Explained: the market reaction to OPEC+ cuts and the Saudi ‘lollipop’

The decision by the 23-member OPEC+ alliance earlier this week to extend its output cuts until the end of 2024 – along with top crude exporter Saudi Arabia announcing a voluntary cut to its output in July and the alliance reworking its baseline for 2024 production – is a clear signal that the world’s most influential group of oil producers is ready to deploy an increasingly complex array of measures as global oil prices remain under pressure from broader macro-economic concerns.

Yet, barring a brief rally on Monday where oil futures jumped by 2.5%, the market trend for the week demonstrate how tough negotiations in Vienna over the weekend have contributed to moderating bearish market sentiments, reducing risks and offering long-term support to the floor rather than dramatically shoring up prices. On Thursday, West Texas Intermediate (WTI) futures traded near $72 a barrel after gaining 1.1% Wednesday.

“This is a Saudi lollipop… We wanted to ice the cake. We always want to add suspense. We don't want people to try to predict what we do … This market needs stabilisation.”

- Prince Abdulaziz bin Salman, Energy Minister of Saudi Arabia

Why have markets been largely subdued following the OPEC+ announcements?

At the OPEC+ meeting, Saudi Arabia pledged to cut its oil output by 1 million barrels per day (bpd), or 10%, in July on top of existing output cuts from other members of the alliance. With this surprise commitment from Riyadh, OPEC+ has agreed to take nearly 4.6 million bpd off the market in July, equivalent to 4.6% of global demand of 100 million bpd.

Additionally, all nine OPEC+ members that implemented voluntary cuts in April of 1.66 million bpd (Saudi Arabia, Iraq, UAE, Kuwait, Oman, Algeria, Kazakhstan, Gabon, and Russia) agreed to extend the cuts by a year, until the end of 2024. OPEC+ also announced a further overall 1.4 million bpd production target reduction from 2024, confirming a figure of 40.46 million bpd for next year.

Yet, according to Norbert Ruecker, the Head of Economics & Next Generation Research at Bank Julius Baer, oil prices reacted surprisingly calmly to the oil policy adjustments. “The market seems to remain convinced about ample supplies due to stagnant Western world demand, China’s lacklustre growth past the re-opening, and production from non-OPEC members in parts compensating their curbs. That said, the market mood looks exceptionally bearish, judged by the futures positions held by speculators,” Ruecker told Energy Connects.

“The market seems to remain convinced about ample supplies due to stagnant Western world demand, China’s lacklustre growth past the re-opening, and production from non-OPEC members in parts compensating their curbs.”

- Norbert Ruecker, Head of Economics & Next Generation Research at Bank Julius Baer

With such market sentiments, how does Saudi Arabia’s ‘lollipop’ fit in?

Market speculation is exactly what Saudi Energy Minister Prince Abdulaziz bin Salman has been warning against over the past few months, asking them to “watch out” for pain ahead. On Sunday, he seemed to follow up on that with the announcement of the surprise cut for July – bringing the Kingdom’s total voluntary curbs to 1.5 million barrels per day and capping its headline production to 9 million barrels.

“This is a Saudi lollipop,” he said at the OPEC+ press conference in Vienna. “We wanted to ice the cake. We always want to add suspense. We don't want people to try to predict what we do … This market needs stabilisation.”

Prince Abdulaziz did not clarify whether the Kingdom will extend the voluntary reduction beyond July, and according to Jorge Leon, Senior Vice President at Rystad Energy, the long-term market price development will hinge on that as well as macroeconomic sentiments. “The pure possibility of the Saudi production cut extending beyond July will limit downside price pressure for the rest of 2023,” he said.

“Global economic sentiment is back in the driver’s seat for oil and a hawkish Fed, bent on keeping rates higher for longer, could dampen the spirits and put a lid on risk appetite, becoming a drag on oil prices.”

- Vandana Hari, Founder and CEO of Vanda Insights

What were the market expectations on possible OPEC+ cuts?

According to Vandana Hari, the founder and CEO of Singapore-based provider of global oil markets macro-analysis Vanda Insights, the market was anticipating more substantial cuts from Saudi Arabia, especially after the Energy Minister’s warning to short-sellers. “Some of crude’s gains towards the end of last week were down to the market pricing in a bigger OPEC+ cut, so it won’t be surprising if these are gradually surrendered,” she told Energy Connects.

At the same time, global economic sentiment “is back in the driver’s seat for oil and a hawkish Fed, bent on keeping rates higher for longer, could dampen the spirits and put a lid on risk appetite, becoming a drag on oil prices,” Hari said.

Noting that Saudi Arabia has exposed itself with the unilateral cut in July, Ruecker of Bank Julius Baer said: “Tensions seem to be building in the oil market below the surface and with it the chances for a wild ride over the coming months. While the market noise could pick up, the big picture seems unchanged. Prices in the 70ies are more aligned longer term with fundamentals than prices in the 80ies.”

“Based on market fundamentals, the demand will increase, and no further cuts are expected right now – in the coming months even more production might be needed, as global demand is still strong and there are no risks here.”

- Dr Cyril Widdershoven, Founder of Verocy and analyst for Hilltower Resource Advisors

What is the demand outlook for the long term following the cuts?

Dr Cyril Widdershoven, veteran global energy market expert, the founder of Verocy and analyst for Hilltower Resource Advisors, was optimistic about the prospect of strong global demand in the long term, and said the OPEC+ cuts won’t alter the fundamentals.

“The market is seeking guidance from OPEC, but none have been given. Based on market fundamentals, the demand will increase, and no further cuts are expected right now – in the coming months even more production might be needed, as global demand is still strong and there are no risks here,” he told Energy Connects.

“Although market demand will grow upwards due to lower price settings, Saudi Arabia’s strategy to become a swing producer again will keep markets cautious. Prices will remain weak for months, with the only possible bullish option being higher demand and lower storage,” he said.

What are the takeaways from the OPEC+ decision to review baselines for 2024?

One of the more long-term impacts of the OPEC+ meeting was the group’s decision to provide guidance into its production management strategy for 2024 and review baselines — the starting level from which producers cut their output during OPEC+ agreements.

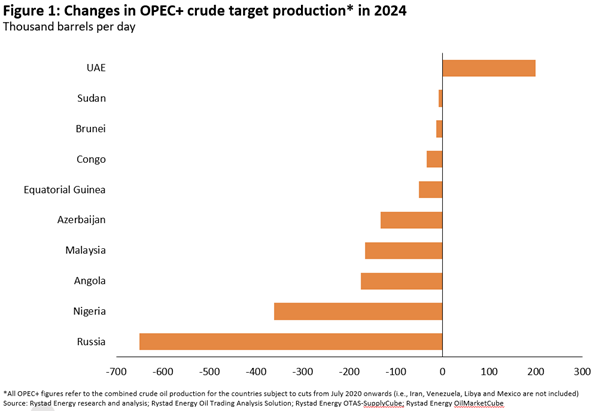

Rystad Energy, one of the three independent agencies engaged by OPEC to study the output capacities of countries, put the new target production for 2024 at 38.7 million bpd – which includes a significant reduction for Russia (650,000 bpd), Nigeria (360,000 bpd) and Angola (175,000 bpd), and a 200,000-bpd increase in the UAE’s target production.

OPEC said in a statement that the decision was taken “in light of the continued commitment … to achieve and sustain a stable oil market, and to provide long-term guidance for the market, and in line with the successful approach of being precautious, proactive and pre-emptive”.

How are other macroeconomic sentiments likely to impact the situation?

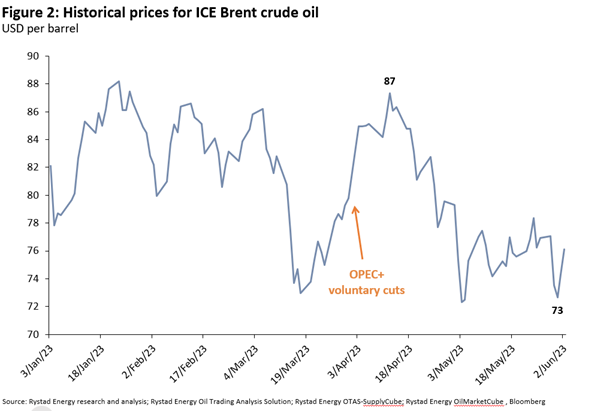

Steady macroeconomic headwinds have kept the crude oil price well below $80 per barrel in the past couple of months, despite the OPEC+ voluntary cuts which initially pushed the price up by $7 in one week to $87 per barrel in mid-April. But the pressure faded in weeks as macroeconomic factors again took over as the main driver of the crude price. In a further sign of those sentiments, China’s trade data missed forecasts this week – with exports tumbling 7.5% year-on-year, while imports saw a smaller fall of 4.5% year-on-year. The country’s trade surplus in May was $65.81 billion, down 16.1%.

Overall, while the short-term price risks remain more skewered to the upside, the market realities of the summer will bear out whether the alliance will need to consider any further strategic interventions for the remainder of the year, perhaps in the run up to the 36th OPEC and non-OPEC Ministerial Meeting in November.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.