Europe’s Biggest Exporter of Power Might Need Imports in Winter

(Bloomberg) -- Extended outages and repairs at Electricite de France SA’s nuclear power plants are stoking fears that France won’t have enough electricity this winter and may need imports from its neighbors and it’s sending prices are soaring.

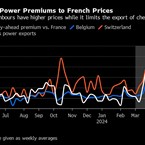

Output from France’s huge fleet of 56 nuclear reactors is forecast to be 25% lower than usual this winter, according to analysis by Baringa Partners LLP. France is usually Europe’s biggest exporter of power, sending vast amounts of electricity through interconnectors to the UK, Germany, Italy and Spain. This winter flows are set to be reversed as the deficit of cheap power in France pushes up prices far above its neighboring markets.

“It could become a fascinating winter across Europe,” said Phil Grant, Partner at energy consultant Baringa Partners. “Those plants are not coming back in time.”

French peakload prices, from 7 a.m. to 7 p.m., for first quarter next year jumped above 1,000 euros ($1,037) per megawatt-hour on the European Energy Exchange AG, almost three times as high as in Germany. The French baseload contract for same period is about double the price in Germany or Italy.

The extended outages couldn’t have come at a worse time for Europe as the continent tries to wean itself off Russian imports of coal and natural gas after the invasion of Ukraine. Instead of getting a helping hand from one of the biggest nuclear fleets in the world, generators in neighboring countries may need to burn more fossil fuels to supply exports of electricity to consumers in France.

The high prices across mainland Europe this year have already stirred up calls for export cuts in countries with lower costs like the Nordic region. So far, governments have not intervened in the market. For the UK, and many other nations used to replying on imports at peak times, the reverse of flows from France will increase the risk of political intervention, according to Grant.

“The possibility where governments might take more unilateral action to protect domestic security of supply has to be more credible,” he said. Given the unusual situation in Europe trying to phase out Russian energy, “the normal rules of the game does not apply.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Europe Is Being Scorched and Flooded by Growing Climate Extremes

Apr 22, 2024

Biden Unveils Winners of $2 Billion in Green Tax Credits

Apr 19, 2024

Europe’s Demand for LNG Set to Peak in 2024 as Crisis Fades

Apr 19, 2024

Clean Hydrogen’s Best Bet May Be a Rainforest State in Borneo

Apr 18, 2024

PG&E, Edison, California Apply for $2 Billion US Grid Grant

Apr 18, 2024

China’s Solar Surge Is Making a Missing Power Data Problem Worse

Apr 18, 2024

First Solar Jumps After Report Says Biden to End Trade Loophole

Apr 17, 2024

Biden’s Climate Law Catalyzed Investment, But Projects Still Face Snags

Apr 17, 2024

Masdar and EGA form alliance on aluminium decarbonisation and renewables

Apr 17, 2024

Chevron Launches $500 Million Fund to Invest in Clean Tech

Apr 16, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum