EU Gas Extends Rally as Crunch Risks Extending Into Next Winter

(Bloomberg) --

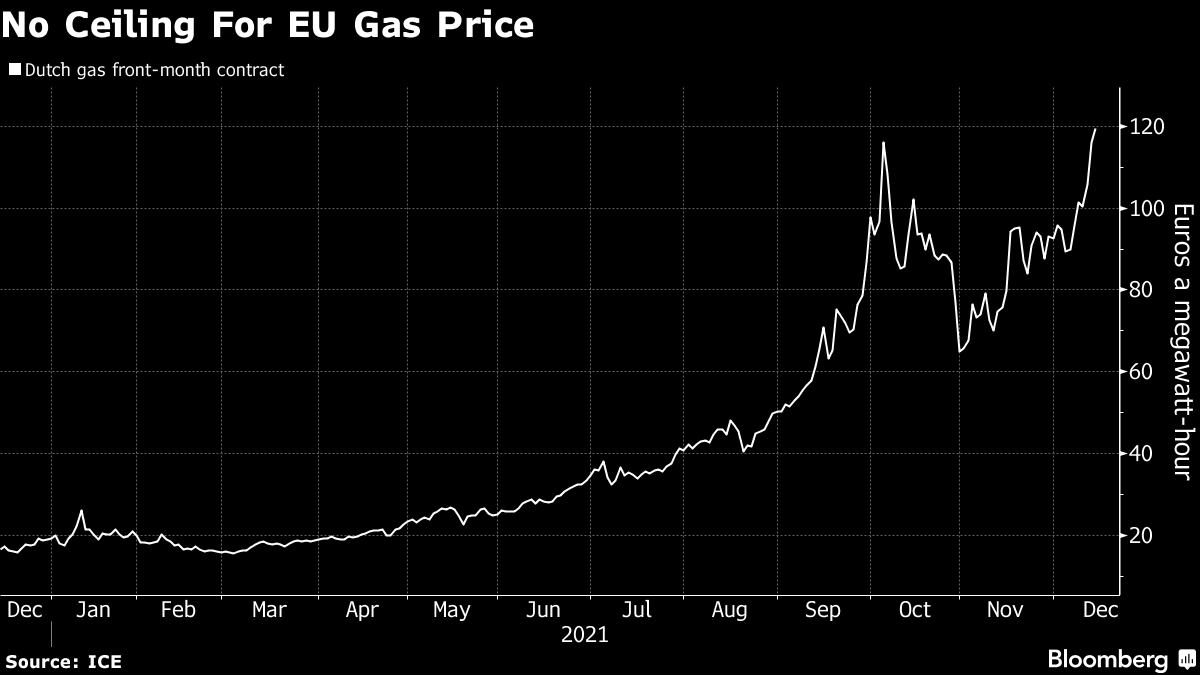

European natural gas surged after Monday’s record high closing with uncertainty over Russian supplies threatening to extend the energy crunch into next winter.

A geopolitical crisis is brewing as Russia builds troops at the border with Ukraine. A potential invasion would come at the height of the European winter, according to U.S. and Ukrainian intelligence. That could not just delay the start of the controversial Nord Stream 2 gas pipeline, but also risk other supplies at a time inventories are running dangerously low.

Why Russia-Ukraine Tensions Are So Hard to Defuse: QuickTake

European Union leaders will on Thursday hold a summit to address the situation. They will discuss ways to respond to the energy crisis, the resurgence of the pandemic and Russia-Ukraine position. In what could be another flashpoint, the bloc wants to set a deadline to end long-term gas supply deals that are favored by Russia.

Europe was facing a dire energy situation even before the geopolitical tensions flared up. As economies reopen, demand is roaring back and supply just can’t keep up, with the continent’s large network of renewable power unable to plug the gap most of the year due to low wind speeds. The weather is also turning cold this weekend, while gas inventories are the lowest on record for the time of the year.

Power prices have also surged in recent days. Electricity for delivery next year traded near record highs in Germany.

“Spot gas and power prices have quadrupled, reflecting market fears of gas shortages over the winter to come,” Antonella Bianchessi, an analyst at Citigroup Inc., said in a report.

Benchmark European gas prices traded in the Netherlands jumped as much as 5.9% and was 2.1% higher at 118.53 euros a megawatt-hour as of 10:33 a.m. local time. The U.K. equivalent gained 2.5% to 301.85 pence a therm.

Omicron Spread

There could, however, be some relief from surging prices as rising cases of the omicron variant of the coronavirus forces nations to impose more restrictions, hitting economic growth and energy demand. Global oil markets have returned to surplus and face an even bigger oversupply early next year as the new variant impedes international travel, the International Energy Agency said.

The current high energy prices threaten utilities and trading companies, many of which had to take out more debt or were forced to curb positions back in October, further risking supply. Poland’s state-controlled gas company PGNiG SA is seeking 2.7 billion zloty ($657 million) in short-term funding to “maintain flexibility” of operations, it said Monday.

“Natural gas markets are vulnerable to price shocks if we experience the below-average temperatures we experienced last winter,” S&P Global Platts said in its energy outlook for next year. “Currently, Russia is the primary source of the world’s spare capacity and delivering that supply to markets eager to meet demand and rebuild storage will dominate balances and prices in 2022.”

The key Nord Stream 2 pipeline that will bring Russian gas into Germanym could take six to eight months to start while it undergoes a certification process before the German government signs off on it.

“The delayed Nord Stream 2 pipeline is essential to boosting Russian gas supply into Europe as Russia is shifting away from” sending supplies through Ukraine and via its e-auctions, S&P Global Platts said. It expects the link to start operations in June, but “further delays would cause European buyers to scramble for alternative gas supply, boosting not only European gas prices, but global LNG prices.”

EUROPE GAS OUTAGES: Elgin Frankin Set to Restart Supply Tuesday

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances