UK Utilities Plunge on Reports Sunak Working on Windfall Tax

(Bloomberg) -- UK utility firms sank after it emerged Chancellor of the Exchequer Rishi Sunak has ordered officials to prepare plans for a possible windfall tax on power generators as well as oil and gas firms.

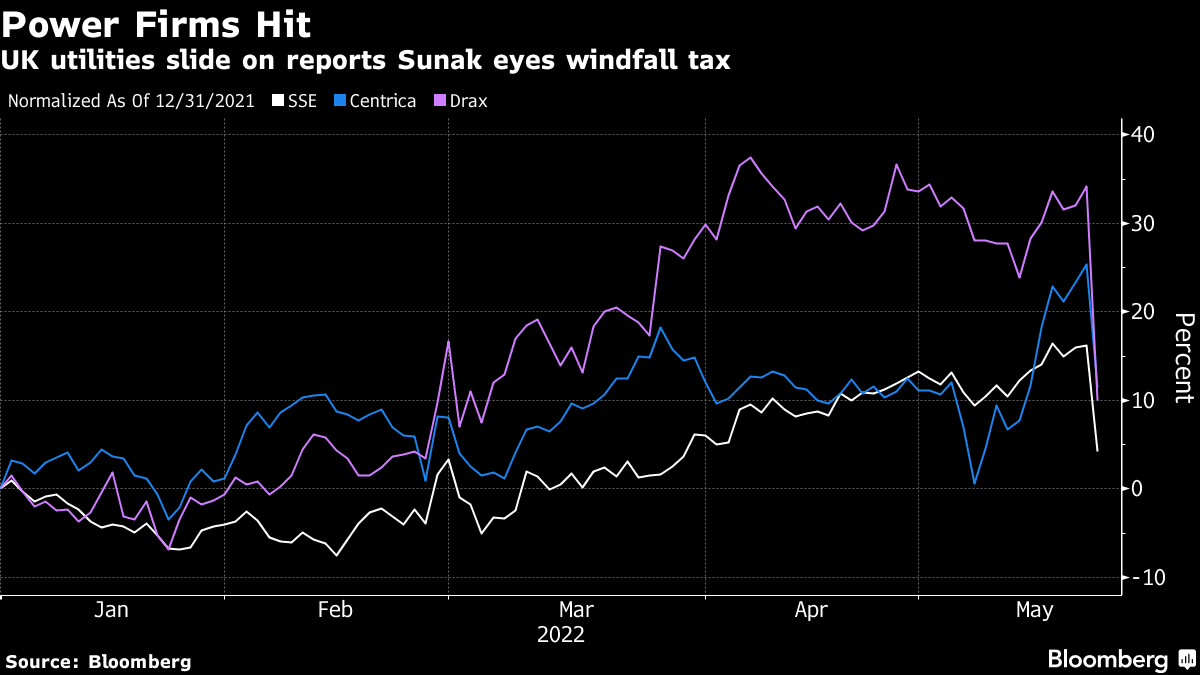

Power plant operator Drax Group Plc tumbled as much as 19%, the most in nearly seven years, while energy suppliers SSE Plc and Centrica Plc both dropped as much as 11%. It also weighed on shares of UK operators listed abroad, including E.ON SE, Electricite de France SA and Iberdrola SA.

“The risk around a UK windfall tax on the power sector, including renewables companies, is likely to overshadow the benefit of inflation and commodity prices,” Citigroup Inc. analyst Jenny Ping wrote in a note to clients. Citi downgraded SSE to neutral from buy and Drax to sell from neutral.

Morgan Stanley analysts, led by Christopher Laybutt, said they expect “elevated volatility” of UK utilities should details of the plan emerge in the coming days, with Drax “expected to be impacted most.”

Read More: UK Warns Energy Firms on Windfall Tax But Won’t Spell Out Target

Sunak is drawing up options for a levy but no decision has been taken, according to two people familiar with the matter who spoke on condition of anonymity. Officials are examining the approaches taken in European Union countries including Spain and Italy, where similar taxes have been introduced, one of the people said. The Financial Times first reported the plan.

Boris Johnson’s government is facing intense pressure to tackle a squeeze on living standards, which has been exacerbated by soaring energy prices in part due to Russia’s war in Ukraine. The crisis has dragged the ruling Conservatives onto uncomfortable political ground; both Johnson and Sunak have repeatedly said they are against a measure they regard as anti-business, but have ultimately not ruled it out.

Awkward Politics

Sunak said this month he wanted to see energy firms investing their profits in new jobs and Britain’s domestic energy security. He warned that if they didn’t “at significant scale” then “no option is off the table.”

“We understand that people are struggling with rising prices,” the UK Treasury said in a statement, when asked about the prospect of a windfall tax. It also reiterated the government’s view that Britons can’t be shielded entirely from issues ministers regard as global in nature, while pointing to existing support.

A windfall tax would be awkward for Johnson, given the opposition Labour Party has been calling for one for weeks. The measure has wide public support but it’s typically regarded as political weakness to concede ground to a rival party. In fact, the plans outlined by the people familiar with the matter would go further than Labour’s proposal, extending the plan to power generators.

Johnson’s Conservative Party is itself deeply divided on the issue, with ministers including Northern Ireland Secretary Brandon Lewis coming out against a tax.

Creating Uncertainty

“It has a knock-on effect,” Lewis said in an interview. “It can make other sectors worry what’s next.”

The government’s plans would target more than £10 billion ($12.6 billion) of excess profit for electricity generators, including wind farm operators, according to the FT, which cited government officials it didn’t identify.

Greencoat U.K. Wind Plc and Denmark’s Orsted A/S were among the renewables companies hit by the media reports.

“A windfall tax is likely to discourage UK investment in clean energy,” Jefferies analyst Ahmed Farman wrote in a note. Companies investing in the green energy transition could potentially get exemptions or tax breaks, as has already been seen within the oil and gas industry, he said.

Read More: To Avoid Windfall Tax, UK May Ask for Quarterly Green Plans

Energy bosses have also warned about the effects of a windfall tax. BP Plc CEO Bernard Looney said this month a tax would “challenge investment in home-grown energy.” Linda Cook, chief executive officer of Harbour Energy said Tuesday that “fiscal instability creates uncertainty,” and that extra levies would mean fewer projects are given the green light.

The debate comes at a sensitive time, with Britain trying to boost domestic energy supplies to reduce reliance on imports following Russia’s invasion of Ukraine. The UK got less than a quarter of its oil supplies from its own fields last year, compared to about 9% from Russia.

Energy Crunch

Domestic output is also dropping fast -- down by 10% in the first quarter from a year earlier -- after companies cut investment or spent their cash elsewhere.

The decline could be halted and the current flow of hydrocarbons maintained for a decade if the country developed all remaining commercially viable resources, according to Wood Mackenzie Ltd. That wouldn’t be transformational for the UK economy -- the North Sea is too old for such feats -- but it would make it easier for the country to implement the ban on Russian oil and gas announced in March.

Leading British businessman Martin Sorrell said the government should press ahead with the windfall tax, despite industry warnings.

“These are super-normal profits and this is an exceptional time,” Sorrell, executive chairman of the digital advertising group S4 Capital, told Bloomberg at the World Economic Forum annual meeting in Davos. “They should do it.”

(Updates with Morgan Stanley and Jefferies notes, more details from fourth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods