Europe Gas Swings With High Stockpiles Offsetting Weather Risks

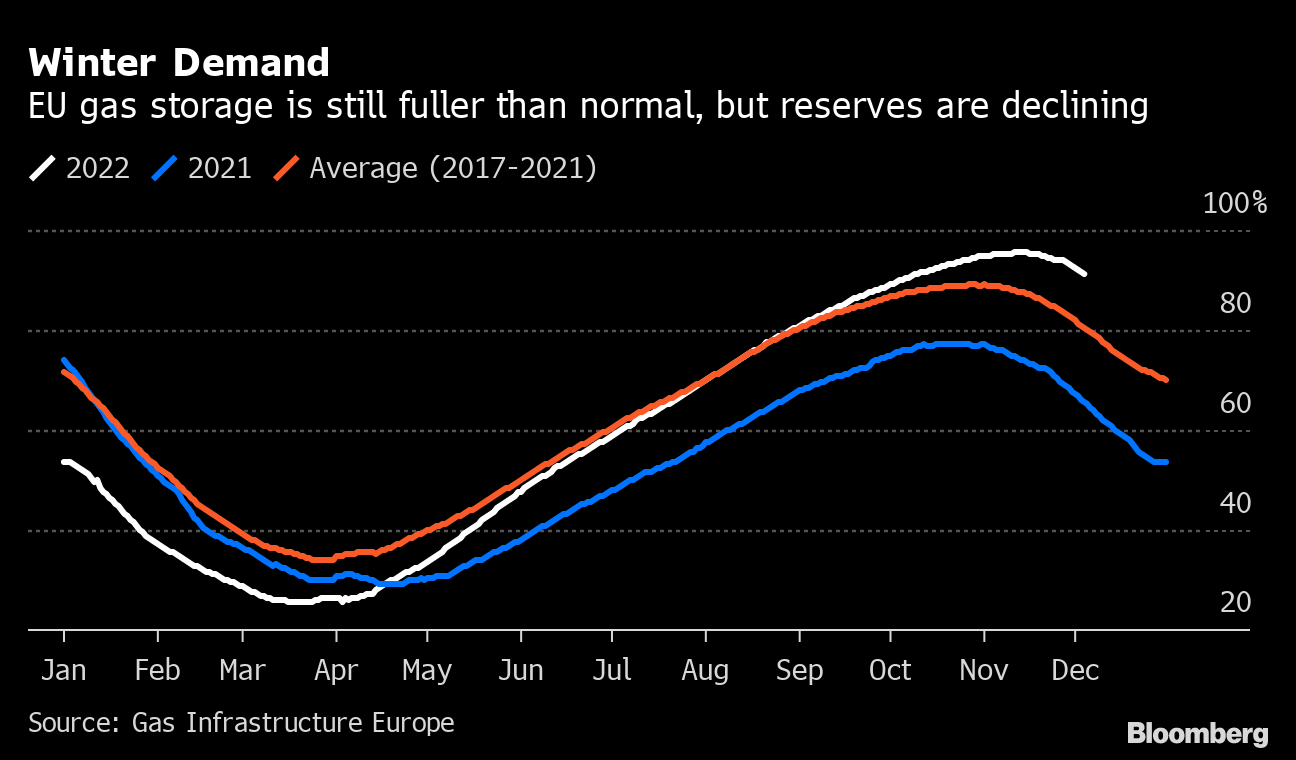

(Bloomberg) -- European natural gas prices fluctuated, with higher-than-normal stockpiles countering worries about higher demand as temperatures drop across the region.

Benchmark futures swung between small gains and losses, after rising as much as 4.3% earlier. The cold snap in northwest Europe is putting more pressure on inventories that have been built up for the winter. But reserves remain fuller than normal at about 91%, keeping gas prices in check.

The outlook for the next two weeks is dominated by an Arctic blast, with temperatures in the UK and Nordics dropping below freezing, according to forecaster Maxar Technologies Inc. Only Iberia and parts of southern Europe are spared from the frigid weather.

Read more: Winter Blast Puts Pressure on UK and Nordic Energy Systems

Following a mild autumn, traders are now torn between rising heating demand and relatively comfortable supply conditions, said Ole Hansen, head of commodity strategy at Saxo Bank A/S. Yet, “given the prospect for colder-than-normal temperatures, the price of gas is likely to remain elevated in the coming weeks.”

Dutch front-month gas futures, Europe’s benchmark, traded 0.4% higher at €135.20 per megawatt-hour as of 10:51 a.m. in Amsterdam. The UK equivalent contract was up 0.9%, also paring earlier gains. German month-ahead power rose 3.1%.

Click here for the daily Europe Energy Crunch blog

Meanwhile, European Union nations are continuing discussions on ways to ease market volatility after energy bills surged to record-highs earlier this year, causing the worst cost-of-living crisis in decades. Seven members of the bloc have called for a tighter cap on gas costs, and the Netherlands proposed putting a ceiling on prices for the fuel used for storage which would help replenish reservoirs next year. EU energy ministers are set to discuss the issue next week.

Read also: EU Spars Over Gas Price Cap as Dutch Float Storage Idea

“Supply is expected to remain tight, especially for winter 2023-24, which means that prices may well rise again, and price volatility is likely to continue,” the Oxford Institute for Energy Studies said in a report this week. “If a price cap makes it more difficult for supply and demand to balance, it could make matters worse.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances