Europe Faces an Energy Shock After Gas and Power Prices Rocket

(Bloomberg) -- After lockdowns forced Basel Hamzeh to close his cafe in a trendy Berlin neighborhood for months, the 53-year-old is confronting a fresh crisis: high energy bills.

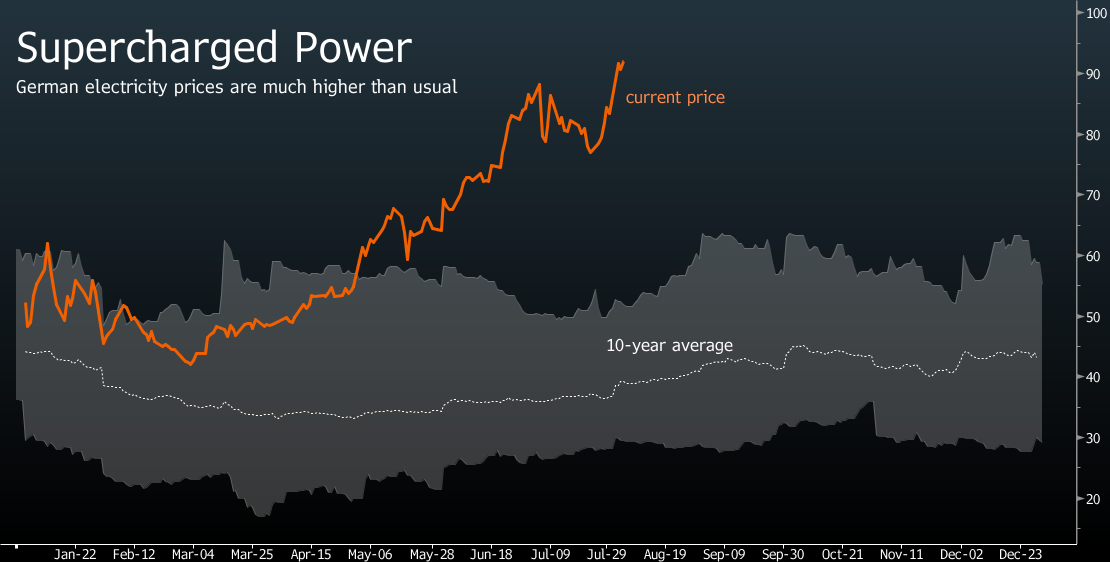

The cost of natural gas and electricity has surged across Europe, reaching records in some countries, as businesses re-open and workers return to the office. In Germany, wholesale power prices have risen more than 60% this year, leaving the owner of the Frau Honig cafe in Friedrichshain with no option but to raise prices of everything from cappuccinos to cinnamon rolls.

“The higher power prices were a double whammy after our cafe was forced to close for such a long time, doing only takeaway during the pandemic,” he said. “We just had to pass on the costs to customers.”

Energy prices are rising around the world as the global economy emerges from the pandemic, fueling concerns about inflation. In Europe, plans to decarbonize the economy are also playing a part as utilities pay near-record prices to buy the pollution permits they need to keep producing power from fossil fuels.

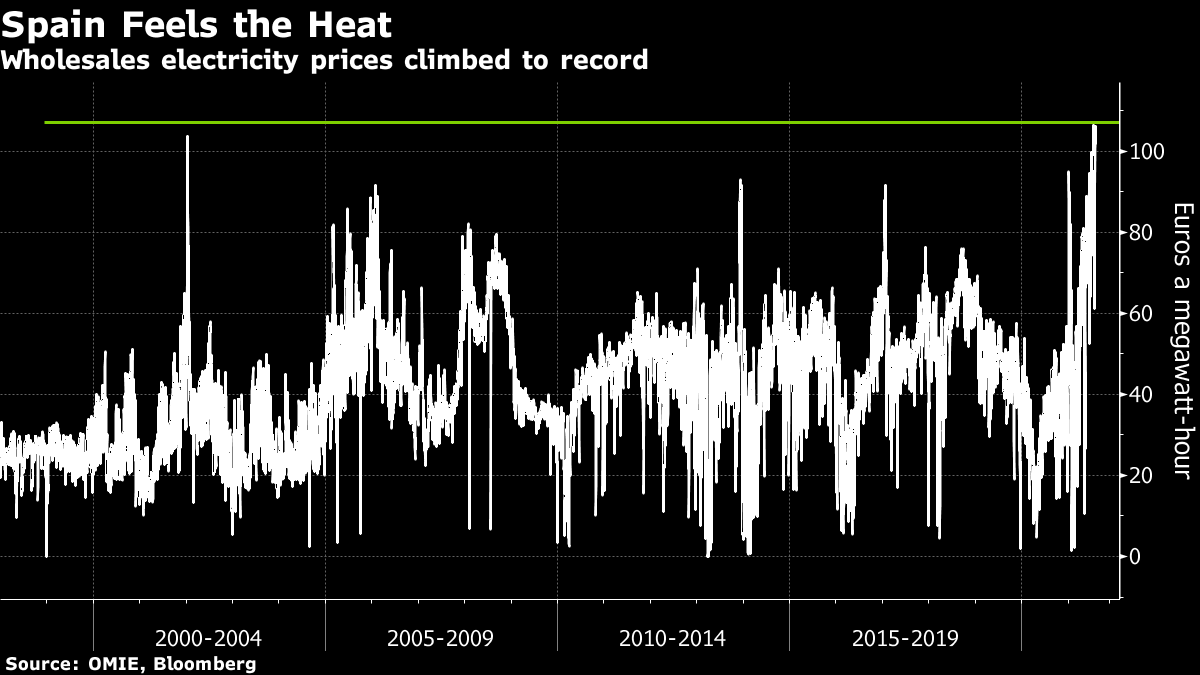

Add to that shortages of natural gas and the result is super-charged electricity prices, a bill consumers will eventually have to foot. Spain was already forced to cut energy taxes as power prices rose to a record, and the U.K. is expected to allow utilities to increase bills a second time this year, a move that will be announced Friday and affects 15 million people.

Higher costs are a headache for politicians less than 100 days before world leaders meet in Scotland to nail down a pathway to net zero. Governments fear a backlash as higher utility bills increase voter to the paying for the energy transition. Swiss voters rejected this year an ambitious climate law that would raise taxes on things like flying and driving.

“Are we going to see yellow vests in the streets, are we going to see a repeat of the Swiss referendum?” said Thierry Bros, an energy professor at the Paris Institute of Political Studies. “You are not going to get re-elected if you are putting so many people into energy poverty. That’s going to be a wake up call for governments.”

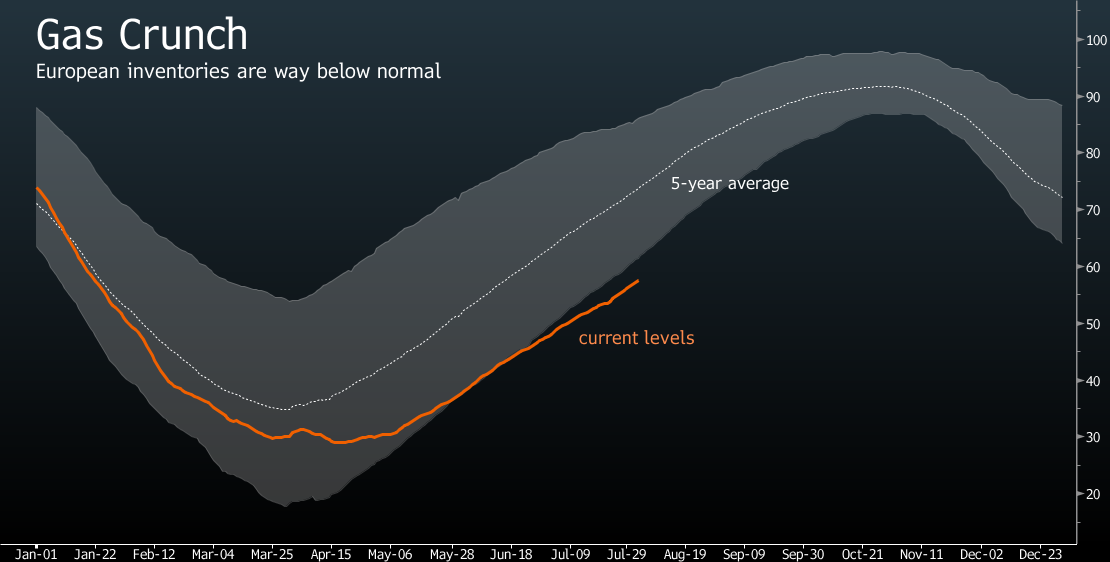

High energy costs are set to persist. Russia is flowing less gas to Europe and Asia is scooping up cargoes of liquefied natural gas, making it harder to refill depleted storage sites after a bitter winter. Benchmark European gas prices have already hit a record and all of that is fueling power prices and boosting earnings for utilities including Germany’s RWE AG and France’s Engie SA.

A hike in utility bills -- frequently the biggest fixed cost after rent -- could push many small businesses over the edge. The U.K. hospitality sector lost at least 80 billion pounds ($111 billion) due to lockdowns, forcing the government to step in. A significant rise in energy costs “would be devastating,” said Kate Nicholls, chief executive officer of industry group UKHospitality.

“Survival and revival is already on a knife edge for many hospitality businesses,” she said. “Should utility bills increase by the sort of figures being forecast, further specific reliefs or measures could become necessary.”

Inflation has been creeping up in Europe as economies rebound and commodity prices rise. Costs for consumers in the rose 2.2% in July, the highest rate since October 2018.

While Europe has the most ambitious de-carbonisation plans in the world, unveiling proposals last month to cut emissions by at least 55% by 2030 from 1990 levels, some countries have started to balk at parts of the agenda.

France is lobbying behind the scenes to water down or delay the new proposed carbon market for heating and road transport. Several countries, including the Netherlands and Hungary, are also concerned about its social impact, according to European Union diplomats with knowledge of the talks.

In the U.K., there are questions about the cost of meeting net zero. It’s still unclear how the government intends to deliver on the targets, including convincing 600,000 people a year to rip out their gas boilers and replace them with expensive heat pumps.

“It’s basically our generation that’s bearing the cost of the energy transition,” said Jonathan Stern, a research fellow at the Oxford Institute for Energy Studies. “How will that come mid-decade if they are told we aren’t going to meet the goals of the Paris agreement let alone net zero? How will that change their views?”

For now, Spain is feeling the biggest impact. Without sufficient interconnection to France, electricity prices have surged above 100 euros a megawatt-hour, more than double the rates at this time in 2019, before the pandemic hit demand. That’s a sensitive topic for the Socialist-led government, which campaigned on lowering energy costs.

“It’s a heavy hit for the government,” said Javier Tobias Gonzalez, an architect who works on energy poverty at ECODES, a Spanish organization focused on sustainable development. “Before they were elected, they were quite critical of the government at the time regarding energy poverty.”

In the U.K. energy regulator Ofgem is expected to allow utilities to increase prices by 125 pounds when it announces the decision Friday, Morgan Stanley analysts estimate. The more than 10% increase would be the biggest ever to the price cap, introduced in 2019 to protect British households on default tariffs.

Back in Berlin, Hamzeh says his cafe has so far managed to survive.

“The support of the neighborhood has been immense throughout the pandemic and also when we had to increase our prices,” he said. “We are very thankful for that.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture