European Gas Drops Amid Higher LNG Flows, Easing Supply Concerns

(Bloomberg) -- Natural gas prices in Europe settled at multi-month lows amid higher imports of LNG and indications that gas buyers will find a workaround to Russia’s demand for payments in rubles.

Benchmark futures closed 2.2% lower at 92.84 euros per megawatt-hour, the lowest level since Feb. 23, the day before Russia invaded Ukraine.

The equivalent contract in the U.K. declined 11% to a seven-month low. Northwest Europe’s imports of liquefied natural gas this month are on course to match the record levels seen in January.

Traders are keeping a close watch on whether a resolution can be found on the Kremlin’s demand to be paid in rubles for its gas. European Union lawyers have said the new mechanism violates existing sanctions, and Russian President Vladimir Putin has warned that flows could be cut if the terms aren’t met.

Concerns that Russian gas flows could be cut off “appear to have largely been shrugged off as a workaround presented itself,” Inspired Energy said in a report on Monday. “The workaround would see European companies continue their purchases in the pre-agreed euros or dollars.”

Uniper SE, one of the largest Russian gas buyers, indicated it’s possible to make future payments in euros and still be compliant with Moscow’s demands. Disruptions also aren’t seen as imminent as most bills due later next month.

Also See: Slovakia Will Pay for Russian Gas in Euros: Premier Heger

EU member states still don’t all agree on the need for a full embargo on Russian oil and gas in response to the war in Ukraine, the bloc’s foreign policy chief Josep Borrell told German newspaper Die Welt.

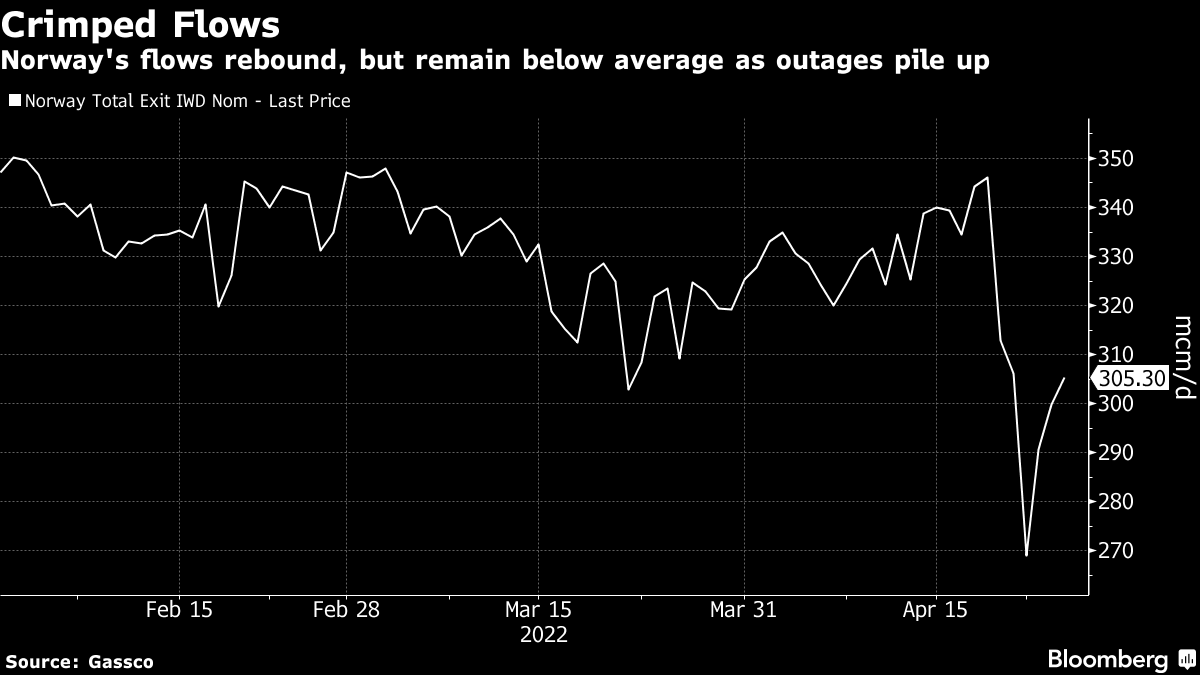

Meanwhile, natural gas flows into the region remained crimped, and cooler weather is forecast for the next couple of weeks, which could boost demand.

Supplies from Norway are set to increase, according to nominations from operator Gassco AS, but remain about 10% below the average of last month because of maintenance work. Orders for Russian gas transiting Ukraine are above Sunday’s levels, but still far below those seen earlier in April.

Infrastructure Risk

The war has raised concerns over damage to infrastructure. One-third of gas volumes shipped to Europe via Ukraine could be lost due to Russian forces in recently occupied territories, according to the head of state-owned Naftogaz Ukrainy. Moscow’s troops are disrupting operation of pumping stations, Yuriy Vitrenko, chief executive of the energy company, said on Twitter over the weekend.

“Russia’s war in Ukraine has certainly brought geopolitics to the forefront of natural gas in an acute way, particularly given the ongoing risk of a complete shut-in,” RBC Capital Markets strategists led by Christopher Louney said in a report.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances