UK Energy Bills to Drop as Easing Gas Costs Finally Register

(Bloomberg) -- British consumers are set to see a big drop in energy bills that have been crippling household budgets since the start of the war in Ukraine.

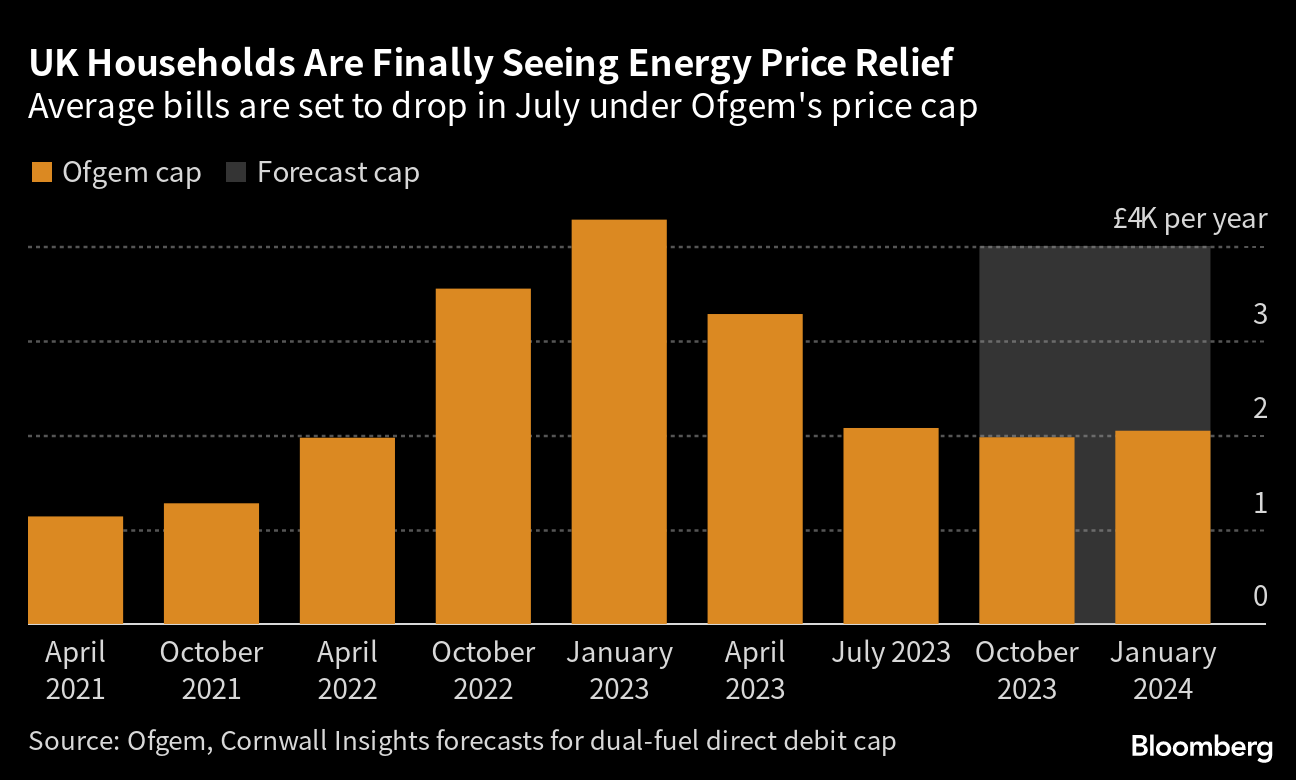

Natural gas prices have been declining steadily since late last year and this will finally feed through to hard-pressed consumers. A new price cap announced Thursday will mean that from July, average bills are set to fall 17% below the current level guaranteed by government subsidies.

The pricing mechanism, set by regulator Ofgem, limits how much suppliers can charge per unit of energy. On an annual basis, the typical household would face a bill of £2,074 ($2,564) in the third quarter.

“After a difficult winter for consumers, it is encouraging to see signs that the market is stabilizing and prices are moving in the right direction,” Ofgem’s Chief Executive Officer Jonathan Brearley said in a statement. “However, we know people are still finding it hard, the cost-of-living crisis continues.”

Energy drove inflation higher last year, but it touched off soaring costs for goods and services of all kinds. And now that the cost of electricity and gas are in retreat, upward forces on prices are coming from goods and services ranging from mobile phone bills to used cars and the cost of beer in pubs. The result is an inflation rate that’s falling much less quickly than the Bank of England expected.

While energy costs remain above pre-invasion levels, any drop will help the BOE in its struggle with inflation, which at 8.7% in April was four times above the target level. Interest rates have risen to the highest since 2008, and the central bank has said it’s determined to return price rises to the 2% target, a sign further hikes are likely.

“It’s positive households across the country will see their energy bills fall by around £430 on average from July, marking a major milestone in our determined efforts to halve inflation,” Energy Security and Net Zero Secretary Grant Shapps said in a statement.

The new price level will be below the UK’s Energy Price Guarantee, a government subsidy that kicks in if rates rise above a certain threshold. That measure ensured household bills were capped when prices soared to record highs. Currently, it’s set at £2,500.

Benchmark gas futures in the UK and Europe are down about 65% this year. Cornwall Insight forecasts the British price cap will stay fairly flat through next winter. That could help customers lock in lower rates if energy suppliers once again start offering fixed-price deals that disappeared when market volatility soared.

“We see no reason why energy suppliers cannot offer competitive fixed deals around the £2,000 level,” said Natalie Mathie from price comparison website Uswitch. “Customers should have the choice of whether to lock in the benefits of lower wholesale prices for 12 months, just as they do in the mortgage market.”

Consumers who lock their prices now, however, may end up paying more than they would have otherwise if energy continues to get cheaper. Gas is near the cheapest levels in two years, but sluggish economies highlighted by a German recession, weak industrial demand and fuller-than-normal storage sites are bringing the prospect of a deeper slide.

For now, prices remain higher than the normal levels before the Ukraine war. That will continue to be a challenge for households and the government.

“Most people will welcome any respite from record-high prices, but it still leaves prices more than two-thirds higher than the start of the energy crisis,” said Adam Scorer, CEO of charity National Energy Action. “More than 2.5 million low-income and vulnerable households are no longer receiving any government support for unaffordable bills. For them, the energy crisis is far from over.”

(Updates with minister’s comment in the seventh paragraph, details on prices from the ninth.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis