Energy Inflation Gathers Pace as EU Gas, Power Surge to Record

(Bloomberg) -- Energy inflation is gathering pace in Europe, with the price of everything from gas to electricity surging to records, fueling concerns about costs to consumers as the world emerges from the global pandemic.

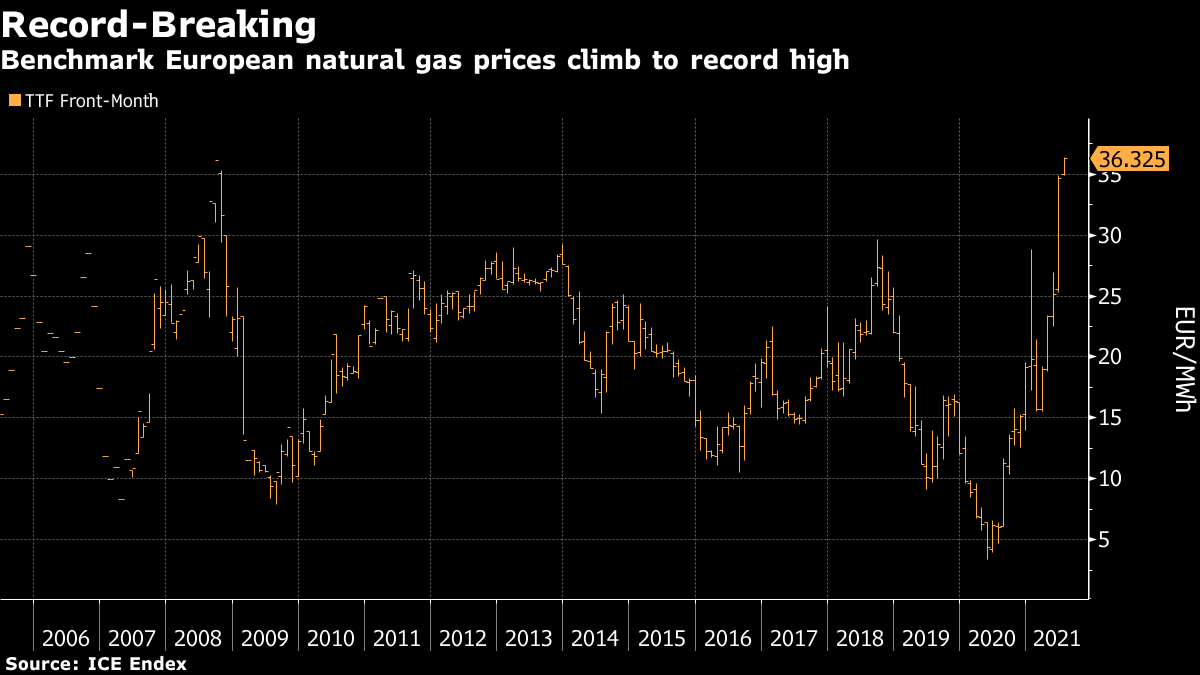

European natural gas, coal and power prices climbed to an all-time high on Thursday, as did the cost of pollution permits. Energy demand is rebounding just as Europe plans to expand and impose tougher limits on emitters later this month, a move that’s helping boost energy costs in the region.

Energy prices are soaring from the U.S. to Asia as economies recover and more people get vaccinated. Consumers are set to face hefty bills this coming winter, with countries like the U.K. raising the cap on how much utilities can charge consumers and Spain moving to cut energy taxes.

Europe is facing a severe gas supply crunch, with prices jumping almost 90% this year after a colder- and longer-than usual winter left storage sites depleted. And supply isn’t rising fast enough, with Russia flowing less gas to Europe through Ukraine -- a key transit route -- and Asia scooping up cargoes of the liquefied fuel as intense heat boosts demand for cooling.

“European gas prices there have surged in recent weeks amid supply constraints, with Russia holding back exports to Western Europe despite strong demand,” said Daniel Hynes, a senior commodity strategist at Australia & New Zealand Banking Group Ltd. “The region is still recovering from the harsh winter’s drain on inventories.”

