China’s Commodities Imports Surge But Demand May Yet Disappoint

(Bloomberg) -- China’s raw materials purchases surged in the first two months of the year, as importers took advantage of weaker prices for some commodities and prepared for more stimulus from Beijing to lift demand.

Imports of most industrial commodities handily beat their levels of a year ago, when the country was still emerging from the pandemic. Energy showed the most notable gains, including a 36% jump in refined oil products. Lower international prices for natural gas and coal saw imports climb by more than 20%. Crude oil shipments rose 5.1%.

Among metals, iron ore shipments were the standout with an increase of 8.1%. Cargoes of copper and copper concentrate saw smaller gains. Soybeans slumped 8.8%.

The question is whether Chinese growth will be sufficient to absorb the extra imports. The cargoes are landing in an economy beset by deflation and weak consumption, which means that much of the supply could be headed for stockpiles rather than end-users. Moreover, the annual legislative meetings that began this week have so far failed to convince investors there’s enough of a plan in place to deliver on the government’s robust GDP target.

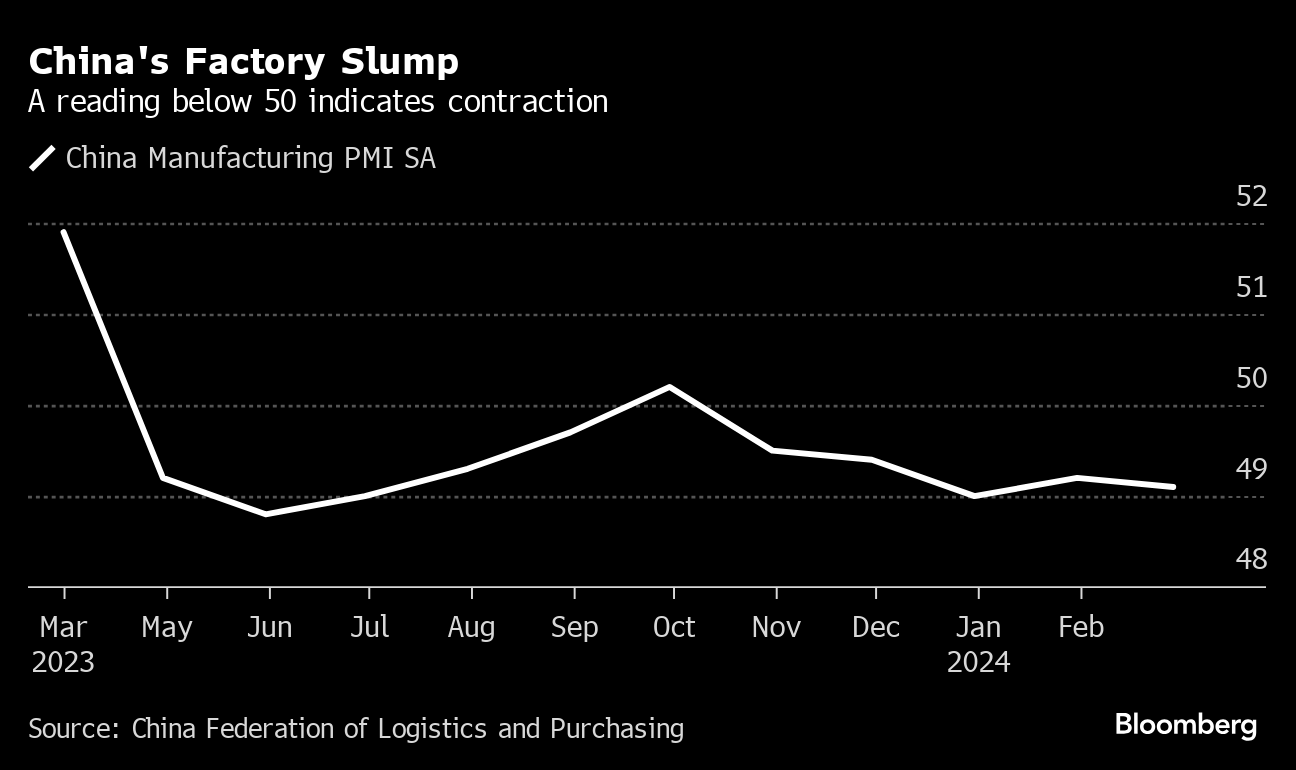

Inventories of items from copper to iron ore, steel and coal are either rising rapidly, or higher than they were last year, just as the country heads into what’s typically a period of peak demand for manufacturing and construction. But the factory sector has been in contraction since October, while traders haven’t seen much evidence that building activity is gearing up in the usual fashion.

Iron ore may find some relief from a jump in steel margins, which should boost production, according to BloombergNEF. The price of the steelmaking input dropped 17% in the first two months of the year. Green demand for copper is also becoming increasingly important, and that should help offset the slump in consumption from China’s crisis-wracked property market.

China combines trade data for January and February to smooth out the impact of the Lunar New Year holiday, which this year fell in the middle of last month. The leap year also included an extra day in February.

On the Wire

China’s exports grew much faster than expected in the first two months of 2024 in an early, encouraging sign for demand as the world’s second-largest economy tries to find its footing.

Australian miner Jervois Global Ltd. is cutting costs and jobs in response to a plunge in cobalt prices that it’s blaming on Chinese oversupply.

China’s ambition of delivering the world’s largest clean energy deployment in remote deserts and interior regions will face challenges without more focus on boosting grid capacity.

China’s growth risks erasing the world’s climate gains.

Pirelli & C. SpA is reviewing the role of its largest shareholder Sinochem after Italy limited the Chinese investor’s influence on the tire maker due to national security concerns.

The Week’s Diary

(All times Beijing unless noted.)

Thursday, March 7:

- China’s National People’s Congress continues in Beijing through March 11

- China’s 1st batch of Jan.-Feb. trade data, including steel, aluminum & rare earth exports; steel, iron ore & copper imports; soybean, edible oil, rubber and meat & offal imports; oil, gas & coal imports; oil products imports & exports. ~11:00

- China’s foreign reserves for February, including gold

- BNEF energy transition forum in Beijing, 13:00

- China International Forum on Imported Coal, Xiamen, Fujian, day 1

Friday, March 8:

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- China International Forum on Imported Coal, Xiamen, Fujian, day 2

Saturday, March 9

- China’s inflation data for February, 09:30

- China to release February aggregate financing & money supply by March 15

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output