Wood Mackenzie: Iraq upstream sector set to grow but exploration activity remains a challenge

Iraq’s upstream sector is undergoing rapid change, with an increasingly diverse corporate ecosystem, and significant investment being funneled into boosting oil and gas production, according to a new report by Wood Mackenzie. However, crucial infrastructure issues still need to be overcome, and a lack of exploration activity remain a challenge, according to the analysis.

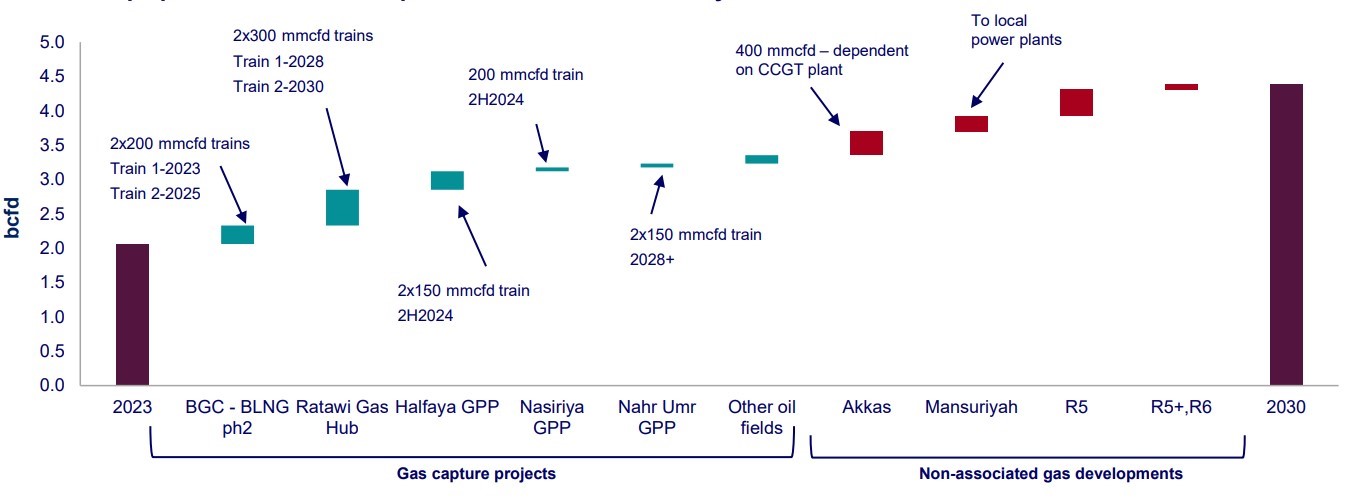

Iraq’s gas output could more than double by 2030 to reach 4.4 bcfd and oil output could hit 5.5 million b/d, in that same time frame, according to Wood Mackenzie’s latest report, ‘Iraq’s upstream opportunities: a review’.

“Iraq’s upstream industry is changing dramatically, and it has the resources to increase both oil and gas output considerably,” said Alexandre Araman, Director at Wood Mackenzie. “Corporate interest is increasing as there are multiple entry opportunities of scale. Many of the Majors are re-evaluating their presence – given the low returns on offer from historically punitive fiscal terms – with willing buyers in South East Asian NOCs and China’s state-backed players.”

According to the report, the majority of potential growth will be from large oil fields in the south, such as Rumaila, West Qurna, Zubair and Majnoon.

But the report also highlights that many challenges remain.

“Operators must overcome several roadblocks right now if production is to be increased, most notably with infrastructure, as export pipelines and terminals, and water injection capacity is currently insufficient,” said Araman. “There are also fiscal issues, as creating value from barrels is difficult.”

The harsh fiscal terms have discouraged both foreign investment and exploration activity. According to Wood Mackenzie, despite more than 150 billion barrels of oil resources, only five exploration wells have been drilled in Federal Iraq since 2013.

However, recent licensing rounds in 2024 showed considerable interest from Chinese firms, demonstrating the growing interest from Asian-based investors. This also highlights how Iraq’s corporate ecosystem has evolved and expanded over time, as more players from more diverse geographies, but Asia in particular, have been attracted to Iraqi upstream opportunities. However, more of this attention has been to discovered resources than exploration potential.

“Iraq’s fiscal terms are still among the least competitive in the Middle East and much more has to be done to increase exploration interest,” said Araman. “If that is addressed, it is likely we will see more activity from Asian players as the corporate landscape in Iraq is shifting from West to East. With improvements in fiscal terms and critical infrastructure, there should be a window of opportunity for more M&A activity and future production growth.”

According to Araman, the country’s ambitious target of doubling gas production, eliminating flaring and ending import reliance is backed by 100 tcf of resources and political will, which also presents new investment opportunities. “Due to the nature of the fiscal terms, these gas opportunities are in some cases more commercially attractive than developing oil. As such, we now see some of the major players turning more of their attention to gas-focused opportunities,” he added.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.