French Nuclear Revival Hits Trouble as New Reactor Defects Found

(Bloomberg) -- France’s troubled nuclear industry is supposed to be in revival, but the discovery of further defects at some reactors this week is stoking fears that the year ahead could be just as difficult as the last.

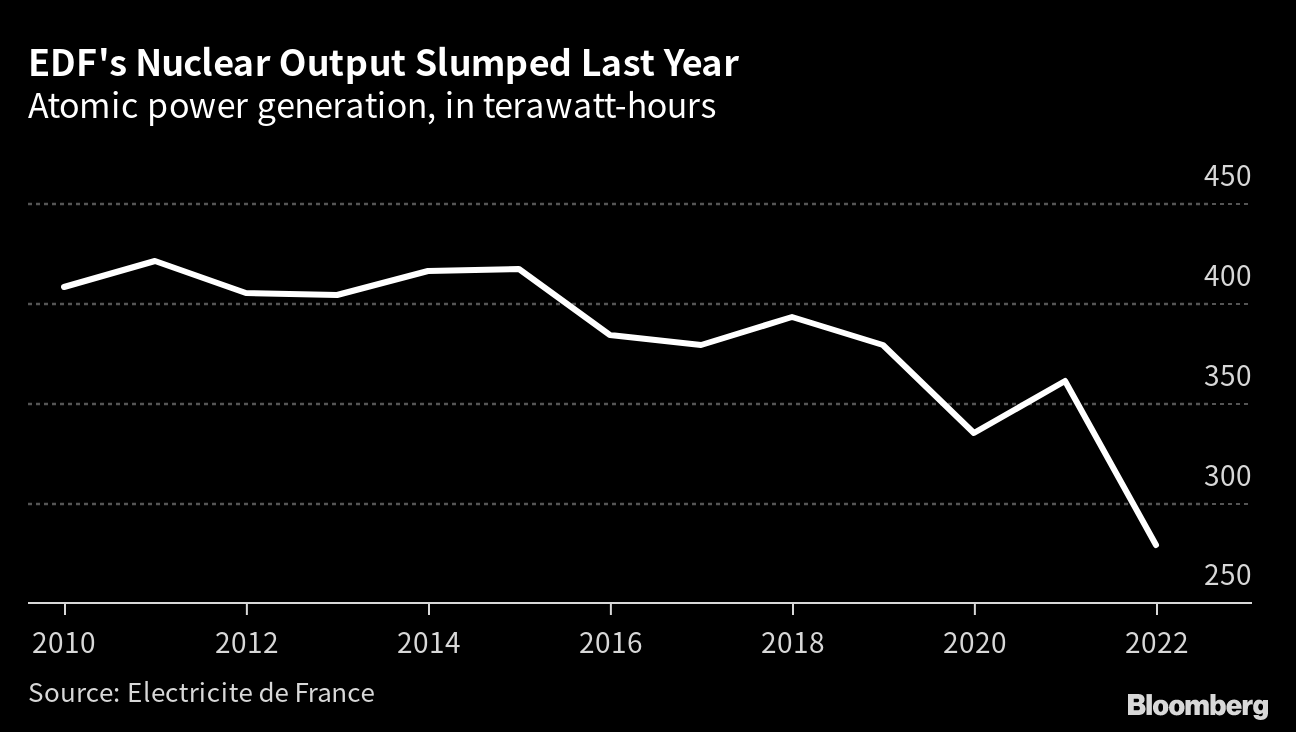

Electricite de France SA’s fleet of 56 atomic power plants has long been the backbone of Europe’s energy system, but in 2022 it was more of a millstone. As reactors were shut down to fix cracked pipes, the company’s nuclear power generation slumped to the lowest since 1988, making the region more dependent on fossil fuels just as Russia squeezed natural gas exports.

The continent is still grappling with the long-term consequences for energy security of the invasion of Ukraine. Everyone from power traders to political leaders had been hoping that France would finally be able to switch from hindrance to help this year, but that’s looking less likely as the country’s nuclear watchdog asks EDF to revise its maintenance program in light of the new flaws.

“If EDF is not able to have a strong comeback in 2023 with a large uptick in generation compared to the very low levels in 2022, the fear is that 2022 can end up being the new normal for the French nuclear generation,” said Fabian Ronningen, a senior analyst for power and renewables research at Norwegian consultant Rystad Energy AS.

As traders digested the week’s news, French power for delivery in 2024 jumped almost a third to about €220 ($235) per megawatt hour, the highest since January.

Following the discovery of so-called stress corrosion cracking at a reactor in late 2021, EDF opened a wide-ranging investigation. The probe found that the company’s 16 newest units were prone to the phenomenon mostly because of the design of the pipes aimed at cooling the reactor in case of an accident. Cracks may also have been caused by welding and other defects.

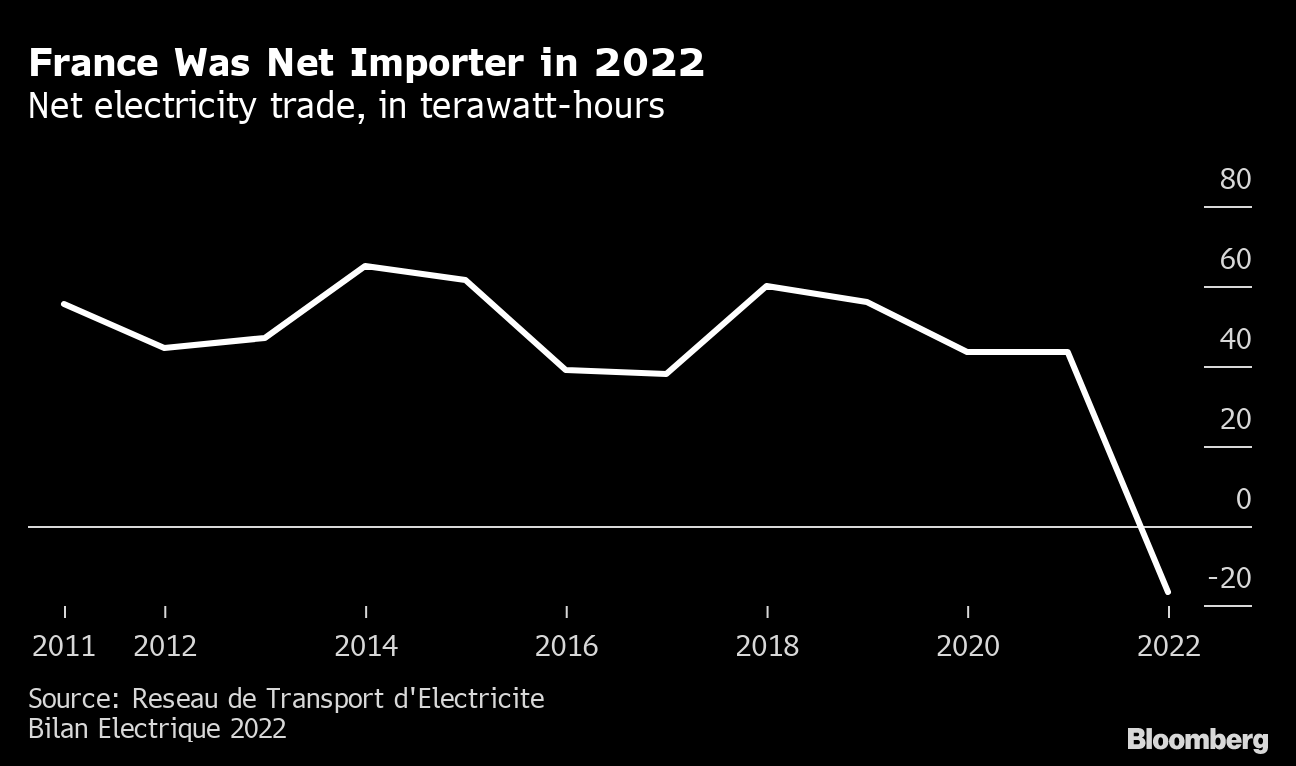

The utility’s nuclear output sank by 23% in 2022 as it halted about a dozen of its 56 reactors to replace cracked pipes. France went from being a major electricity exporter to its neighbors into a net importer for the first time since 1980.

EDF’s nuclear output hit a low point in August and gradually began to recover. Crucially, a surge of plant restarts in December helped France avoid the blackouts it had been fearing and preparing for during a severe cold snap.

Power generation peaked briefly near 46 gigawatts in early February, but has declined by almost 30% since as more plants were taken offline for safety checks and maintenance, plus the impact of workers’ strikes, according to data from grid operator RTE. Repairs continue at several units and more pipe replacements are planned later this year at a handful of plants. The rest of the fleet is due to be progressively checked up until 2025.

More Problems

These maintenance shutdowns have been uncovering more problems. On Tuesday, France’s nuclear safety authority asked EDF to revise its program of reactor checks following the utility’s discovery of a “significant” corrosion crack at its Penly-1 plant. The defect is located near a weld that had been mended twice during construction of the facility, which was commissioned in the early 1990s.

The watchdog also said EDF would have to extend areas where it looks for signs of so-called thermal fatigue — a different type of defect — after such flaws were found on pipes at the Penly-2 and Cattenom-3 reactors.

So far, the company and nuclear watchdog haven’t been able to give a clear answer on how the discovery of these flaws will affect the recovery in nuclear output.

“This shouldn’t jeopardize the planning of stoppages, but this will have consequences on the duration of halts,” Julien Collet, Deputy General Director of France’s nuclear safety authority, told Agence France-Presse.

The pipes affected by thermal fatigue have now been replaced as part of the broader program of repairs tackling the issue of stress corrosion, according to the watchdog. EDF said it will propose an update of its reactor-check strategy in the coming days.

It’s a bleak start to the year that raises questions about EDF’s target to boost its atomic output by between 7.5% and 18% in 2023.

“Market confidence in nuclear availability levels has not been very high as EDF hasn’t stuck to its schedule,” said Jean-Paul Harreman, a director at consultant EnAppSys. “This is definitely not helpful in combination with the low snow cover in the Alps that may lead to more issues this summer if it’s dry.”

EDF’s nuclear woes are being exacerbated by difficulties with French hydropower production, which sank by 22% to 32.4 terawatt-hours last year due to prolonged droughts. Rainfall has barely rebounded so far this year. On the top of that, the company’s power output is being regularly curbed by striking workers, who are protesting against a government plan to increase the retirement age.

Read more: Europe’s Parched Lifeline Flashes Trade Disruption Warning

In 2023, for a second year, neighboring countries won’t be able to rely much on power imports from France. They may have to use more fossil fuels to generate electricity, making them more vulnerable to the gas squeeze that Russia has imposed on Europe in retaliation for its military support of Ukraine.

This makes it less likely that Europe can move past the current energy crisis, and all the sacrifices it has entailed in terms of demand reduction and high prices.

“We went through the winter unscathed because it was an average one with some cold spells, mostly because we had a massive destruction in demand,” said Emeric de Vigan, vice president in charge of power markets at consultant Kpler. “Next winter may require the same level of vigilance.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances