Korea Edges Ahead of Rivals to Build Europe’s Nuclear Reactors

(Bloomberg) -- South Korea’s long-held ambition of exporting its nuclear power technology got a major boost this week, potentially setting it up to be the reactor provider of choice to several countries.

State-owned Korea Hydro & Nuclear Power Co. was chosen to build two multibillion-dollar reactors in the Czech Republic, beating out rivals and paving the way for Korean companies to potentially score a string of deals across the continent.

“Now a bridgehead has been established for us to export nuclear plants to Europe,” Korea’s Trade, Industry and Energy Minister Ahn Duk-geun declared after the win.

The project, once finalized, could put the Asian nation in pole position to build reactors in Europe, which is once again warming to nuclear energy to wean itself off expensive fossil fuels and hit ambitious pollution reduction targets. Thanks to their cost-competitiveness and an export strategy honed over decades, the Koreans are edging out rivals mired in budget overruns and delays or geopolitical and trade tensions.

Korea Hydro & Nuclear is conducting a feasibility study for a nuclear plant in the Netherlands, while Sweden’s Vattenfall AB is considering using Korean technology. The country is also in talks to supply reactors to the UK, Poland and Slovenia, putting it on track to achieve the government’s pledge to export 10 units by 2030.

Its rise won’t be without contest. President Joe Biden this week signed a bill that promises to revive the US’s nuclear industry, and even facilitate the export of technology. Westinghouse Electric Co. has filed a lawsuit claiming South Korea is using its intellectual property and should be barred from sharing it. The US company warned it may file legal challenges over the Czech deal.

All-in-One Package

Much of South Korea’s ascent is due to its ability to deliver reactors as all-inclusive packages — from equipment, construction, and fuel supply to commissioning, maintenance, and even financing — while largely meeting deadlines and containing costs.

“A nuclear plant is so much more than a reactor,” said Mark Nelson, managing director at Radiant Energy Group, a consultancy. “It is civil engineering, it is blueprints, crane operators. And Korea has that,” he said. “They can offer the most competitive package,” he added.

South Korea was picked to build the reactors in the Czech Republic for 400 billion koruna ($17.3 billion).

By contrast, Electricite de France SA said earlier this year that two reactors at Hinkley Point in the UK would cost as much as £35 billion in 2015 terms, which would equate to $45 billion at current exchange rates, and take several years longer than planned. In the US, Southern Co.’s Vogtle nuclear facility came in more than $16 billion over budget and seven years behind schedule.

Seoul’s nuclear export strategy has been decades in the making. Back in 1987, its state-run utility agreed to a technology transfer with US-based Combustion Engineering, then developed the design to create its own homegrown reactor. Since then, it’s built 28 reactors domestically, with four more scheduled to operate before 2040.

Its first reactor export, to the United Arab Emirates, was announced in 2009. The Arab world’s first commercial nuclear facility grappled with delays and came in 25% over budget, but that didn’t stop South Korea’s export push.

“Korea has a full domestic, experienced, supply chain,” said Jeremy Gordon, an independent nuclear energy consultant. “And their industry has the assurance of a government that is committed to nuclear, strategically, for energy security, economic and climate reasons, which gives the whole Korean nuclear ecosystem the confidence to invest.”

This means the Asian nation is well-placed to scoop up opportunities as the world returns to atomic energy after it was shunned for decades due to the worst nuclear accident in history at Chernobyl. Russia’s invasion of Ukraine has served as a wake-up call for European leaders to reduce dependence on imported gas, and 25 countries, including more than a dozen in Europe, have set a goal to triple global capacity by 2050.

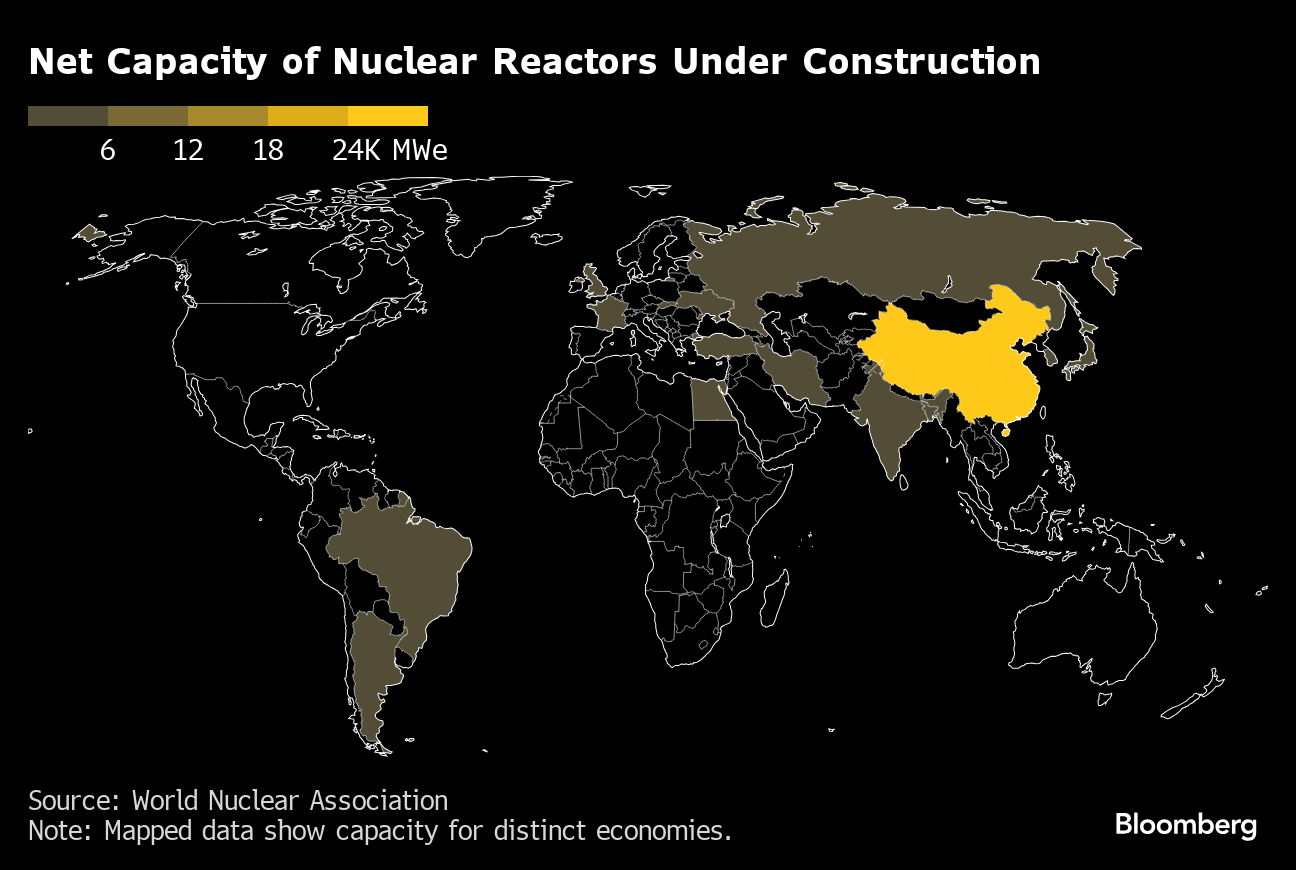

But it’s a small pool of reactor builders out there. Western companies struggle to deliver on time and on budget. And European governments are reluctant to sign off on projects with state-owned giants from Russia and China — currently dominant in global reactor construction — due to security concerns, since nuclear plants are particularly sensitive pieces of infrastructure.

“If South Korea manages the construction of these reactors in the Czech Republic at least reasonably well, it wouldn’t surprise me if they go on to sell more to other countries,” said Matt Bowen, a senior researcher at the Center on Global Energy Policy at Columbia University. “And then, yes, South Korea would become more important to world nuclear energy supply.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Longi Delays Solar Module Plant in China as Sector Struggles

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry

California Popularized Solar, But It's Behind Other States on Panels for Renters

A $50 Billion London Investor Takes a Contrarian View on Trump