Goldman Sachs Fund Unit Finds Value After Green Market Rout

(Bloomberg) -- A senior manager at the fund unit of Goldman Sachs Group Inc. says last year’s deep selloff of green stocks may have blinded some equity investors to the growth potential in key corners of the market.

Luke Barrs, managing director and global head of fundamental equity client portfolio management at Goldman Sachs Asset Management, says he sees evidence that investors are ignoring opportunities to buy in the renewables sector.

“Many of the environmental solution providers — within which we’d include renewable technology and renewable utilities — repriced aggressively through much of last year,” he said in an interview. But despite the huge shift underway in power generation and transportation, there are still investors who are “just not baking in the uplift in value that comes from successfully navigating that transition.”

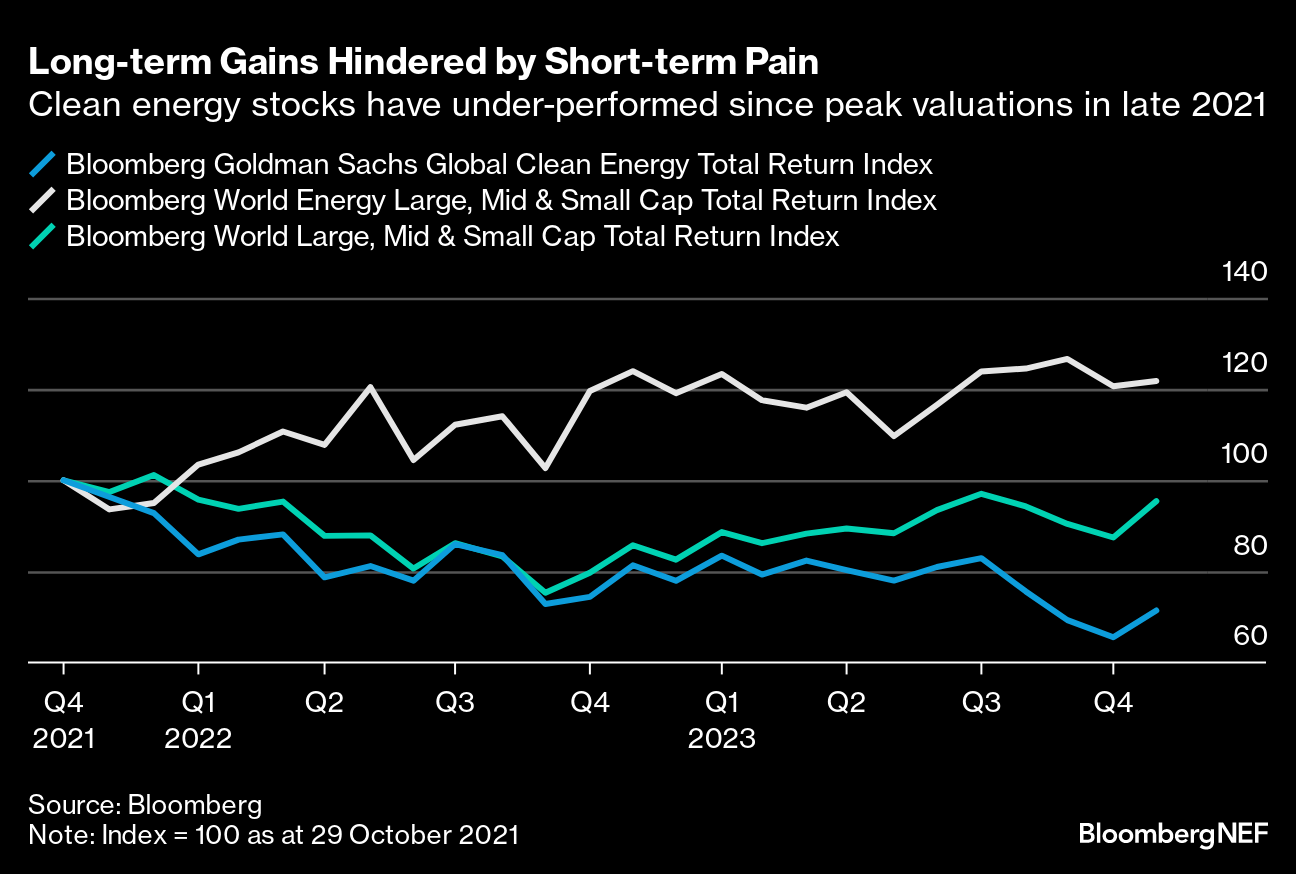

Investors have remained skeptical toward renewable technology stocks, after wind and solar producers emerged as some of the biggest losers of 2023. And utilities, including those with a focus on renewable technology, were last year’s worst-performing sector overall.

Much of that underperformance was caused by higher interest rates and supply-chain bottlenecks, with capital-intensive green projects such as wind parks often struggling in the face of the macro forces that have dominated the post-pandemic world.

Last year the S&P Global Clean Energy Index, whose members include wind park operator Orsted A/S and solar products and services maker SunPower Corp., slumped more than 20%. And so far in 2024, the index has continued to slide, down about 10%. By comparison, the S&P 500 Index rose about 24% in 2023 and has gained about 5% year-to-date. Barrs at GSAM didn’t single out any individual stocks.

Not all corners of the green investing world delivered losses last year. The Nasdaq Clean Edge Smart Grid Infrastructure Index gained more than 20% in 2023, as investors bought into the underlying infrastructure behind the renewable energy transition.

That index is composed of companies including Eaton Corp., a power-management company with businesses that span everything from components for aerospace to hydraulics used in electrical power distribution. Its shares gained more than 50% last year. Other index members include Schneider Electric SE, whose products include electric vehicle chargers. It was up almost 40% in 2023.

Goldman Sachs Asset Management “fundamentally” buys into the medium-term growth prospects of stocks that are geared to do well in the green transition, Barrs said.

He emphasized the appeal of so-called transition stocks, which are typically not green yet but for which credible strategies exist to make them greener over time. Their value lies in shielding investors from the stranded-asset risk that many other old-economy stocks face as the world moves toward a low-carbon future.

Transition finance is fast becoming a major focus among banks and asset managers, with new dedicated investment and corporate banking desks being created across the industry. BlackRock Inc. has referred to the energy transition as a “mega force” that’s reshaping markets and economies.

For now, though, a key hurdle around transition finance is the absence of a clear regulatory definition of the term. And fund managers are already warning that lack of clarity has the potential to upend some portfolio strategies.

Many of the US funds targeting transition are packed full of well-established technology behemoths. According to an analysis published by Morningstar Inc. in September, the most popular stocks for US transition funds are Alphabet Inc., Microsoft Corp. and Nvidia Corp. The market researcher also notes that the companies currently have business models that are aligned with global temperature rises of between 2.5C and 4.0C, well in excess of the critical 1.5C threshold set by scientists.

How much capital a company spends on going from brown to green is emerging as one of the best ways for investors to identify promising transition stocks, analysts at JPMorgan Chase & Co. said last year.

Barrs said the upshot is that transition-orientated businesses have the potential to be “very beneficial” to portfolios that are already tilted toward outperforming environmental, social and governance metrics.

What BloombergNEF Says:

Over an extended period, low-carbon energy stocks have faired better. An investor in the clean energy index at the end of 2018 would have doubled their money if still held today. Given the exponential nature of clean energy growth, investors may benefit from applying a longer-term perspective. This doesn’t diminish the fact that large investors are demanding returns from the clean energy sector today.

Click here to read the full note by BNEF’s Ryan Loughead.

(Adds reference to SEC climate rule in fourth paragraph from the end.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Longi Delays Solar Module Plant in China as Sector Struggles

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry

California Popularized Solar, But It's Behind Other States on Panels for Renters

A $50 Billion London Investor Takes a Contrarian View on Trump