S&P 500 Hits a Wall at End of Best Week in 2024: Markets Wrap

(Bloomberg) -- The rally in stocks lost traction Friday, with the market still notching its best week in 2024 amid speculation the Federal Reserve will be able to cut interest rates as soon as June.

US equities wavered after a record-breaking run that drove the S&P 500 up about 10% this year. In an almost broad-based weekly advance, the gauge climbed more than 2% in the span. The market resilience has left strategists scrambling to update their targets, while spurring calls for a consolidation or a pullback.

“With some sentiment and positioning indicators looking elevated, we would not be surprised to see a modest pullback in the coming months,” said David Lefkowitz at UBS Global Wealth Management. “That could offer investors a better opportunity to add to equity positions.”

In the absence of economic data, traders kept an eye on Fedspeak. Jerome Powell’s remarks during a “Fed Listens” event didn’t include monetary policy. Michael Barr, the Fed’s vice chair for supervision, said there will likely be significant changes to a proposal to force lenders to hold more capital.

The S&P 500 closed below 5,235. Nvidia Corp. extended gains into an 11th straight week. FedEx Corp. — an economic barometer — surged on solid earnings and a $5 billion buyback plan. Nike Inc. and Lululemon Athletica Inc. dropped on weak outlooks.

Treasury 10-year yields slipped six basis points to 4.21%. The dollar approached its highest level this year.

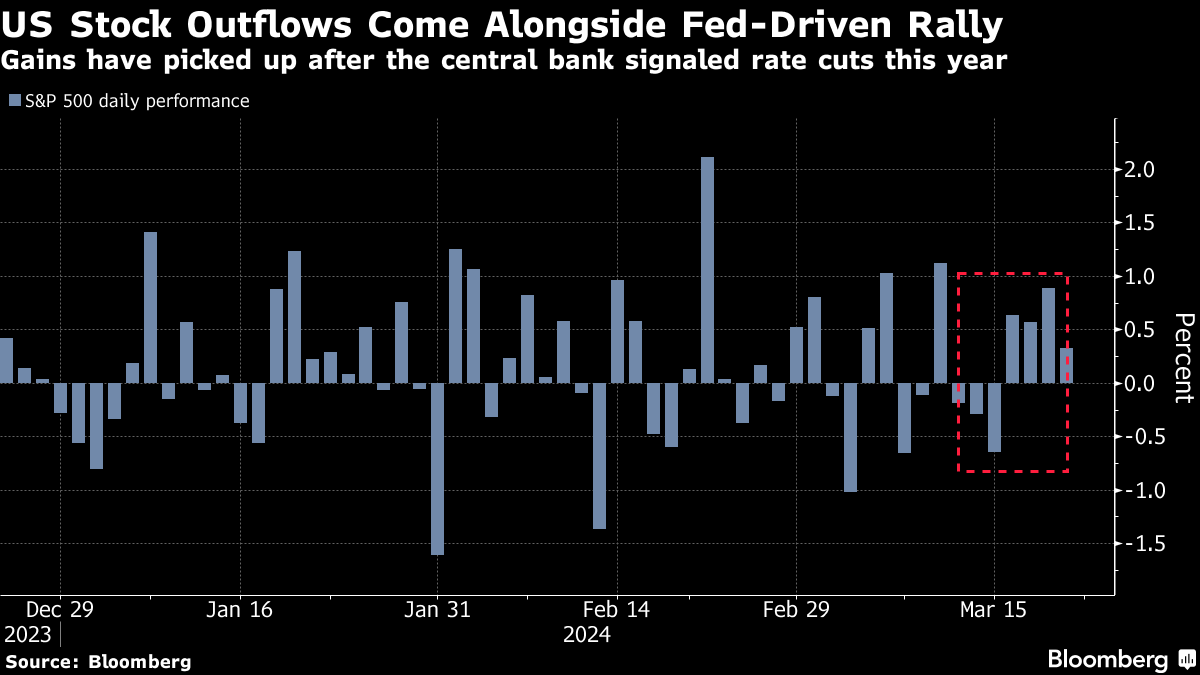

While a relative sense of calm prevailed at the end of the week, American stocks saw hefty outflows in the run-up the highly anticipated Fed policy meeting.

US equity funds suffered redemptions of about $22 billion in the week through Wednesday — the biggest since December 2022, according to a note from Bank of America Corp., citing EPFR Global data. The trend was also a sharp turnaround from the previous week, when stocks had attracted record inflows.

Following the Fed decision, stocks were swept up in rally driven by the perception that the central bank wasn’t as hawkish as feared. Policymakers kept their forecast for three rate cuts this year, and Chair Powell didn’t seem overly concerned about the recent uptick in inflation.

Yet examining Fed rate cycles since the 1970s has revealed that, in general, investors have more to fear from the first rate cut in a cycle than a pause, according to Ryan Grabinski at Strategas Securities.

On average, the S&P 500 is up more than 5% over 100 days between the last Fed tightening and the first rate cut, he noted. However, the trough in the broader market exceeds a 23% drop over 200 days after the first rate cut in a series.

Despite still elevated rates, the recent round of housing, manufacturing and labor-market data pointed to a resilient economy.

“Six months ago, investors were largely pessimistic, with ‘good news being treated as bad news’ and ‘bad news treated as bad news’,” said Mark Hackett at Nationwide. “The pendulum has shifted almost completely, with strong data being viewed as a sign of a ‘soft landing’ — while sluggish data reinforces the belief that the Federal Reserve will cut rates.”

This has driven impressive momentum in the market, Hackett noted. The technicals underlying the recent stock rally were impressive — with more than three-quarters of the S&P 500 above the 200-day moving average — the best level since 2021, he noted.

One of few Wall Street forecasters who correctly predicted last year’s stock market rally finds himself in a contrarian position once again. But this time, Brian Belski thinks equities are set up for a plunge — just as many of his peers are turning bullish.

A correction is imminent after stocks have run up too far, too fast on false optimism over how soon the Fed will dial back interest rates, the BMO Capital Markets chief investment strategist and long-time bull said in an interview.

Bill Gross, the one-time bond king, warned that investors are in for a bumpy ride as “excessive exuberance” sweeps financial markets.

“It tells me that fiscal deficit spending and AI enthusiasm have been overriding factors, and momentum and ‘irrational’ exuberance have dominated markets since 2022,” Gross, the co-founder and former chief investment officer of Pacific Investment Management Co., wrote in his latest investment outlook. “Buckle up for excessive exuberance.”

Meantime, HSBC strategists were the latest on Wall Street to say that equities aren’t in a bubble despite the sharp rally since last year. The team led by Max Kettner raises its view on US stocks to “tactically overweight” from “neutral.”

“Re-accelerating inflation is a risk, but the key here is when central banks and markets will really start to care,” they said. “We’re still quite some way away from that.”

Equity valuations outside the US are relatively more attractive following a recent rally in technology megacaps, according to Goldman Sachs Group Inc. strategist Peter Oppenheimer.

“We think technology is still going to be crucially important and do well, but as interest rates come down and we get this soft landing, the opportunity for broadening out into some more cyclical parts of the market is improving,” Oppenheimer told Bloomberg Television.

“US equities remain in an uptrend, but still vulnerable to potential consolidation/correction ahead in our opinion,” according to Dan Wantrobski at Janney Montgomery Scott. “Momentum is pushing several areas (not just megacap leadership) into overbought/extended territory on a short-term basis — which is what continues to concern us from a technical perspective.”

Still, overall market breadth continues to expand, he added, citing the fact that the cumulative advance-decline line for New York Stock Exchange shares is now close to breaking new all-time highs.

“This is an important metric to watch as it indicates the markets are no longer being carried by just a few names (like the Mag 7, for example), but are starting to fire on all cylinders across multiple market caps and sectors, Wantrobski said.

Corporate Highlights:

- Tesla Inc. has reduced production at its plant in China, according to people familiar with the matter, amid sluggish growth in electric-vehicle sales and intense competition in the world’s biggest auto market.

- Nike Inc. warned that sales will take a hit as it responds to a growing challenge from upstart running-shoe brands like On and Hoka that have exposed the US sporting-goods company’s reliance on classic basketball models such as the Air Force 1.

- FedEx Corp. topped Wall Street’s third-quarter profit expectations and announced a new $5 billion share buyback plan as the courier said it’s seeing results from a plan to cut costs and boost margins.

- Lululemon Athletica Inc. reported a slowdown in its US business and lower-than-expected outlooks for the first quarter and full year.

- Grifols SA sank as investors evaluated a regulatory review of the Spanish bio-science company’s financial reports, which found “relevant deficiencies” but no major accounting mistakes.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.1% as of 4 p.m. New York time

- The Nasdaq 100 rose 0.1%

- The Dow Jones Industrial Average fell 0.8%

- The MSCI World index fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.4%

- The euro fell 0.5% to $1.0806

- The British pound fell 0.5% to $1.2594

- The Japanese yen rose 0.1% to 151.44 per dollar

Cryptocurrencies

- Bitcoin fell 2.4% to $63,888.13

- Ether fell 4.1% to $3,342.24

Bonds

- The yield on 10-year Treasuries declined six basis points to 4.21%

- Germany’s 10-year yield declined eight basis points to 2.32%

- Britain’s 10-year yield declined seven basis points to 3.93%

Commodities

- West Texas Intermediate crude fell 0.3% to $80.79 a barrel

- Spot gold fell 0.8% to $2,163.66 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company