight oil resources in the basin.

Moving forward, Rystad Energy expects M&A activity to continue to pick up outside of the basin, with this being the second significant Eagle Ford acquisition this month, following Crescent Energy’s purchase of SilverBow, as operators look to pursue less expensive options outside of an already crowded Permian.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.