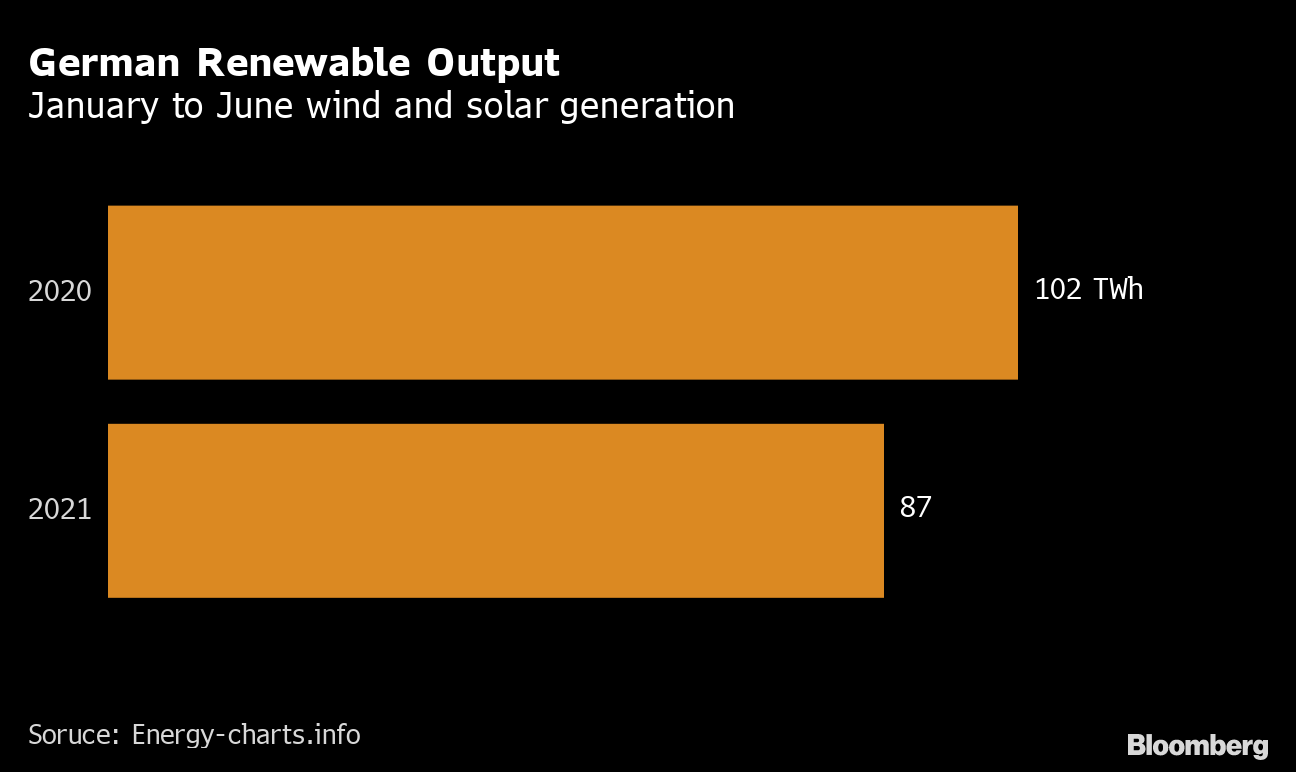

With gas so expensive, Europe needs to use more coal to keep the lights on as output from renewable sources remains low. That means that if the price of carbon gains, gas had to follow suit to ensure coal is the cheapest feedstock to make electricity, said Bjarne Schieldrop, chief commodities analyst at SEB AB.

“European gas and coal prices are driven by low renewable output that makes fossil fuels more attractive,” Swedish utility Bixia said in emailed report. “It is more attractive to generate coal than gas power in some cases.”

Gas inventories in Europe are already at the lowest level in more than a decade for this time of year. To make matters worse, Russia on Tuesday opted against sending additional gas to Europe through Ukraine for a third consecutive month, snubbing one of two monthly auctions.

“July was seen as the one month they would book added capacity given maintenance on all of their other main pipes,” said Trevor Sikorski, head of natural gas and energy transition at consultants Energy Aspects in London.

The Nord Stream 1 pipeline linking Russia directly to Germany undergoes maintenance for 10 days in July, while the Yamal-Europe link will be shut down from July 6-10.

The European Commission is planning the biggest overhaul of the world’s largest carbon market for later this month. The reform, due to be unveiled on July 14, is set to increase the rate at which the emissions caps shrink each year and to toughen the rules to get carbon allowances for free.

Dutch gas futures on the Title Transfer Facility hub rose as much as 5.1% to 36.375 euros a megawatt-hour, while German power for 2022 climbed as much as 3.3% to record 74.55 euros per megawatt-hours on the EEX exchange.

The price of coal for 2022 delivery in Europe added 1.4% to $88.40 a metric ton, the highest since December 2018. The benchmark carbon-contract surged as much as 3.8% to a record of 58.49 euros a ton.

To be sure, these aren’t the highest gas prices Europe has ever paid. Before the Dutch market became the benchmark, Russian gas at the German border rose to about $16 per million British thermal units in 2008, according to monthly data from the International Monetary Fund. That compares with just over $12 per mmBtu for Dutch gas futures.

Supplies are also tight as Norway is undergoing heavy maintenance after pandemic-induced delays and the cost of polluting in Europe surged to a record ahead of market reforms this month. That’s making gas more expensive. Asia is also buying up cargoes of liquefied natural gas.

Prices in Asia and the U.S. are also surging.

“The EU and the U.K. need to import LNG and the price for that is going up,” Schieldrop said. “It is a global LNG and natural gas price rally, and not solely European.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally

UK Nuclear Plants to Stay Online Longer in Clean-Power Boost