Options Volatility Is Getting Crushed With Little Relief Ahead

(Bloomberg) -- Volatility is getting crushed. Everywhere.

One risk event after another, from inflation data to Nvidia Corp. earnings, gets cleared with barely a ripple to slow the market’s grind higher. And with option selling in full demand, volatility is going nowhere but lower this month.

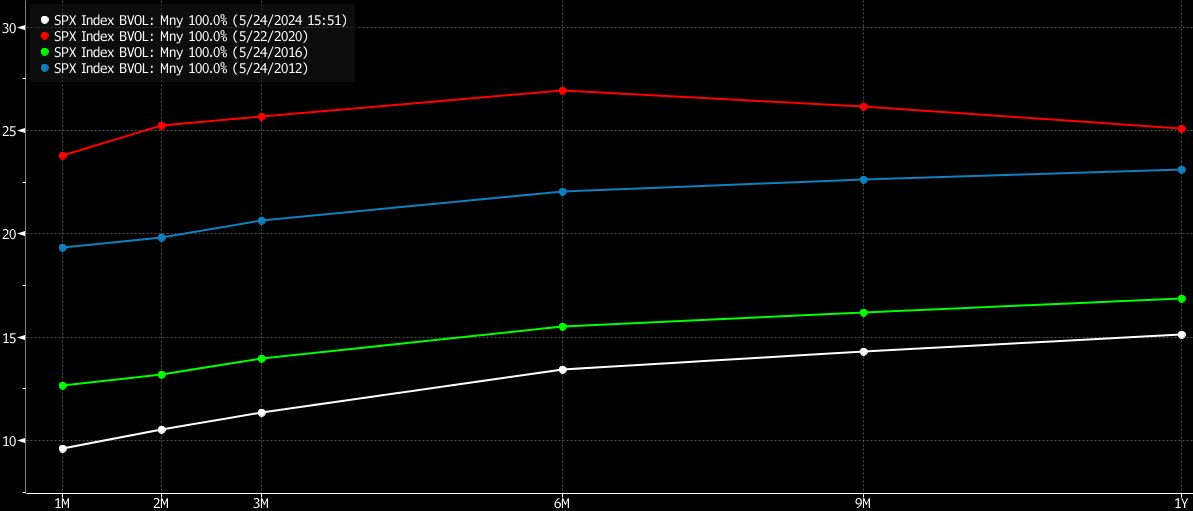

The VIX Index sank early Thursday to the lowest in almost five years before bouncing back a bit. At 11.5, it was a few points shy of the record lows from 2017, which marked the least volatile stock market in modern history. Three-month S&P 500 implied volatility ended the week at the lowest since October 2018.

Stocks are not alone: Oil, bonds, credit and even FX measures of volatility are all grinding lower. OPEC+ supply cuts have stabilized the oil market in a range. Declines in realized rates volatility and a narrow outlook for G10 currencies is keeping implied levels in check.

Looking ahead, there are few near-term chances for surprise. Earnings season is coming to an end and summer holidays in Europe and the US are fast approaching. OPEC+ delegates expect the group to extend output cuts into the second half of the year when it meets virtually on June 2. And most forecasts from Wall Street banks compiled by Bloomberg see the Federal Reserve cutting rates in September or later.

With stocks pushing to new highs and nothing seriously threatening the rally, there’s little incentive for investors to short the market. Hedging demand is very low, with long put options positions failing to pay out in the face of shallow declines that are quickly reversed. At the same time, the boom in investment vehicles designed around selling options pushes volatility lower.

Positioning by options dealers won’t help spur wider swings either. Dealers are long gamma, which acts as a market stabilizer as trading desks sell into rallies and buy the dips to rebalance their books.

“As the S&P 500 keeps heading higher, the positive gamma keeps getting thicker,” Spotgamma strategists said Thursday. “More positive gamma implies tighter trading ranges and less upside volatility.”

