Major Investors More Confident in Australia’s Climate Policy

(Bloomberg) -- Investors with a combined A$35 trillion ($23 trillion) in assets are becoming more optimistic about Australia’s climate policy, with roughly half considering financing renewable-energy projects, according to an extract of a survey released Monday.

Only 40% of the 63 respondents in the Investor Group on Climate Change’s 2023 annual Net Zero Survey cited policy and regulatory uncertainty as a key barrier to investment. That’s down from about 70% in 2021. National decarbonization plans for specific sectors including energy, transport and resources, as well as the announcement of the 2035 emissions target, remain the highest priority for investors this year.

Policy and regulatory uncertainty, once seen as a barrier to clean economy investment in Australia, “has fallen dramatically,” according to the extract of the survey. The group has more than 100 members ranging from large pension funds to specialist investors.

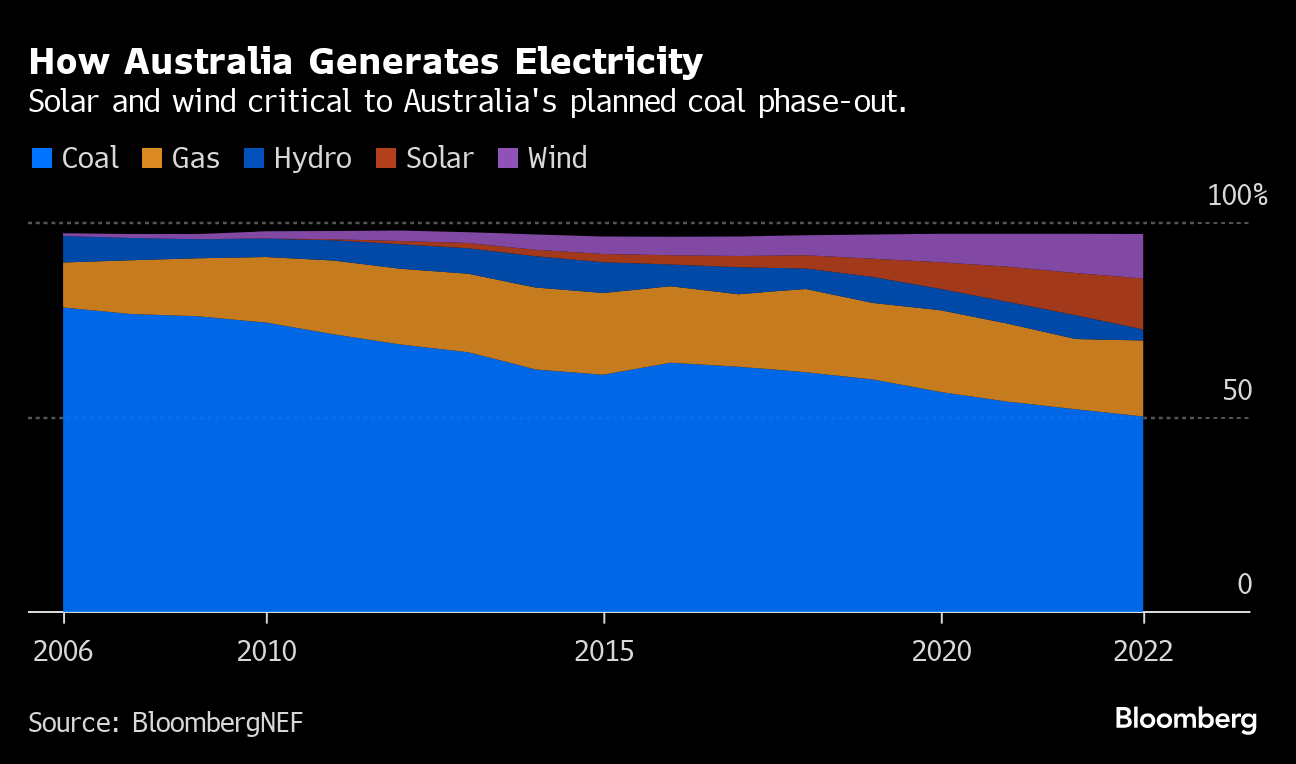

The results are a boon for the Labor government, which came to power in 2022 on a platform that promised to accelerate the transition away from coal-fired power generation and end Australia’s reputation as a climate laggard. Those ambitions have faced headwinds, however, with Oxford Economics last week warning that the slow roll-out of renewable energy means emissions aren’t dropping fast enough to meet a target for a 43% cut by 2030 from 2005 levels.

Investors see the Australian government’s move to follow a global trend to legislate climate-related disclosures as among the biggest changes in policy priorities in the past year, according to the report.

Renewable energy is seen delivering the best long-term financial returns, while investors are also looking at technologies where Australia has a comparative advantage, such as critical minerals and green hydrogen. Nuclear energy is the least appealing option, with just 10% exploring new investment, IGCC said.

The full results of the survey will be released later this year.

©2024 Bloomberg L.P.