Oil Advances With OPEC+ Meeting and US Fuel Demand in Focus

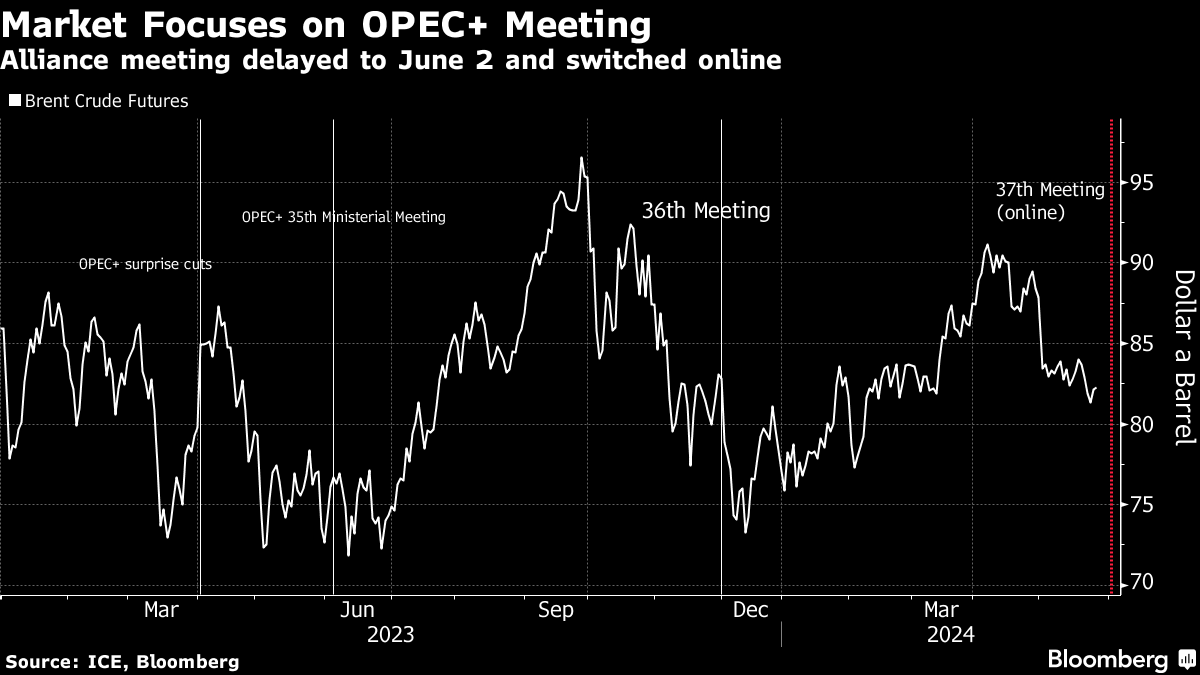

(Bloomberg) -- Oil rose after dropping last week, with the focus on an OPEC+ supply meeting on Sunday and US demand at the start of the summer driving season.

Brent futures rose above $83 a barrel after dropping 2.2% last week and touching the lowest since early February. West Texas Intermediate advanced above $78. The Organization of the Petroleum Exporting Countries and its allies will hold a policy meeting online, and are widely expected to prolong production cuts into the second half of 2024.

Prices were also supported by concern that Israel’s war in Gaza may expand to the broader region, threatening oil supplies, after an Egyptian soldier was killed in a clash with Israeli forces at the Rafah border crossing.

Activity was muted with a holiday in the UK and the US, where the Memorial Day weekend kicks off the summer driving season, which will provide clues on demand trends. Early signs have pointed to a solid showing, with expectations that the number of people to fly over the weekend will be the highest in nearly 20 years, according to the American Automobile Association.

“We saw a very strong demand from the US last week ahead of the Memorial day long weekend,” said Giovanni Staunovo, a commodity strategist at UBS Group AG. “Record flight activity and strong gasoline demand should give some support to oil prices.”

Brent is up almost 8% this year, supported by persistent geopolitical risks and OPEC+’s roughly 2 million barrels a day of output cuts. Egypt’s military confirmed a border guard died on Monday, and the Israel Defense Forces said “a shooting incident occurred on the Egyptian border,” without giving any more detail.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company