Oil Steadies as China Demand Concerns Offset Libyan Disruptions

(Bloomberg) -- Oil steadied as concerns over China’s dour economic outlook offset supply disruptions in Libya.

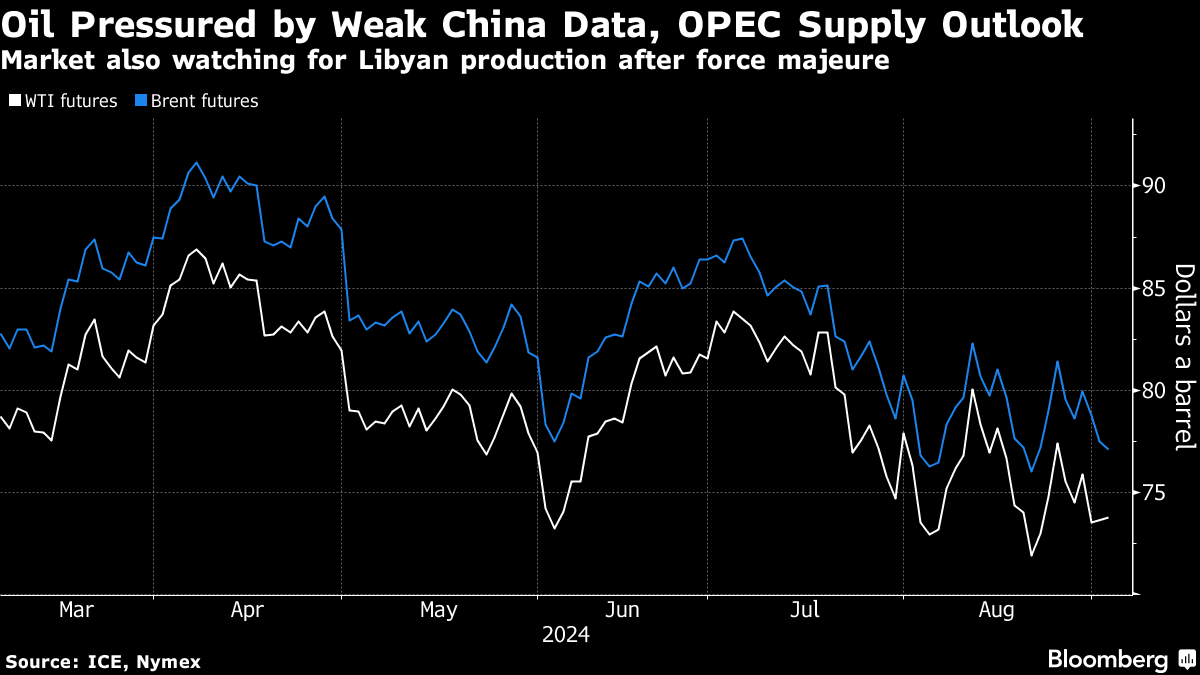

Brent traded near $77 a barrel after closing 0.8% higher on Monday, while West Texas Intermediate was close to $74. China’s remaining growth engines are showing signs of sputtering as a property crisis continues to drag on the economy, with an official growth target looking out of reach.

In Libya, the state oil firm declared force majeure at the El-Feel field, with an escalating power struggle already halving the nation’s output. The disruptions may give OPEC+ the space to restore some production next quarter, as planned.

Oil has wiped out nearly all of this year’s gains over the past couple of months as economic concerns in key consumers — including China and the US — and ample supply weighed on sentiment. The market is also bracing for the additional barrels from OPEC+.

“Libyan supply outages may offer some reprieve for prices, but that will be pitted against upcoming supply additions from OPEC+ from October,” said Yeap Jun Rong, a market strategist at IG Asia Pte Ltd. in Singapore. “Appetite for risk-taking has been limited.”

The US, meanwhile, is laying the groundwork for new sanctions on Venezuelan government officials in response to Nicolás Maduro’s disputed reelection in July, according to documents seen by Bloomberg. The measures target key leaders the US says collaborated with Maduro to undermine the July 28 vote.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week