Europe Gas Falls as Sluggish Demand Helps Preserve Winter Stocks

(Bloomberg) -- European natural gas prices declined as persistent low demand for the fuel helps to preserve the region’s inventories.

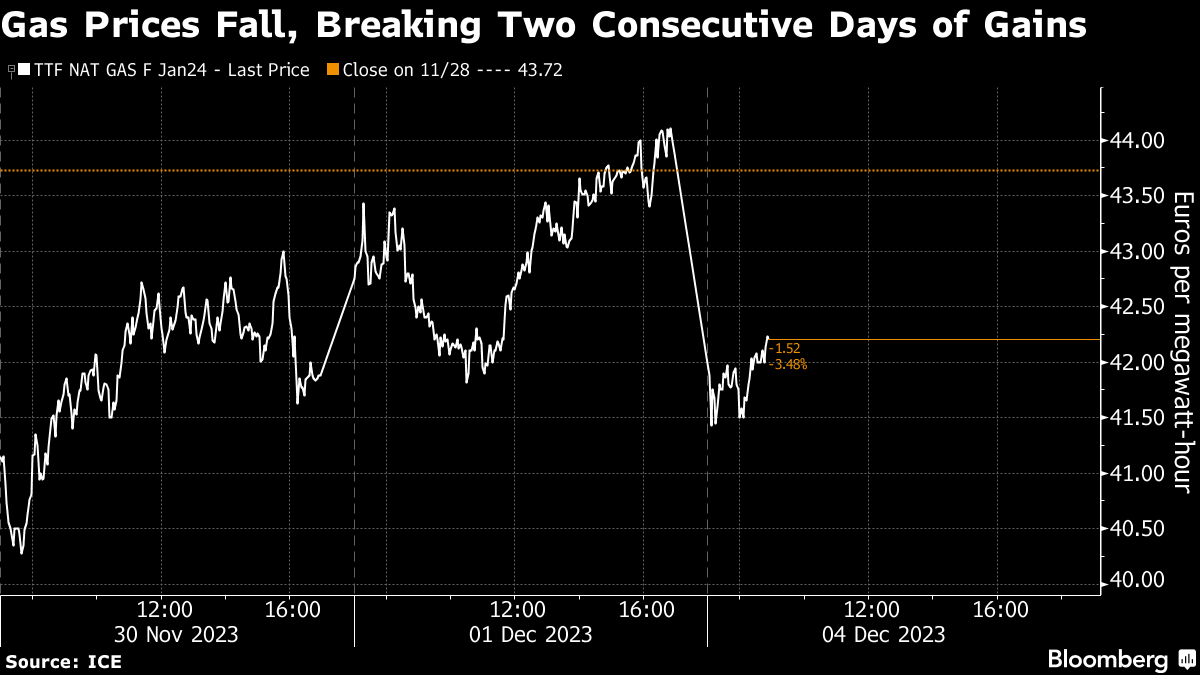

Benchmark futures fell as much as 4.9% on Monday, breaking two consecutive days of gains for the contract late last week.

The market is regaining confidence that Europe will end the winter with plentiful gas supplies as prices have stayed within a narrow range despite a severe cold snap. Overall demand is proving to be stubbornly subdued amid a grim macroeconomic picture, indicating that prospects for a substantial increase in industrial consumption remain unlikely in the near future.

Prices may drop further on Monday to below €40 per megawatt-hour “given the strong increase in wind generation and the upward revision of temperatures,” analysts at Engie SA’s EnergyScan wrote in a note.

The weather is set to get milder from London to Berlin toward the end of the week, according to forecaster Maxar Technologies Inc. That’s leaving the continent in a comfortable position for its second winter after Russia curbed pipeline flows. Withdrawals from storage sites have so far been marginal compared to previous years.

Dutch front-month futures, Europe’s gas benchmark, fell to € a megawatt-hour at 10:18 a.m. in Amsterdam.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Where Harris and Her Potential Running Mates Stand on Climate Change

China Greenlights Massive Offshore Wind Project for Shanghai

Germany Accused of Hoarding Gas Meant for Czech Republic

Sabesp Privatized in Year’s Biggest Latin America Stock Deal

Wildfires Erupt in Canada Crude Patch in Threat to Oil Sands

SK Group to Merge Energy Units to Help Ailing Battery Business

UK Water Watchdog Now Probing All Utilities on Sewage Spills

Enersol signs agreement to acquire a majority stake in NTS Amega

The World’s Power Grids Are Failing as the Planet Warms

Audi and BP partner for Formula 1 entry in 2026

CSIS: long-term LNG demand to reshape global export capacity growth

More women in energy vital to the industry’s success

India’s energy sector presents lucrative opportunities for global companies

Oil India charts the course to ambitious energy growth

Maritime sector is stepping up to the challenges of decarbonisation

Partner content

Navigating the trading seas: exploring the significance of benchmarks

Back to the Future(s): the best commodities benchmarks are still physically settled

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape