How to Sell ‘Carbon Neutral’ Fossil Fuel That Doesn’t Exist

(Bloomberg) -- The junior traders at TotalEnergies SE were essentially winging it last September by orchestrating the French energy giant’s first shipment of “carbon-neutral” natural gas. It’s the greenest-possible designation for fossil fuel and an important step in making the company’s core product more palatable in a warming world. Nailing down the deal involved googling and guesswork. Listen to this story

Total had proposed the trade after learning a client had already purchased two carbon-neutral cargos from rivals at Royal Dutch Shell Plc, according to people with knowledge of the deal who asked not to be named discussing a private transaction. One of these insiders said that only after getting the go-ahead did the inexperienced team attempt to figure out how to neutralize the emissions contained in a hulking tanker full of liquified natural gas. Their first step was to search the internet for worthy environmental projects that might offset the pollution.

Thousands of miles away, a Zimbabwean volunteer named Kembo Magonyo would spend the spring months clearing stubborn jumbles of branches near the thickly forested border with Mozambique. Wildfires tend to leap between the two countries, laying waste to trees before anyone can respond. “This whole bush can be razed to the ground if we don’t do what we’re doing,” Magonyo says, hacking away with his machete. His work is organized by a group partly funded by Total’s carbon-neutral deal.

In the complicated new math of climate solutions, villagers clearing brush in southern Africa can end up redefining networks of global commerce worth billions of dollars. Environmental projects stand as shadow partners to emission-heavy energy trades happening far away.

What Total’s gas cargo puts into the atmosphere, the machete-wielding villagers will remove. That’s the theory.

But to make it work Total’s pioneers of carbon neutrality first needed to find green projects capable of meeting two requirements: generate carbon credits backed by an international organization, without costing too much. After struggling to come up with an answer, the team set up a meeting with South Pole, a project developer based in Zurich that came recommended by rival traders. That’s how $600,000 from a $17 million LNG transaction ended up, in part, paying for forest protection in Zimbabwe.

The resulting trade looks like a win for everyone. Total kept its promise to investors to shrink its carbon footprint. Impoverished communities received financial support. And the buyer, China National Offshore Oil Corp., cited the shipment as one of the steps it’s taking to “provide green, clean energy to the nation.” But climate experts and even a crucial organizer behind the deal say it will do virtually nothing to decrease carbon dioxide in the atmosphere, falling far short of neutral.

“The claim that you can market the sale of fossil fuels as carbon neutral because of a meager few dollars you put into tropical conservation is not a defensible claim,” says Danny Cullenward, a Stanford University lecturer and policy director at CarbonPlan, a nonprofit group that analyzes climate solutions for impact.

At best, Cullenward says, efforts to prevent deforestation by stopping wildfires can only avoid additional heat-trapping gas released when trees burn. Rural villagers can’t do anything to counteract the large-scale pollution from natural gas, other than making energy traders and consumers feel good for supporting green causes in regions where money is scarce.

Total said in a statement that it conducts due diligence on offset projects and confirmed that it split the cost of offsets in the LNG transaction with Cnooc. The French company declined to discuss details, including prices paid for carbon credits, citing a non-disclosure agreement. Cnooc didn’t respond to requests seeking comment. Total also said it doesn’t count carbon credits in its companywide emissions reports or as part of its plan to reach net zero by 2050. “While an important tool,” the company said, “offsetting cannot be considered as a substitute for direct emissions reductions by corporates, but as a complement.”

The use of scientifically defined terms like “carbon neutral” and “net zero” in marketing language introduces additional confusion. Both terms mean balancing any emissions added to the atmosphere with an equivalent amount of removal. Most experts agree that avoiding deforestation isn’t the same as removing greenhouse gases. “This paradigm,” warns Cullenward, “is encouraging a fictitious engine that doesn’t help advance our net-zero goals.”

That view isn’t reserved for outside critics. The leader of South Pole, which helped develop the Zimbabwe project and sold its carbon credits to Total, doesn’t believe forest protection can rectify pollution from natural gas. “It’s such obvious nonsense,” says Renat Heuberger, co-founder of South Pole. “Even my 9-year-old daughter will understand that’s not the case. You’re burning fossil fuels and creating CO₂ emissions.”

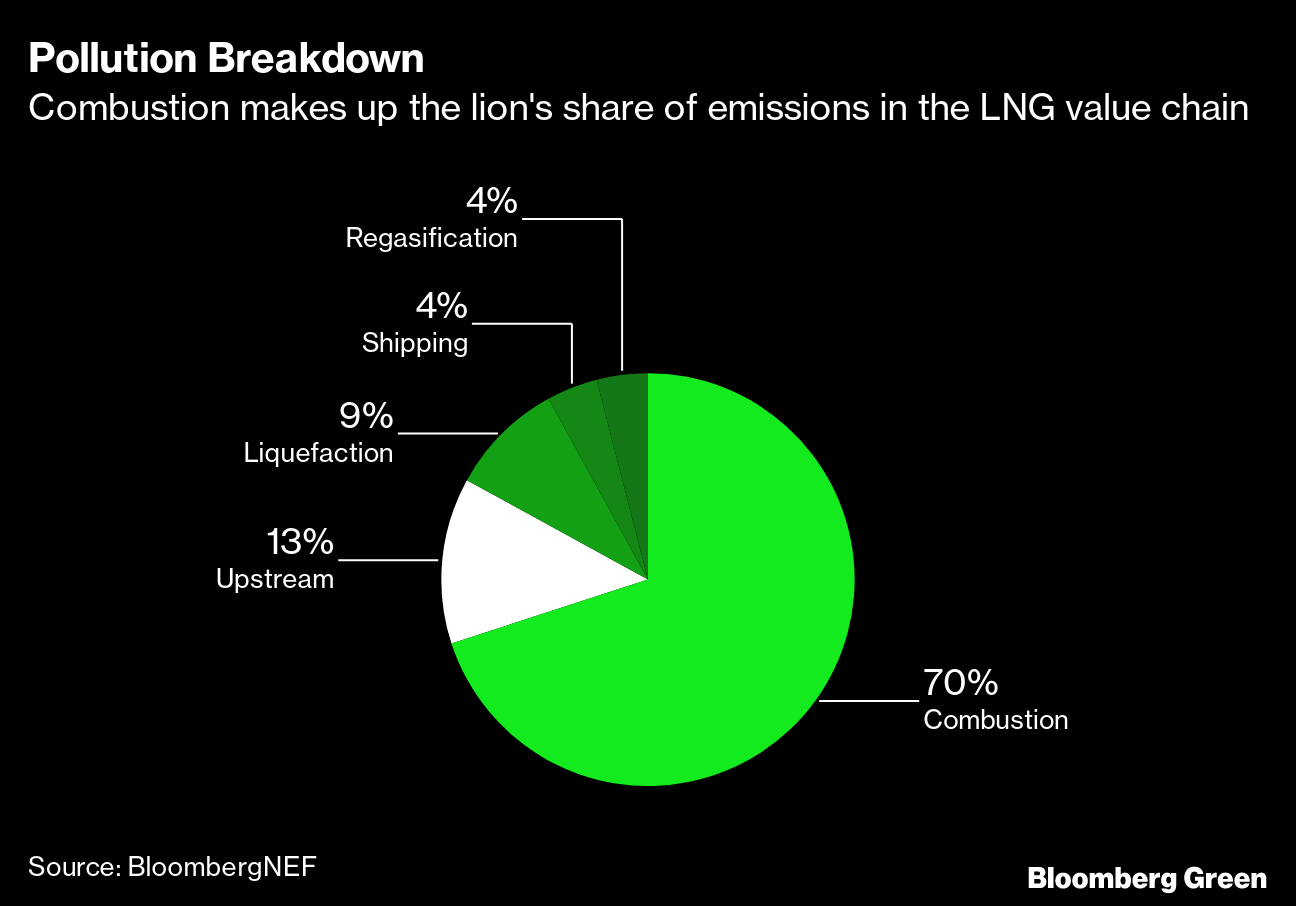

Total’s product started warming the planet at the moment of extraction from the deep-sea Ichthys field off the Australian coast. Every part of its lifecycle generated greenhouse gas. Sending the gas to an export facility through an 890-kilometer (553-mile) pipeline risked leakage of methane, a powerful pollutant that traps 80 times more heat than CO₂ in its first two decades. Chilling the gas into a liquid for shipping wrought additional emissions. Even the tanker that brought the LNG to Shenzhen in southern China burned some of the fuel while sailing.

At the final destination, after Cnooc claimed the cargo last September, the LNG was likely burned to power the city’s countless factories or an electricity grid serving more than 12 million people. This would leave a centuries-long residue of atmospheric CO₂ that Total’s traders had to neutralize. But how much? Total and Cnooc agreed to set the shipment’s emissions at 240,000 metric tons of CO₂, the same amount of pollution generated by 30,000 U.S. households in a year.

The figure is, at best, a rough estimate since there are too many variables. “No one has convincingly produced an accurate calculation,” says Fauziah Marzuki, an analyst at research group BloombergNEF. “All of these deals are making assumptions.”

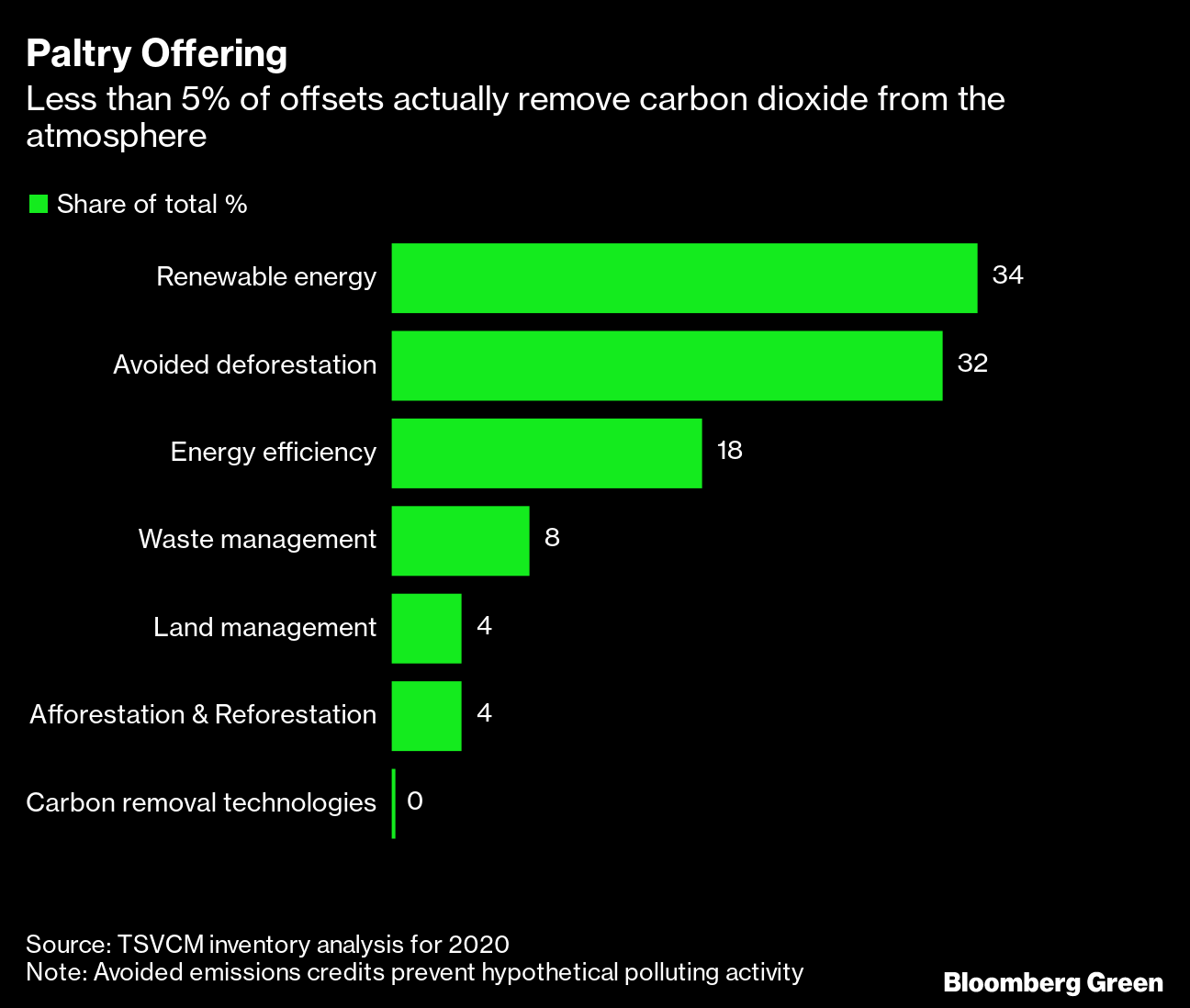

If Total’s team started out as rookies at carbon math, South Pole’s experts arrived as old hands. The company has been generating credits for more than 15 years—long before the corporate world took interest in their emissions-erasing power—and today operates in dozens of countries. Over virtual meetings, according to people familiar with the transaction, South Pole’s sales representatives laid out options. The cheapest offsets they had were tied to support for renewable energy projects, while the most expensive helped fund reforestation efforts to plant new trees.

Enough carbon credits to offset a shipment of LNG can cost anywhere between $1 million to $15 million, according to Eurasia Group, a New York-based think tank. Most trades fall on the lower end of the spectrum, in terms of cost and quality. Traders in Asia who have participated in similar deals say the offsets involved usually sell for less than $6 per ton of CO₂.

“We’ve been hearing low single digits,” in terms of what companies pay per ton, says Lucy Cullen, an analyst with energy consultant Wood Mackenzie Ltd. “It makes sense from a commercial standpoint.” By comparison, Bill Gates said in an interview earlier this year that he pays about $600 a ton to suck carbon out of the air using cutting-edge technologies, as a way to offset his personal carbon footprint.

Total decided to source the bulk of its offsets from the Hebei Guyuan Wind Farm Project, located in a Chinese steel-making province surrounding Beijing. A similar logic linked the wind farm and the forest-fire prevention in Zimbabwe. In this case the electricity generated by the wind turbines would theoretically avoid use of Hebei’s dirty coal-fired power plants. The resulting reduction in emissions, compared to an alternative scenario in which only coal electricity had been used, would form the basis for neutralizing Total’s gas deal.

Total chose to add additional credits from the project in Zimbabwe’s Kariba region, which South Pole co-developed with Carbon Green Africa. Those credits cost more than those from the Chinese wind farm but on average amounted to less than $3 a ton, according to the people familiar with the deal. Total declined to comment, citing the non-disclosure agreement.

Did the money from the deal help lower emissions in China? The Hebei wind farm has been generating clean energy for over a decade, and it’s unlikely it would have ceased doing so without several hundred thousand dollars from Total and Cnooc, says Gilles Dufrasne, policy officer at nonprofit Carbon Market Watch.

Verra, the organization that certified the Hebei credits used in the Total deal, has since updated its policies to exclude large-scale grid-connected renewables. If the wind farm’s operators tried to register as an offset project today, “it would not be accepted,” says Dufrasne.

When climate scientists think about offsets, a key concept they grapple with is called “additionality.” You only balance the carbon scale if you actually remove CO₂ that wouldn’t have been absorbed without your support. It’s an extremely tricky concept that’s prone to abuse. After all, how do you prove that something worse would have happened if you hadn’t intervened?

Carbon Green Africa, the organizer of the Zimbabwe effort backed by South Pole and Total, is working to defend a 785,000-hectare wildlife corridor across four provinces. Volunteers are told that keeping fires at bay is about more than protecting crops and livestock. It’s part of a global mission to arrest global temperatures. By safeguarding forests from the flames, the project is supposed to be keeping CO₂ stored in the form of trees.

But projects like this have become a point of contention. They’re based on a framework known as Reducing Emissions from Deforestation and Forest Degradation (REDD+), a program started under the auspices of the United Nations. The initial goal was to help governments trade offsets with each other so that rich countries might financially support climate action by developing nations. After political leaders couldn’t agree on how the system should work, project developers started marketing the offsets directly to corporations.

Even if work to combat deforestation can’t counteract an LNG shipment, corporate patronage has helped improve life in Mbire, one of the districts in Zimbabwe that’s home to volunteers in the forest-protection project. More than a dozen residents spoke positively about the program during a visit by a reporter earlier this year.

Theresa Mutseura, a health administrator at the Chitsungo Mission Hospital, said the project helped set up a biogas digester to power the 65-bed facility. The only hospital in a region with 33,000 people and just two doctors had previously relied on firewood. Zvionere Chaku, 43, said volunteers with Carbon Green taught her how to farm more expensive vegetables in a small garden rather than clearing land.

Benefits of the program can be measured. The region lost about 0.23% of its tree cover between 2011 and 2020, according to analysis of satellite images by Global Forest Watch, compared with a rate of 0.65% before the project began. Economic growth has also been stronger in the districts covered by the project compared with similar areas, according to gross domestic product figures provided by the local government.

Last year Carbon Green paid Z$215 million ($2.5 million) to Mbire, with the bulk of the funding going to infrastructure projects such as roads and schools that help boost development. About 20% goes directly to environmental protection. “The money was a windfall,” says Tarcisius Mahuni, who runs the local district council from an office decorated in posters for the REDD+ program. The funds from carbon credits were more than triple what local officials had hoped to collect in tax revenue.

Mbire’s improving infrastructure must also contend with impacts from warming temperatures, made worse by the use of fossil fuel. “We have had droughts, floods, cyclones, hunger and diseases,” says Charles Ndondo, Carbon Green’s managing director who oversees local operations. “If I was not worried about climate change, I would not be running this project.”

This puts on display an uncomfortable truth about the global climate movement: powerful multinational companies can essentially outsource the cleanup of their pollution to faraway places in need of help for a fraction of their profits. Doing so is far cheaper than direct means of removing pollution from their businesses. Carbon Green says the project in Zimbabwe avoids 6.5 million tons of carbon emissions each year while getting, at most, $1.50 per ton; sometimes the group gets paid as little as $0.20.

Heuberger, the co-founder of South Pole, stands by the sale of credits to support the work in Zimbabwe. But it troubles him that Total is using offsets to market natural gas as carbon neutral. His company tells clients they should use such offsets to “take responsibility” for their emissions, not to make claims that they have neutralized ongoing pollution. In a statement, Total said South Pole never raised objections over using the term “carbon neutral.”

In a way, it comes down to semantics. As corporate climate action grows more complex, so do the norms around net-zero goals. There’s growing consensus among top companies that the cheap and abundant credits used by Total—called avoided emissions offsets—should not be used to claim progress towards net zero. That’s why executives are increasingly turning to the phrase “carbon neutral” as a compromise. The term is gaining cache as a way for companies to take credit for supporting environmental projects, even if they haven’t actually removed CO₂ from the atmosphere.

Scientists warn that “net zero” and “carbon neutral” are technical terms and diluting their meanings in marketing campaigns could have a disastrous impact on the global effort to account for emissions and reduce greenhouse gas.

The nuance isn’t lost on Heuberger. The 44-year-old Swiss social entrepreneur has spent almost half his life working on environmental conservation projects in developing countries. It’s been an uphill battle to secure funding for the programs, and Heuberger is grateful for every dollar companies put into South Pole’s projects. It makes sense to him that firms want to tout their environmental contributions, especially to worthy efforts to help improve life for African villagers.

But he says the idea that such contributions can make up for selling fossil fuels will do more harm than good. They risk undermining the projects themselves, especially as scrutiny of carbon offsets increases. “These claims are damaging ourselves as well,” Heuberger says.

That’s in part why well-regarded registries such as Gold Standard don’t certify offsets from most REDD+ projects, and many experts including the Science-Based Targets initiative disapprove of using offsets based on avoided emissions to make net-zero claims. It’s possible to claim that some trees are standing today that might have been lost without brush clearing. But it’s just not possible to establish that extra carbon was removed from the atmosphere.

Total is writing its own tale on the strength of its first-ever sale of carbon-neutral LNG. It’s the transformation of an old-school energy behemoth into a clean supermajor.

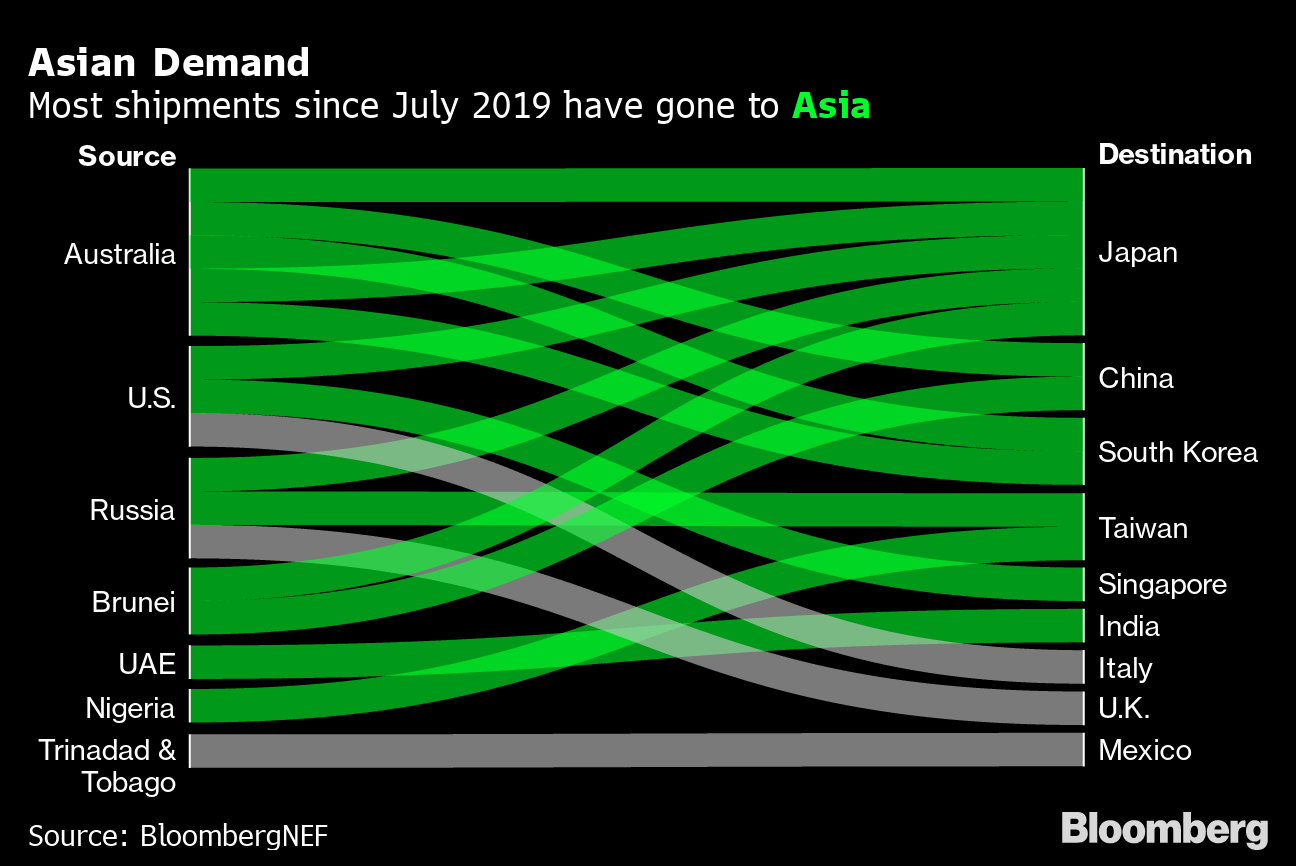

The company spent the last decade investing billions to position itself as one of the world’s top LNG producers and has green-lit new export projects from Russia to Mozambique that are slated to begin operations this decade. For the last 60 years, natural gas has been viewed as a cleaner alternative to coal and crude oil. That’s given companies like Total confidence in its longevity, even in an era of unprecedented climate action.

That future is looking more and more uncertain. The price of solar and wind energy is falling much faster than anyone expected. There’s growing awareness of the climate dangers from leaky pipelines used to transport the gas, which can release large amounts of methane, the super-potent greenhouse gas that’s the main component of LNG. The latest assessment published this week by UN-backed scientists calls for reducing methane emissions in the next 10 years if the world is to meet its climate goals.

The International Energy Agency recently put forward a timeline for keeping global temperatures from rising more than 1.5° Celsius above pre-industrial levels. The use of natural gas would have to fall by more than half its current level, meaning no new gas fields or export terminals should be built from now on.

As a European company, Total is in an awkward position as the continent’s politicians advance the world’s most-ambitious package of climate policies. The goal is cutting emissions 55% from 1990 levels by the end of the decade. Total Chief Executive Officer Patrick Pouyanne said in July that the company would probably aim to accelerate efforts to cut all its emissions, in line with the European Union, if those aggressive climate measures are implemented. In a sign of this shift, Total recently added “Energies” to its name to highlight the increasing share of its business that has nothing to do with fossil fuels.

Even as those changes are underway, Total and its peers in Europe are working to bolster demand for their core product. Labeling LNG shipments “carbon neutral” is one way to satisfy customers who are under pressure from their investors and governments to cut emissions. At least 16 carbon-neutral shipments have changed hands since 2019, and there’s a push from buyers and sellers to do more deals. This is especially true in Asia where two of the world’s top importers—Japan and China—have set targets to zero out emissions.

None of the energy companies involved have disclosed the math behind their carbon-neutral claims, and there’s no requirement that they do so. While Total says it won’t erase emissions from the LNG shipment it sold to Cnooc from its carbon accounts, there’s no guarantee that Cnooc will take the same approach. The Chinese state-owned company has described the gas shipment as “net-zero carbon emissions” and has indicated that it will rely on similar deals to meet President Xi Jinping’s goal of reaching net zero by 2060. The trade was a “pioneering case in China's natural gas industry to explore carbon-neutral practices,” Cnooc said in a press release announcing the LNG delivery from Total.

This sets a troubling precedent, says Arvind Ravikumar, an assistant professor at Harrisburg University of Science and Technology in Pennsylvania who studies sustainable development. A nature-conservation project without clear carbon benefits could be used to cancel out emissions for both Cnooc and China, the world’s single biggest polluter.

The credits “help them remove emissions from their annual report on paper without actually ensuring that the amount of emissions gets removed from the atmosphere,” Ravikumar says. “It seems like they have all fallen into the trap of finding the quickest and cheapest way to appear to do something.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

WEC Energy Offered $2.5 Billion US Loan for Renewable Projects

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals