Oil Heads for Weekly Advance as Spreads Signal Market Strength

(Bloomberg) -- Oil was on track for a modest weekly gain as market gauges continued to show signs of strength, with OPEC+ set to decide early this month whether to extend supply cuts into the next quarter.

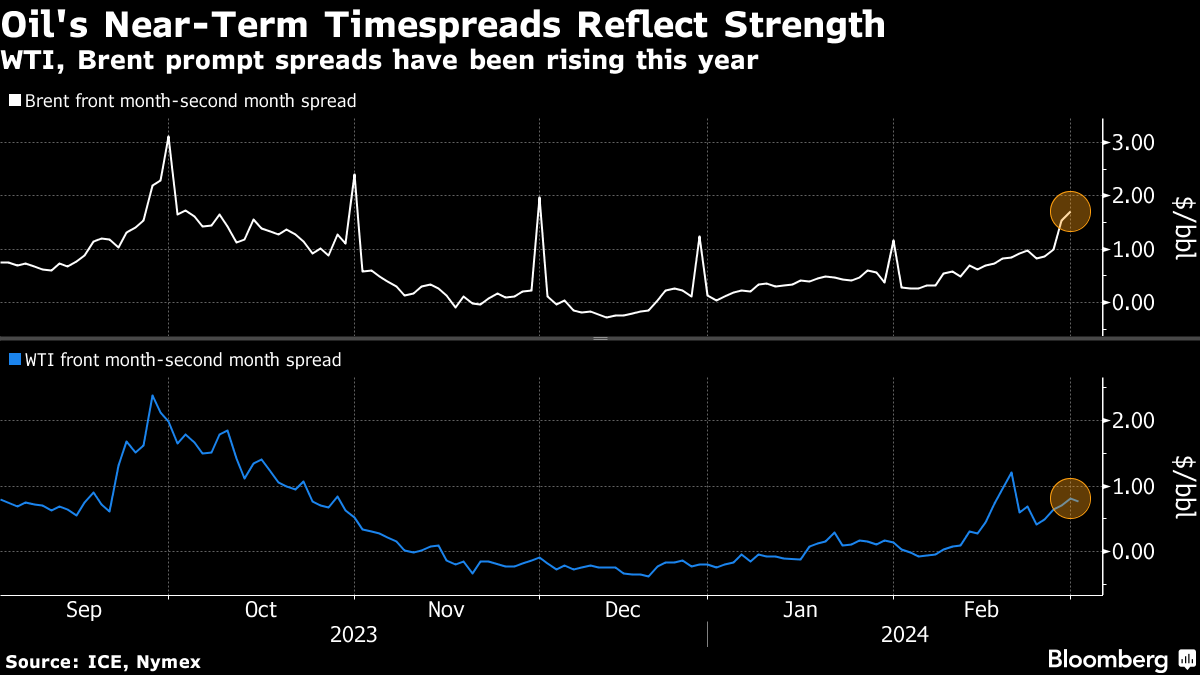

Brent crude futures climbed above $82 a barrel and were up 0.7% for the week, while West Texas Intermediate edged higher toward $79. Prompt spreads for both benchmarks have been expanding further in a bullish backwardation structure, an indication of tightening physical markets.

Oil capped a second monthly increase in February, although prices remain in a tight trading range. Geopolitical tensions including the Israel-Hamas war have helped spur some of the gains, but expanding non-OPEC supply and persistent concerns about China’s outlook have kept futures from rallying. The nation’s factory activity shrank again last month, adding to signs of weak demand.

“Tailwinds like tightening physical markets and headwinds such as Chinese growth concerns and higher rates in US” have kept prices in a tight range, said Ravindra Rao, head of commodities research at Kotak Securities Ltd. China’s economic recovery and OPEC+ policy remains the focus, he added.

OPEC+ is expected to extend its current supply cuts into the next quarter in a bid to avert a global glut and prop up prices, according to a recent Bloomberg survey. The group has put in place about 2 million barrels-a-day of curbs.

Meanwhile, expectations that the US will hold interest rates steady for longer were bolstered when the Federal Reserve’s preferred inflation gauge rose by the fastest pace in nearly a year. That’s likely a headwind for wider energy demand, which hurts commodities including crude.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight