Oil Steadies as Geopolitical Tensions Rise Before OPEC+ Meeting

(Bloomberg) -- Oil steadied after two days of gains even as tensions in the Middle East ratcheted higher following the death of an Egyptian soldier during a clash with Israeli troops.

Global benchmark Brent held above $83 a barrel, while West Texas Intermediate edged toward $79. Egypt’s military confirmed that a border guard died at the Rafah crossing into Gaza on Monday, which could escalate tensions with Israel.

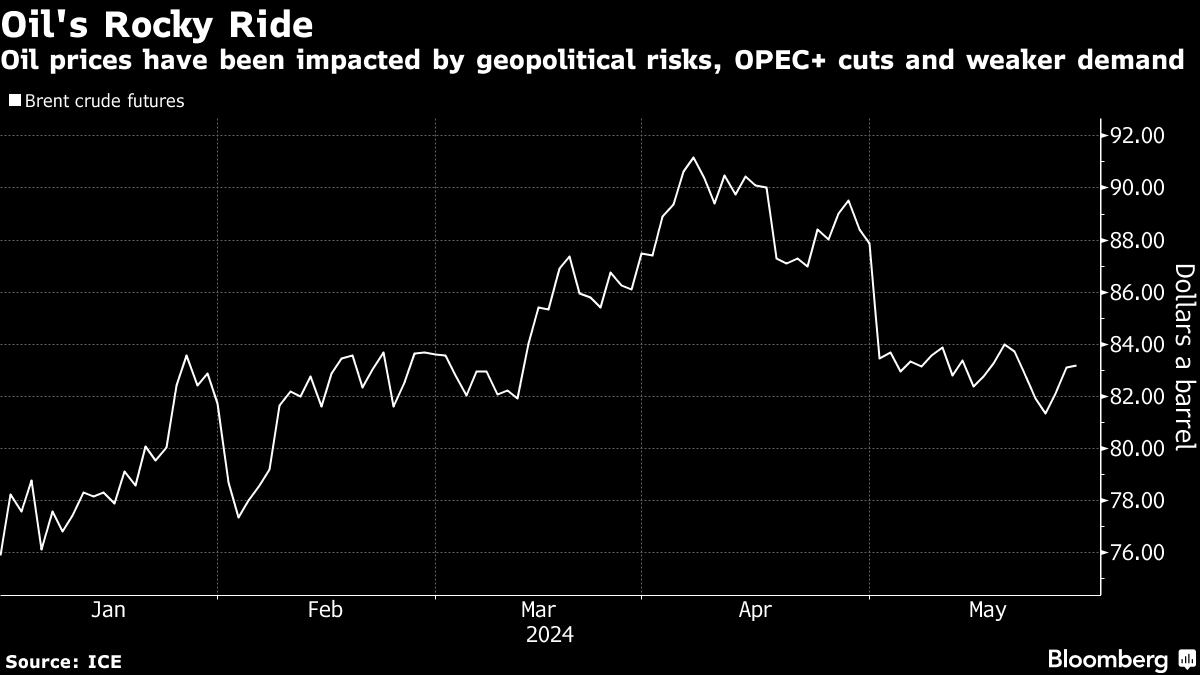

Oil has risen this year on persistent geopolitical risks and OPEC+’s roughly 2 million barrels a day of output cuts, which the group is expected to prolong into the second half of 2024 at a meeting on Sunday. Prices have dipped since early April on weakening demand from Asia, causing Brent’s prompt spread to get close to a bearish contango structure that indicates supply is increasing relative to consumption.

“A confluence of factors suggest some upside sensitivity in oil — from fraught geopolitics to inventory drawdown to OPEC’s assumed preference to maintain curbs,” said Vishnu Varathan, chief economist for Asia ex-Japan at Mizuho Bank Ltd. However, “the Gaza situation is only a warning not to be aggressively short, but not quite the unbridled bullish trigger.”

The death of the Egyptian soldier, which followed Israeli airstrikes on Sunday on a camp for displaced people that were condemned by governments across the world, is an added risk to oil markets, but the conflict has largely stayed contained so far. There has been no major disruption to crude flows from the Middle East — which accounts for about a third of global output — although Houthi attacks in the Red Sea have led to the rerouting of some supply.

Investors will also be looking for signs of US fuel demand data after the Memorial Day holiday, which traditionally marks the start of the peak summer driving season.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week