VW, Glencore Back $1 Billion SPAC Mine Deal to Secure EV Metals

(Bloomberg) -- Russian metal industry veteran Artem Volynets’ blank check firm agreed to acquire two Brazilian mines for $1 billion including debt in a bid to tap demand from electric-vehicle makers.

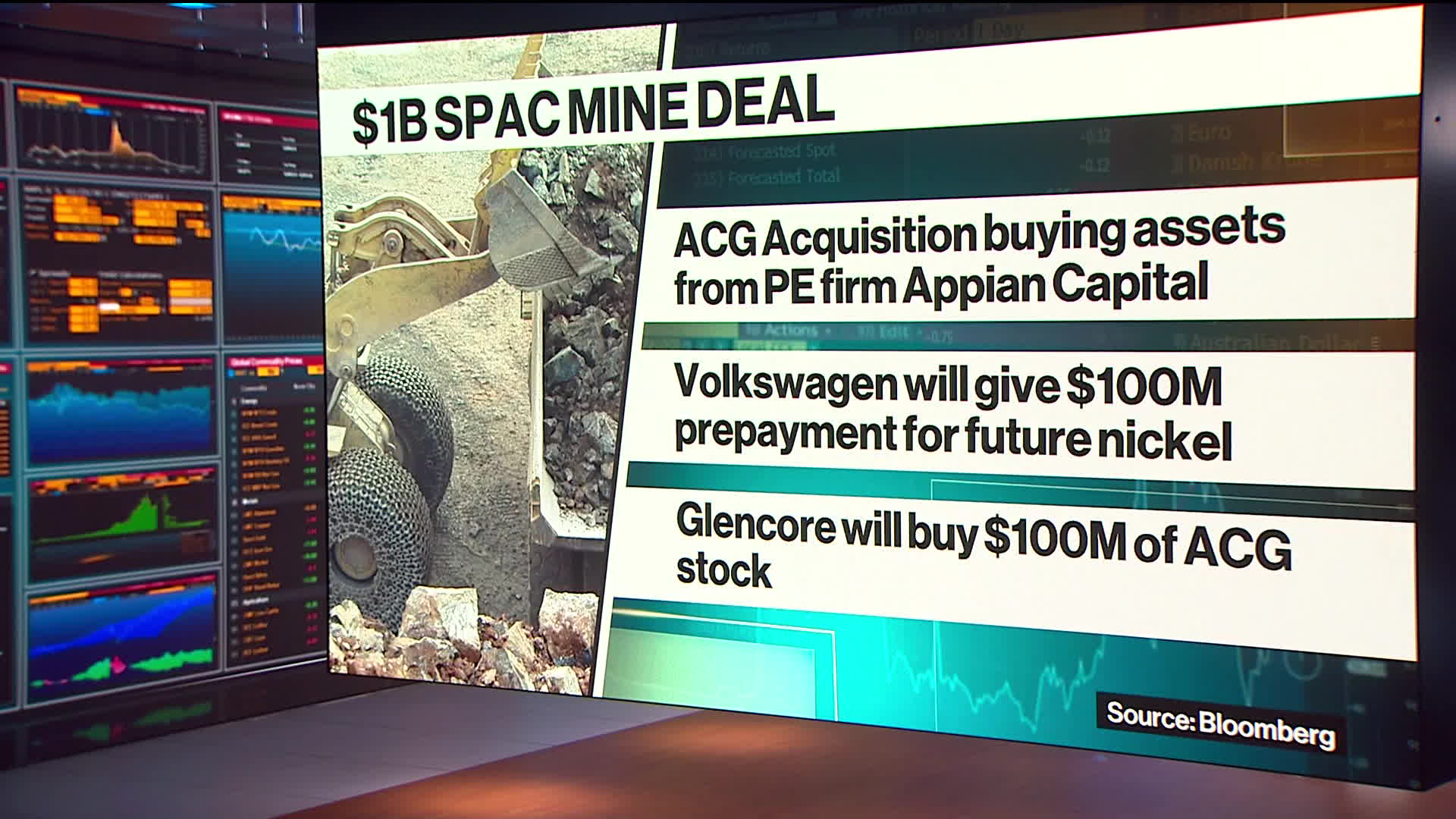

London-listed ACG Acquisition Co. is buying the assets from private equity firm Appian Capital Advisory, according to a statement Monday confirming an earlier Bloomberg News report. Volkswagen AG’s battery arm will support the deal with a $100 million prepayment for future nickel deliveries, while commodities trader Glencore Plc will buy $100 million of ACG stock.

The transaction includes a nickel sulphide mine in Santa Rita, known as Atlantic Nickel, as well as the Mineraçao Vale Verde copper mine in Serrote. Chrysler owner Stellantis NV and La Mancha Resource Capital have agreed to buy $100 million of ACG stock apiece, according to the statement.

Carmakers have been scrambling to secure supplies of key metals like copper needed for the production of electric vehicles. Nickel has also been in demand as it’s essential to the lithium-ion batteries powering such cars.

Essential Supplies

Glencore will buy some of ACG’s nickel for its refineries in western Europe and North America, according to Monday’s statement. ACG plans to raise another $300 million in equity from other investors to support the deal.

The London-listed company will be renamed ACG Electric Metals Ltd. after the merger and said it will seek further consolidation in the metals industry in the future.

“ACG Electric Metals will be a company designed to take advantage of the opportunities presented by key global trends: the massive increase in demand for battery metals, the polarization of supply chains and the need to reduce carbon emissions,” Volynets said in the statement. “These high-quality mines will enable ACG’s mission to be the green metals supplier of choice to western EV automakers.”

Royal Gold Inc. has committed $250 million of royalty financing across the two mines. Citigroup Inc., ING Groep NV and Societe Generale SA are helping arrange $300 million of senior debt, comprised of a $225 million term loan facility and $75 million revolving credit facility.

South African metal producer Sibanye Stillwater Ltd. had agreed to buy the same assets from Appian in 2021. It later pulled out of the deal, citing a geotechnical event at one of the properties.

Russian Dealmaking

ACG raised $125 million in a London initial public offering in late 2022 to target mining assets including those producing “new economy” metals. Its sponsors include Volynets, who is chief executive officer of the special purpose acquisition company, and emerging-markets specialist Argentem Creek Partners.

Volynets was previously an executive for companies backed by Russian tycoons Viktor Vekselberg and Oleg Deripaska. He worked as head of strategy at Deripaska’s United Co. Rusal, one of the world’s largest aluminum producers, and helped arrange its $2.2 billion Hong Kong initial public offering in 2010.

He later served as CEO of Rusal’s parent company, En+ Group. More recently, Volynets led Chaarat Gold Holdings Ltd. as it developed gold mines in Kyrgyzstan and Armenia.

Appian Capital, founded in 2012, is led by former JPMorgan Chase & Co. banker Michael Scherb and manages about $3.6 billion.

Rothschild & Co. advised ACG on the deal, while Appian worked with Citigroup and Standard Chartered Plc. Bank of Montreal, Citigroup and Royal Bank of Canada are acting as placement agents in relation to the acquisition and equity offering.

(Updates throughout with confirmation, executive quote in seventh paragraph.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances