Oil Holds Near Three-Month Low as Market Shows Signs of Weakness

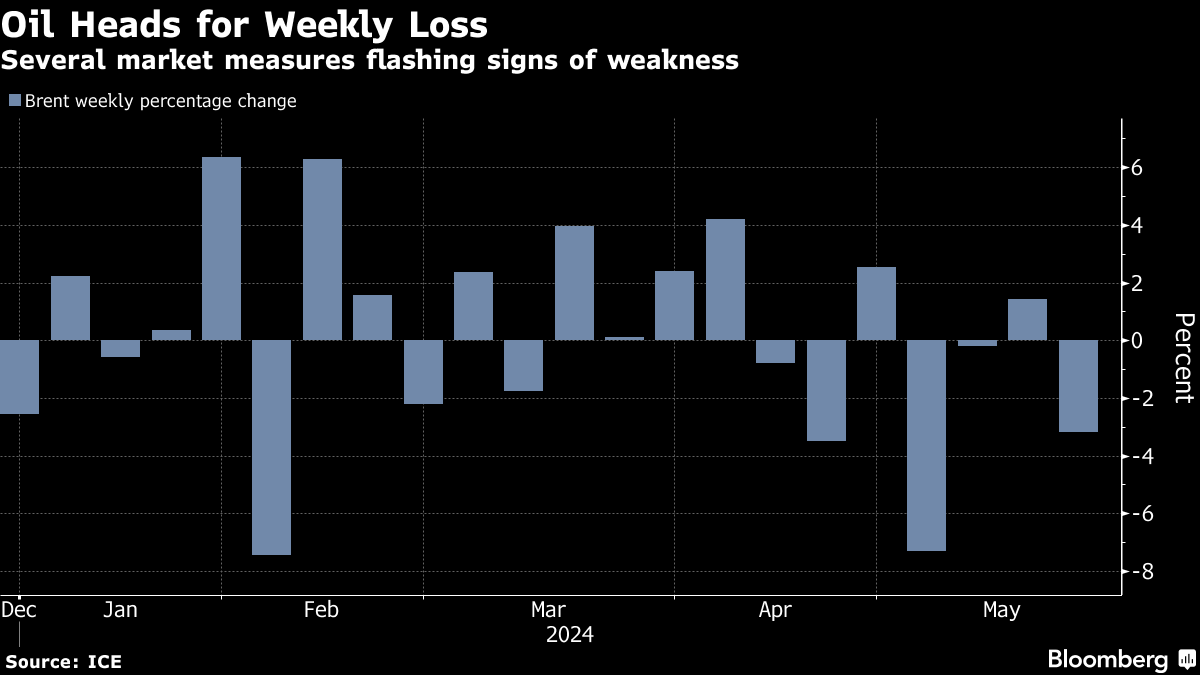

(Bloomberg) -- Oil traded near lowest level in over three months as the market flashed signs of weakness ahead of the US summer driving season.

Brent crude was little changed near $81 a barrel, while West Texas Intermediate held below $77. Both benchmarks are set for a weekly loss. The Memorial Day weekend is typically seen as the start of the peak driving period in the US and investors will be watching to gauge the demand outlook.

Crude is still higher this year in part due to OPEC+ output cuts, but futures have eased since mid-April. The prompt spread for Brent was close to slipping into a bearish contango structure earlier this week, indicating ample supply, while money managers have trimmed their bets on rising prices.

The OPEC+ alliance meets on June 1 and is widely expected to prolong current output curbs into the second half of 2024. The group has been keeping roughly 2 million barrels a day offline this year.

“The upcoming OPEC+ meeting will dispel uncertainty on supply,” said Zhou Mi, an analyst at the Chaos Research Institute in Shanghai, adding that US demand is recovering and should get a boost from the summer travel season.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week