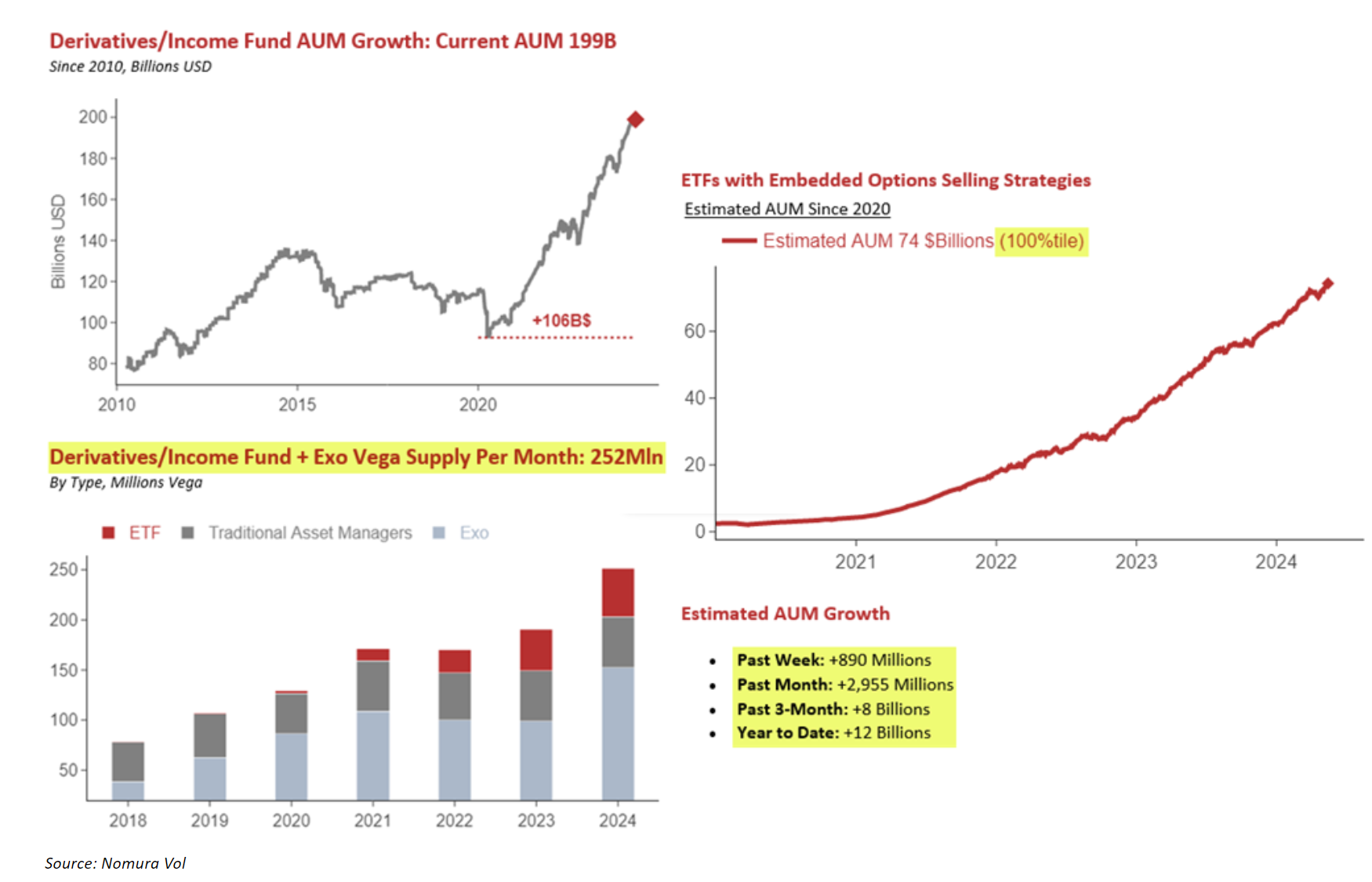

Meanwhile, the army of volatility sellers is becoming bigger by the month, with assets under management in derivatives income funds now at $200 billion. They are supplying more than 250 million of vega into the market each month, suppressing volatility in an unprecedented way.

The calm across markets is in contrast of the perceived fundamental picture, with US economic surprises now near a level that matches the May 2022 swoon, strategists at Tier 1 Alpha wrote.

“May 2022 was the midst of the S&P plunge that took us to 3,700 a few weeks later, down from 4,800. This cycle has seen nothing of the sort. A good reminder that the market is not the economy.”

With 2024 being an election year in the US and elsewhere, a big question is how long the low-volatility regime can persist. India stock-market implied volatility has jumped this month during its ongoing national elections.

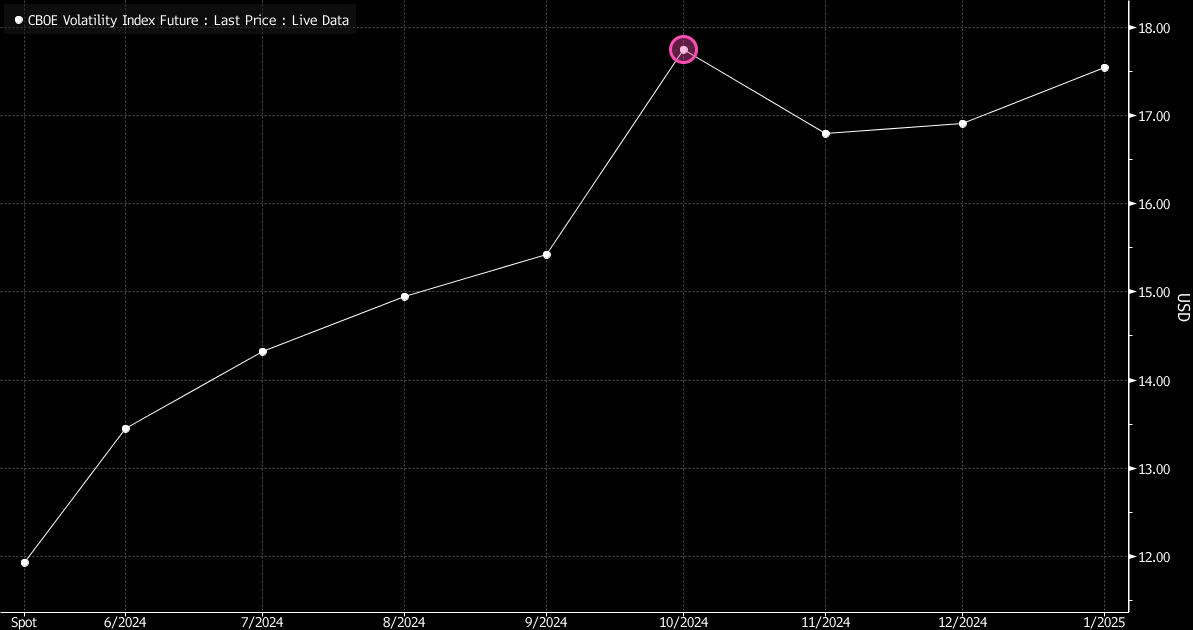

While low compared to other election years, VIX futures are already becoming more sensitive to the event, with October contracts at a premium to September and November. And two-month volatility on the pound picked up last week, incorporating risks around the UK election July 4.

“The kink that typically occurs on the VIX futures curve into a US election is happening early this time around,” wrote Bloomberg Intelligence chief global derivatives strategist Tanvir Sandhu.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week